Significance of Caocao Chuxing Management's Voluntary Share Lockup for Investors

Related Stocks

Based on Caocao Chuxing’s latest announcements and relevant materials, I will analyze the significance of the management’s voluntary share lockup behavior for investors:

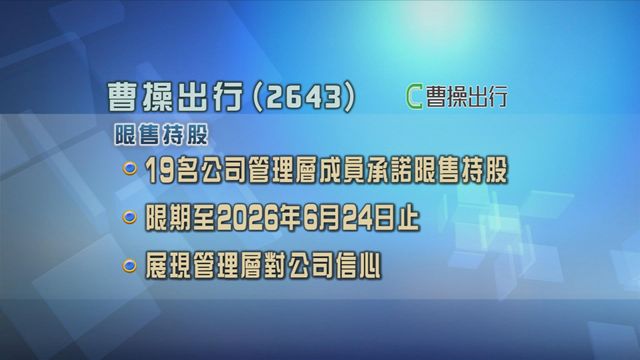

Caocao Chuxing (02643.HK) announced on December 16, 2025, that 19 members of the company’s management voluntarily committed not to sell the shares obtained from exercising options under the pre-IPO share incentive plan until June 24, 2026 [1]. These shares are derived from the share incentive plan adopted by the company in November 2022 [2].

Management voluntarily extended the share lockup period to June 24, 2026, which is an additional commitment of about 6 months beyond the regular lockup expiration time. This conveys the following positive signals:

- Long-term development confidence: Management is willing to align personal interests with the company’s long-term value

- Performance expectations: Implies optimism about the company’s business prospects in the next 12-18 months

- Reduced selling pressure expectation: No significant selling pressure from management’s large-scale share reductions in the short term

- Stock price protection: Reduces the impact of concentrated selling during the lockup expiration period on the stock price

- Investor confidence: Avoids panic selling by investors due to lockup expiration

- Liquidity management: Provides the market with a more stable expectation of share supply

Caocao Chuxing listed on the Hong Kong Stock Exchange on June 25, 2025, with an issue price of HK$41.94 [3]. Its post-listing performance was poor, breaking below the issue price by 14.16% on the first day [3]. As of December 2025, the stock price is still below the issue price, in a state of “hitting a 52-week low and falling below the listing price” [3].

The ride-hailing industry is highly competitive, and Caocao Chuxing faces the following challenges in the fierce market environment:

- Financing environment: From 2021 to before the IPO, Caocao Chuxing’s financing was stagnant [4]

- Competitive pressure: Competitors like T3 Chuxing have an advantage in financing scale

- Profit pressure: The ride-hailing industry generally faces profit challenges

- Reasonable time span: An 18-month lockup period shows a medium-to-long-term commitment

- Wide coverage: 19 management members include all relevant directors, with sufficient coverage

- Voluntary nature: Not mandatory, with stronger initiative

- Scale of equity incentives: Caocao Chuxing’s equity incentives exceeded 50 million shares at the time of IPO, benefiting more than half of its employees [4]

- Poor stock price performance: Commitments during a period of low stock prices may have the purpose of stabilizing the market

- Nature of options: The locked-up shares are those obtained after exercising options, and exercise costs are still required

- Industry cycle: The ride-hailing industry is still in a phase of fierce competition and cash burning

- Concentrated lockup expiration period: There may be concentrated lockup expiration pressure after June 24, 2026

- Positive signal: Management’s commitment provides short-term stock price support

- Risk reduction: Reduces uncertainty during the lockup expiration period

- Wait-and-see attitude: It is recommended to pay attention to subsequent performance and management’s actual actions

- Fundamentals are key: Still need to pay attention to the improvement of the company’s profitability and changes in market share

- Industry prospects: The ride-hailing market is expected to grow from 358.9 billion yuan in 2025 to 666.1 billion yuan in 2029, with a compound annual growth rate of nearly 17% [5]

- Competitive advantages: Pay attention to the company’s synergies under the Geely system and technological innovation

Management’s voluntary share lockup commitment

- Positive significance: This is an important gesture by management to show long-term commitment, playing a role in stabilizing the market during the current period of low stock prices

- Limiting factors: Cannot fully replace fundamental improvements; still need to pay attention to the company’s actual operating performance

- Investment decision: Should make a comprehensive judgment based on the company’s financial status, industry trends, and competitive advantages

It is recommended that investors, while paying attention to management’s confidence, focus more on the company’s path to improving profitability, changes in market share, and differentiated advantages in the fierce ride-hailing competition.

[1] Sina Finance - Caocao Chuxing: Management Voluntarily Locks Up Held Shares (https://finance.sina.com.cn/stock/hkstock/ggscyd/2025-12-17/doc-inhcaekv7481848.shtml)

[2] NetEase - Caocao Chuxing (02643.HK): Management Voluntarily Locks Up Held Shares (https://www.163.com/dy/article/KGVAM6IB05198ETO.html)

[3] ETNet - New Stock IPO Performance Data (https://www.etnet.com.hk/www/tc/stocks/ipo-sponsor-review.php?id=2)

[4] Securities Times - “Provincial Team” Ride-Hailing IPO: Loss of 1.9 Billion Yuan in 3.5 Years! Backed by SAIC, Alibaba, and CATL (https://www.stcn.com/article/detail/3527529.html)

[5] New Fortune Magazine - Ride-Hailing Market Growth Forecast (https://www.stcn.com/article/detail/3527529.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.