In Vivo CAR-T Technology Route Investment Value Analysis

Related Stocks

Based on my in-depth research on the In Vivo CAR-T technology route, I will provide you with a comprehensive investment value analysis.

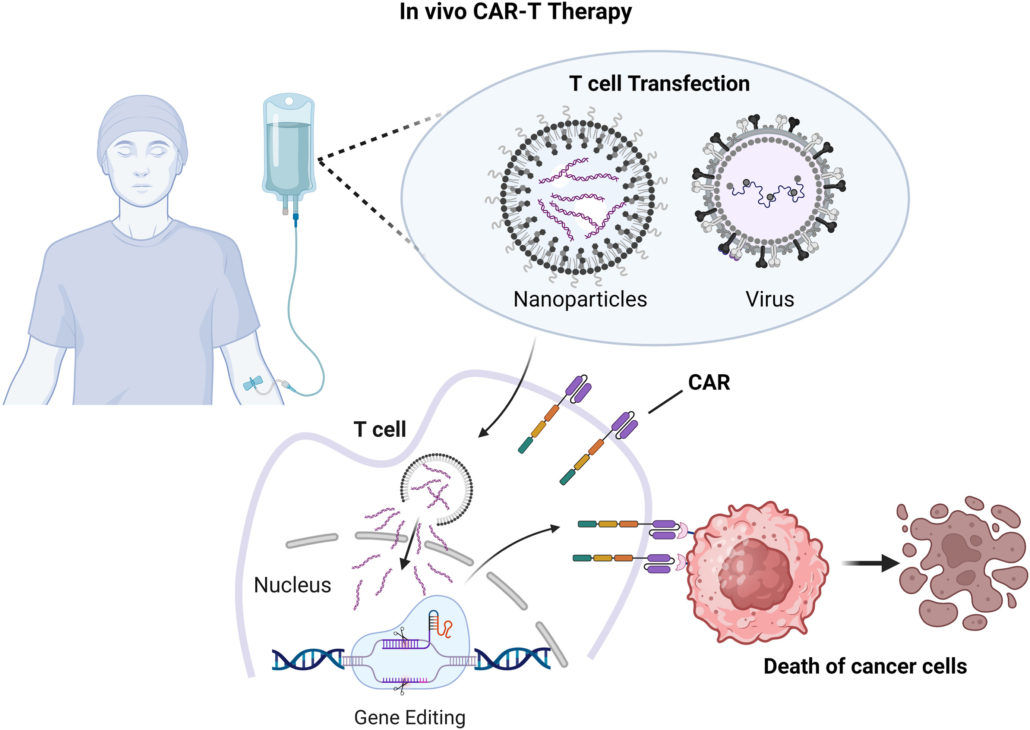

In Vivo CAR-T technology represents a major breakthrough in the field of cell therapy. By directly generating CAR-T cells in the patient’s body, it completely changes the complex process of traditional CAR-T therapy that requires ex vivo cell manufacturing. This technical route has revolutionary advantages:

- Significantly Reduced Manufacturing Costs: Eliminates complex ex vivo operations such as cell separation, modification, and expansion

- Improved Treatment Accessibility: Shift from “personalized customization” to “off-the-shelf products”

- Shorter Treatment Time: From the 2-4 week preparation cycle of traditional CAR-T to a few days

- Rapid Transfection: The LNP platform enables rapid T-cell targeting and transfection [1]

- Repeatable Administration: LNP formulations have better safety and repeatable administration characteristics [2]

- Targeting Precision: T-LNP (T-cell targeting lipid nanoparticle) technology achieves highly selective T-cell targeting

Vivacta Bio’s GT801 released encouraging first-in-human trial data at the 2025 ASH Annual Meeting [1]:

- Uses T-LNP to deliver mRNA encoding anti-CD19 CAR

- Both patients showed high CAR expression in circulating T cells

- Well-tolerated with no obvious off-target effects

- Supports the feasibility of repeat administration

CREATE Medicines’ MT-303 also initiated clinical trials in first-line treatment of hepatocellular carcinoma [3], demonstrating the application potential of LNP technology in solid tumors.

- Stable Integration: Lentiviral vectors enable stable integration of genes, providing long-lasting therapeutic effects

- High Transduction Efficiency: Significant advantage in transducing T cells in vivo

Kelonia Therapeutics’ KLN-1010 achieved breakthrough progress in BCMA multiple myeloma treatment [4]:

- 100% MRD-negative response rate (4 patients)

- Longest follow-up of 5 months, all patients maintained response

- No grade 3 or higher cytokine release syndrome (CRS) or immune effector cell-associated neurotoxicity syndrome (ICANS)

- Excellent safety profile

-

BMS Acquires Orbital Therapeutics - $1.5 Billion[5]

- Acquisition Core: OTX-201 (next-generation in vivo CAR-T therapy)

- Strategic Significance: Strengthens CAR-T layout in the field of autoimmune diseases

-

Gilead Acquires Interius BioTherapeutics - $350 Million[6]

- Acquisition Core: Lentivirus-mediated in vivo CAR-T platform

- Strategic Significance: Deepens cell therapy layout through the Kite division

-

Other M&A Activities with Undisclosed Amounts

- Technical Complementation Needs: Large pharmaceutical companies need to quickly acquire emerging technology platforms through acquisitions

- Market Access Barriers: High threshold for in vivo CAR-T technology, high risk of independent R&D

- Urgency of Patent Layout: Early patent layout is crucial for future market position

- Cost-Effectiveness Considerations: Acquiring mature platforms is more cost-effective than R&D from scratch

-

Clinical Data Catalysts

- Pay attention to key clinical trial data readout time points of various companies

- Data releases at important academic conferences such as ASH and ASCO

- Regulatory milestone events

-

Technology Platform Companies

- LNP delivery technology platform companies (e.g., Acuitas Therapeutics)

- Targeting ligand technology providers

- CDMO service providers

-

Commercial Breakthroughs

- First in vivo CAR-T product approved for marketing

- Indication expansion (from hematological tumors to solid tumors)

- Cost reduction due to mature manufacturing processes

-

Platform Licensing Opportunities

- Licensing cooperation of technology platforms to large pharmaceutical companies

- Commercial cooperation in regional markets

-

Technology Integration and Innovation

- Combination of in vivo CAR-T and gene editing technology

- Application of artificial intelligence in drug design

- Development of personalized medicine

-

Market Pattern Reshaping

- Traditional CAR-T companies transitioning to in vivo technology

- IPO opportunities for emerging technology companies

- Accelerated industry integration

-

Technical Risks

- In vivo delivery efficiency and specificity still need optimization

- Long-term safety and immunogenicity issues

- Solid tumor treatment faces greater challenges

-

Regulatory Risks

- Regulatory path for new technology routes is not yet clear

- Potential impact of safety events

-

Market Risks

- Pricing and medical insurance access challenges

- Continuous improvement of traditional CAR-T technology forms competition

-

Key Investment Directions:

- Companies with differentiated technology platforms

- Projects in clinical data validation phase with good safety

- Mid-to-late stage projects with potential for cooperation with large pharmaceutical companies

-

Timing of Investment:

- Pay attention to clinical data catalyst events

- Use market fluctuations to invest at low points

- Attach importance to the scalability of technology platforms

-

Risk Control Strategies:

- Diversify investment in technical routes

- Pay attention to regulatory progress and safety data

- Set clear exit mechanisms

[1] BioSpace - “Vivacta Bio Announces Promising First-in-Human Results for GT801, an In Vivo CAR-T Therapy, in Non-Hodgkin’s Lymphoma at the 2025 ASH Annual Meeting” (https://www.biospace.com/press-releases/vivacta-bio-announces-promising-first-in-human-results-for-gt801-an-in-vivo-car-t-therapy-in-non-hodgkins-lymphoma-at-the-2025-ash-annual-meeting)

[2] BioSpace - “Acuitas Therapeutics Showcases Collaboration with Children’s Hospital of Philadelphia for Personalized CRISPR Therapy and New LNP Research at ASGCT 2025” (https://www.biospace.com/press-releases/acuitas-therapeutics-showcases-collaboration-with-childrens-hospital-of-philadelphia-for-personalized-crispr-therapy-and-new-lnp-research-at-asgct-2025)

[3] BioSpace - “CREATE Medicines Doses First Patient in Frontline HCC Trial Evaluating MT-303, an In Vivo CAR Therapy” (https://www.biospace.com/press-releases/create-medicines-doses-first-patient-in-frontline-hcc-trial-evaluating-mt-303-an-in-vivo-car-therapy-in-combination-with-standard-of-care-immunotherapy)

[4] BioSpace - “Kelonia Therapeutics Presents First-in-Human Data From Phase 1 inMMyCAR Study of KLN-1010 in vivo BCMA CAR-T Therapy at the 2025 ASH Annual Meeting” (https://www.biospace.com/press-releases/kelonia-therapeutics-presents-first-in-human-data-from-phase-1-inmmycar-study-of-kln-1010-in-vivo-bcma-car-t-therapy-at-the-american-society-of-hematology-ash-2025-annual-meeting)

[5] Yahoo Finance - “Bristol Myers buys Orbital Therapeutics for $1.5 billion” (https://finance.yahoo.com/news/bristol-myers-buys-orbital-therapeutics-111651114.html)

[6] Yahoo Finance - “Gilead’s Kite scoops in vivo CAR-T specialist Interius for $350m” (https://finance.yahoo.com/news/gilead-kite-scoops-vivo-car-105336605.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.