Defensive Sector Investment Opportunity Analysis - Market Context and Historical Performance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

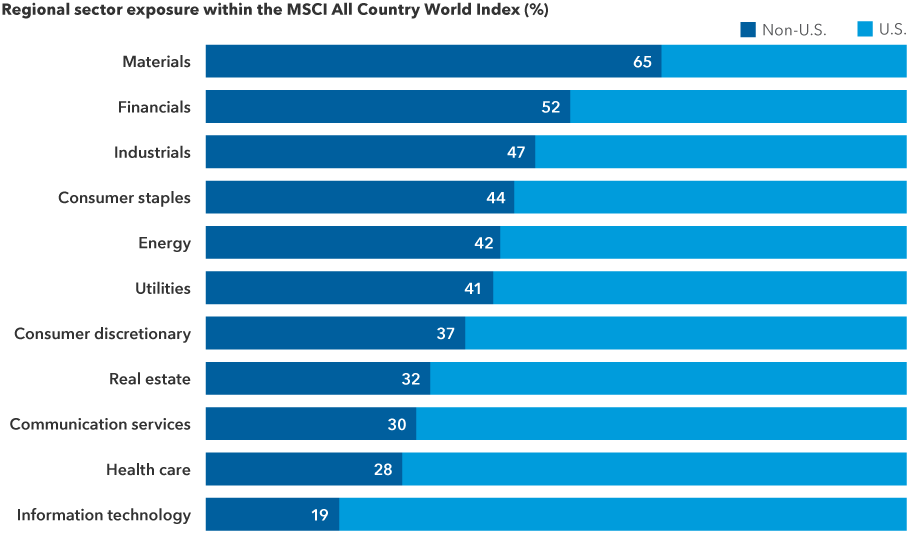

This analysis examines a Reddit post published on November 13, 2025, arguing that defensive sectors present current investment opportunities based on historical crash performance patterns. The post suggests trimming technology exposure in favor of Energy, Consumer Staples, Utilities, and Materials sectors.

Recent market data reveals a complex picture that challenges the post’s immediate recommendations [0]. While Utilities (+4.14%) and Energy (+3.15%) show strong performance, Technology continues to outperform (+2.65%), and Consumer Staples (-0.57%) and Materials (-0.69%) are lagging. The S&P 500 gained 1.47% to close at 6,770.22, indicating overall market strength rather than the downturn conditions that typically favor defensive rotation [0].

Current P/E ratios suggest defensive sectors are not undervalued as claimed [1]:

- Consumer Staples: 21.64x (below 5-year average of 22.36x)

- Utilities: 21.87x (above 5-year average of 20.01x)

- Energy: 17.40x (below 10-year average of 18.42x)

- Materials: 24.25x (significantly above 5-year average of 19.70x)

While defensive sectors trade at lower multiples than Technology (39.77x), most are above historical averages, contradicting the “undervalued” thesis [1].

The post’s historical analysis is substantially accurate. During the dot-com bust (2000-2002), defensive sectors demonstrated remarkable resilience [2]:

- Consumer Staples delivered +11.2% annualized returns while S&P 500 fell -22.3%

- Utilities dramatically outperformed, with some companies gaining +132% during the bear market

- Energy emerged as a winner, driven by oil price rallies from $20 to $35+ per barrel

- Materials declined -8.5% annually versus S&P’s -22.3%, representing significant outperformance [2]

However, the current market environment lacks the recession signals and crash conditions that historically triggered defensive sector outperformance.

The analysis reveals oversimplification in the post’s defensive categorization:

- Energy is fundamentally cyclical and commodity-dependent, not purely defensive

- Materials performance correlates strongly with global economic growth

- Utilities face significant interest rate sensitivity and regulatory risks

Historical patterns show defensive rotations typically occur

- Valuation Risk: Most defensive sectors trading above historical averages suggest limited upside potential [1]

- Sector-Specific Volatility: Energy faces geopolitical and commodity price risks; Utilities vulnerable to interest rate changes

- Opportunity Cost: Potential missed gains in technology and growth sectors if market strength continues

- Timing Risk: Premature defensive rotation without clear recession signals

- Selective Utility Exposure: Current strong performance (+4.14%) may indicate continued momentum

- Energy Sector Strength: Recent gains (+3.15%) align with historical crash performance patterns

- Hybrid Strategy Benefits: The post’s suggestion of balanced positioning rather than all-cash approach offers prudent risk management

Decision-makers should track:

- Economic indicators (GDP growth, unemployment, consumer confidence)

- Federal Reserve policy and yield curve movements

- Market breadth metrics and sector rotation patterns

- Valuation relative to earnings growth expectations

The Reddit post accurately identifies historical defensive sector outperformance during market crashes but appears premature in its current market application. While defensive sectors have lower valuations than technology, most trade above historical averages, limiting immediate upside potential. The current market shows technology resilience rather than collapse, with Utilities (+4.14%) and Energy (+3.15%) being the only defensive sectors showing strong performance [0].

A more prudent approach involves maintaining diversified exposure while monitoring economic indicators for deterioration signals that historically trigger defensive sector advantages. The post’s core thesis has merit but requires better timing and more nuanced sector analysis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.