Temu's Transition to Semi-Managed Model and Impact on Pinduoduo's Valuation

Related Stocks

Based on the latest market data and financial analysis, I will provide a comprehensive analysis of the strategic significance of Temu’s transition from a fully managed to a semi-managed model and its impact on Pinduoduo’s valuation.

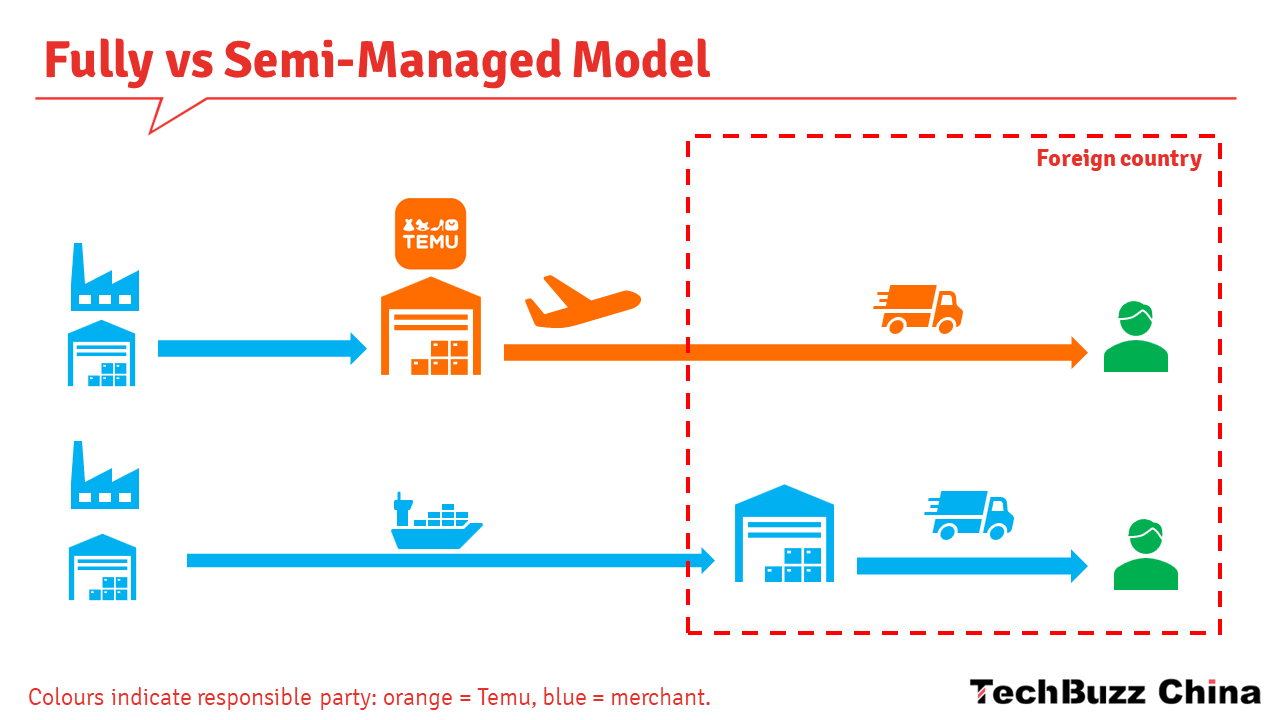

In 2024, the U.S. canceled the $800 tariff exemption policy, which dealt a major blow to Temu’s low-price advantage. The fully managed model is taxed on the final sales price, resulting in a tariff impact of up to 54%; while the semi-managed model is taxed on the cost of goods, with a tariff impact of only 13%-18%[1]. This fundamental difference has pushed Temu to accelerate its transition to the semi-managed model.

According to data analysis, the gross margin of sellers in the semi-managed model can stabilize at 25%-35%, while that in the fully managed model is only 5%-10%[2]. This significant difference mainly stems from:

- Transfer of pricing power: from platform-unified pricing to seller-independent pricing

- Logistics cost optimization: sellers can choose more economical localized logistics solutions

- Operational efficiency improvement: reducing the platform’s cost expenditures in intermediate links

As of 2025, Temu’s market share in the U.S. e-commerce market has reached 1.6%, which is far lower than Amazon’s 37.6%, but the growth momentum is strong[3]. The YoY growth rate of GMV in the third quarter rebounded to about 40%, close to the level of Q1 2025[1].

From the perspective of financial data analysis, the improvement in Temu’s unit economics is mainly reflected in:

- Logistics costs reduced by 18-25%[4]

- Order fulfillment efficiency improved by more than 40%[4]

- Tariff costs sharply reduced from 54% to 13%-18%[1]

- Profit margin of semi-managed sellers increased to 25%-35%[2]

- Average order value increased by 18% through localized products[1]

- Customer satisfaction index reached 4.8/5.0[4]

According to the latest financial data[0]:

- Current valuation: Market capitalization of $152.55 billion, P/E ratio of 10.50x

- Profitability: Net profit margin of 24.43%, operating margin of 22.10%

- Analyst target price: Consensus target price of $140.50, with a 28.9% upside potential from the current price

According to market analysis, Temu is expected to achieve break-even in the U.S. market in Q4 2025[1], which will significantly improve Pinduoduo’s overall valuation logic:

- Profit model verification: The semi-managed model has successfully verified its feasibility

- Cash flow improvement: From burning money for expansion to contributing profits

- Valuation system transformation: From growth premium to value investment logic

- Current P/E ratio is only 10.50x, significantly lower than the industry average

- If Temu achieves break-even, it is expected to rise to the range of 15-18x

- Corresponding to a stock price upside potential of about 40-70%

Through its partnership with Shopify[5], Temu has attracted nearly 3 million U.S. enterprises to settle in[6], forming an ecosystem different from Amazon’s. This differentiated strategy lays the foundation for long-term development.

In the second quarter of 2025, the number of users in Europe and Latin America increased by 74% and 122% YoY respectively, and these two markets together account for 60% of global users[1]. This diversified layout effectively reduces dependence on a single market.

- Short-term catalyst: Expectation of Temu’s break-even in the U.S. market

- Mid-term logic: Global replication of the semi-managed model

- Long-term value: Pinduoduo has abundant cash (more than 400 billion yuan)[1], with the ability to continue investing

- Regulatory risk: The EU will implement the policy to cancel the €150 tax exemption limit in Q1 2026[1]

- Intensified competition: Competition with Amazon and TikTok Shop is becoming increasingly fierce

- Exchange rate risk: Impact of U.S. dollar exchange rate fluctuations on cross-border business

Temu’s transition from the fully managed to the semi-managed model is a strategic inevitable choice. This transition not only effectively responds to regulatory challenges but also fundamentally improves unit economics. The 70% semi-managed model penetration rate in the U.S. market and the expectation of break-even in 2025 indicate that Temu’s business model has been verified.

For Pinduoduo’s overall valuation, Temu’s successful transition will bring an opportunity for re-rating of the valuation system. The current P/E ratio of 10.50x does not fully reflect Temu’s potential value; once the profit model is confirmed, it is expected to achieve significant valuation repair.

[0] Jinling API Data - Pinduoduo Company Profile and Financial Data

[1] Sina Finance - “Interpretation of Pinduoduo’s Latest Earnings Report” (November 20, 2025)

[2] CSDN Blog - “Detailed Explanation of TEMU Semi-Managed Model Knowledge”

[3] Eccang Technology - “TEMU’s Price Matching Mechanism Has Changed! 10% Discount to Benchmark Amazon”

[4] CSDN Blog - “Logistics Efficiency Analysis of TEMU Fully Managed Model”

[5] Retail Touchpoints - “Temu Launches Shopify Seller Integration” (December 16, 2025)

[6] Retail Gazette - “Temu unveils app for Shopify sellers” (December 16, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.