Government Shutdown Economic Impact Analysis: GDP Effects, Market Valuation Risks, and Data Disruption Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit post published on November 13, 2025, at 11:50:07 EST, which examined the potential economic impacts of government shutdowns by drawing parallels to the 2013 shutdown experience [1]. The author estimated that an extended government shutdown could reduce Q4 real GDP growth by 0.4-1.2 percentage points and warned that delayed economic data increases market uncertainty and risk of negative surprises.

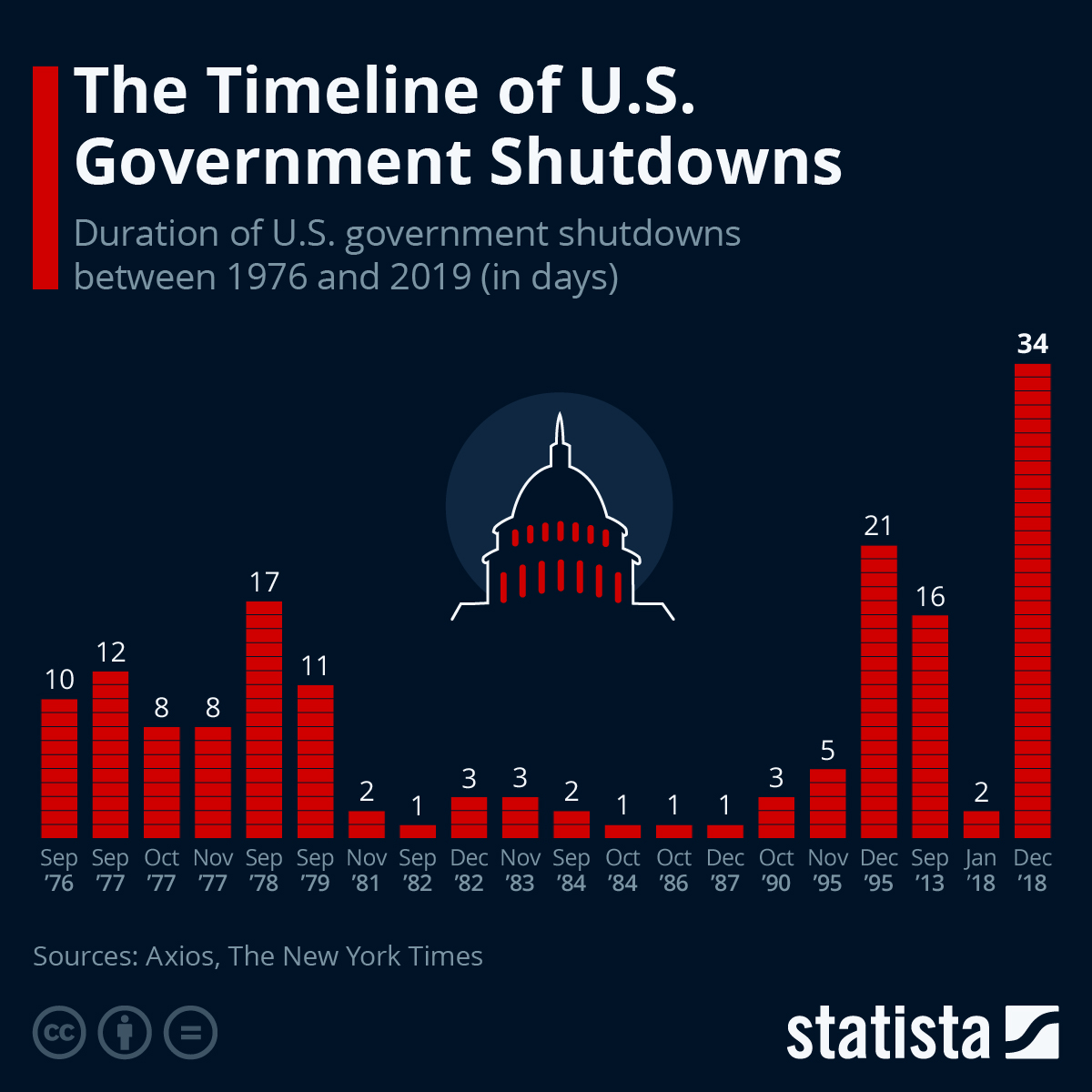

The analysis coincided with a significant real-world government shutdown context. The U.S. federal government had been experiencing a prolonged shutdown since October 1, 2025, after Congress failed to pass appropriations legislation for fiscal year 2026 [2]. This shutdown continued for 43 days until November 12, 2025, making it one of the longest shutdowns in U.S. history [2][3]. The extended duration aligns closely with the Reddit post’s concerns about “extended” shutdown impacts.

Market data reveals significant volatility during this period. On November 13, 2025 (the day of the Reddit post), major indices experienced sharp declines: S&P 500 fell 1.3%, NASDAQ dropped 1.69%, and Dow Jones declined 1.49% [0]. However, by November 14, markets recovered strongly with S&P 500 gaining 1.47%, NASDAQ jumping 2.24%, and Dow Jones adding 0.26% [0]. This pattern supports the Reddit author’s observation that markets historically “shrug off” shutdowns, though the volatility during the period reflects increased uncertainty.

The Reddit post’s GDP impact estimates of 0.4-1.2 percentage points are well-supported by historical data. The 2013 government shutdown reduced Q4 GDP by 0.3 percentage points according to the Bureau of Economic Analysis [4]. The Congressional Budget Office estimated that the 2018-2019 shutdown reduced economic output by $11 billion, with $3 billion never recovered [5]. For the 2025 shutdown, CBO estimated that if it lasted four weeks, $7 billion in economic losses would be permanently incurred, extending to $14 billion for eight weeks [4]. Given that the 2025 shutdown lasted 43 days (over 6 weeks), the economic impact would likely be toward the higher end of the Reddit author’s range.

The Reddit author’s concern about higher current valuations compared to 2013 represents a crucial insight. In Q3 2013, the S&P 500 P/E ratio was approximately 17.82 [6]. By contrast, as of November 2025, the S&P 500 P/E ratio stands at 30.58, with the Shiller CAPE ratio at 39.93 [7]. This represents a roughly 71% increase in valuation multiples from 2013 levels. Current Market Valuation analysis shows the S&P 500 is 80.9% above its modern-era average P/E ratio of 20.5, putting it 2.0 standard deviations above average and indicating “Strongly Overvalued” conditions [8].

This elevated valuation environment means that any economic disruption from the shutdown could have more pronounced market impacts than in 2013, as investors have significantly less margin for disappointment. The Reddit author’s decision to trim holdings out of caution appears well-founded given this valuation context.

The shutdown’s impact on economic data availability creates significant information gaps that amplify market uncertainty. During government shutdowns, key economic reports including employment data, inflation figures, and GDP estimates are delayed or suspended [4]. This data vacuum increases market uncertainty and can lead to mispricing of risk, exactly as the Reddit author warned. The delayed economic data releases may persist for several months, requiring decision-makers to rely more heavily on private-sector data sources and anecdotal evidence.

Current sector performance data shows defensive positioning amid uncertainty. Defensive sectors like Utilities (+4.14%) and Energy (+3.15%) outperformed, while Communication Services (-2.01%) and Basic Materials (-0.69%) underperformed [0]. This pattern suggests investors are seeking safety amid uncertainty, consistent with the Reddit author’s cautious stance and reflecting broader market concerns about shutdown impacts.

Users should be aware that the combination of elevated market valuations and economic disruption from the extended shutdown may significantly impact market stability in the coming months. The following factors warrant careful consideration:

-

Valuation Risk: Current market valuations are 71% higher than 2013 levels, providing less cushion for economic disappointments [6][7][8].

-

Data Quality Risk: Delayed and potentially compromised economic data may lead to misinformed investment decisions through Q1 2026.

-

Consumer Confidence Risk: Historical patterns show significant drops in consumer confidence during shutdowns, which could persist beyond the government reopening [4].

-

Sector Concentration Risk: Government-dependent sectors (defense, healthcare, consulting) may experience prolonged disruption effects.

Decision-makers should closely monitor Q4 2025 GDP revisions and underlying components, federal employee spending patterns post-shutdown, private-sector economic data releases for alternative indicators, policy negotiations for potential future shutdown risks, and corporate earnings guidance revisions for Q1 2026.

While markets have historically recovered from shutdowns, the combination of record-high valuations and extended duration in this case creates a different risk profile. The Reddit author’s cautious approach appears prudent given these elevated risk factors, particularly as the delayed economic data creates an information vacuum that may persist well into 2026.

The Reddit analysis accurately identified several critical factors regarding government shutdown impacts. The estimated 0.4-1.2 percentage point Q4 GDP reduction aligns with historical patterns from 2013 and subsequent shutdowns. The concern about elevated current valuations is particularly noteworthy - with S&P 500 P/E ratios at 30.58 versus 17.82 in 2013, markets have significantly less cushion for economic disappointments [6][7].

The 43-day duration of the 2025 shutdown places it at the more severe end of historical shutdowns, suggesting economic impacts may be toward the higher end of the estimated range. The delayed economic data creates persistent uncertainty that may affect market pricing through Q1 2026. While markets showed resilience with quick recovery from November 13 declines, the underlying valuation concerns and data quality issues warrant continued monitoring.

Sector performance indicates defensive positioning by investors, suggesting market participants share the Reddit author’s caution despite historical patterns of market resilience to shutdowns.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.