2026 S&P 500 Outlook: AI Capex and Valuation Dynamics Analysis

Related Stocks

This analysis leverages a Seeking Alpha article [1] published on December 16, 2025, which forecasts 2026 S&P 500 (SPX) gains driven by robust AI adoption and capex spending. The article posits that AI-driven operating efficiencies will justify a 22x forward price-to-earnings (P/E) ratio, a premium to the index’s 40-year historical average of ~16.7x [5].

On the publication day, the SPX closed at 6,795.22, down 0.07% from the prior day, but within a broader upward trend (16.04% year-to-date gain through December 16, 2025) [0]. Notably, the Technology (+0.54%) and Communication Services (+0.70%) sectors—closely tied to AI—outperformed other sectors that day [0].

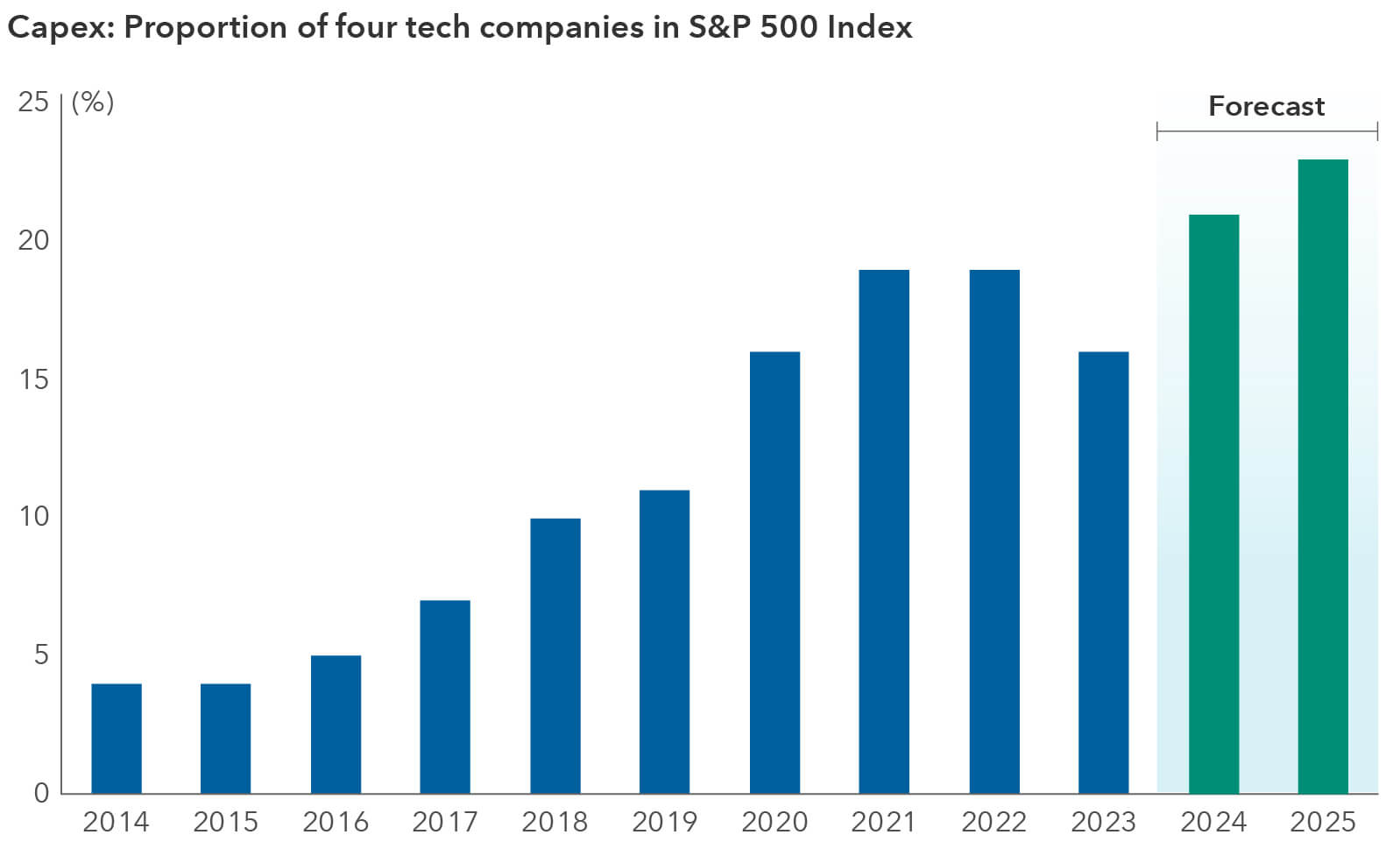

Supporting the article’s thesis, the “big 4” AI spenders (Meta, Microsoft, Alphabet, Amazon) project ~$400 billion in AI capex for 2026, up from initial 2025 estimates [2][4]. J.P. Morgan Global Research identifies AI capex as a persistent 2026 tailwind [3], while Lord Abbett notes AI investment expansion beyond mega-caps to mid- and small-cap firms, creating multi-layered earnings growth [4]. As of December 2025, the SPX’s forward P/E ratio stands at ~22.4x [6], aligning with the article’s forecasted 22x multiple.

- AI Capex Broader Adoption: While mega-cap tech dominates current AI spending, the trend is expanding to smaller firms, indicating a systemic market impact rather than isolated mega-cap growth [4].

- Sector Performance Correlation: The outperformance of AI-relevant sectors on the article’s publication day suggests investor sensitivity to AI-related catalysts [0].

- Valuation Premium Justification: Multiple analysts support the article’s view that AI-driven efficiencies offset the SPX’s current above-average P/E, highlighting modern companies’ enhanced earnings growth potential [5].

- Valuation Correction: A slowdown in AI adoption or capex growth could trigger a correction, as the current 22.4x P/E is well above the 40-year average [5].

- Capex Concentration: The majority of AI spending is concentrated in four mega-cap firms, making the market vulnerable to negative news from these companies [2].

- Economic Headwinds: Slowing consumer spending, stagnant housing, and labor market weakness may counterbalance AI capex benefits [3].

- Regulatory Scrutiny: Inquiries into AI data centers’ electricity usage could increase costs or restrict capex plans, a risk unaddressed in the article [7].

- Cross-Industry Earnings Growth: AI capex is spreading across the value chain (semiconductors, cloud, data centers), creating opportunities beyond mega-cap tech [4].

- Productivity Gains: Mid- and small-cap firms’ AI-driven productivity improvements may unlock new growth pathways [4].

- SPX year-to-date gain (through 12/16/2025): 16.04% [0]

- Big 4 2026 AI capex projection: ~$400 billion [2][4]

- Current SPX forward P/E: ~22.4x (40-year average: ~16.7x) [5][6]

- Publication day sector outperformance: Technology (+0.54%), Communication Services (+0.70%) [0]

Decision-makers should monitor quarterly earnings for AI capex updates and productivity gains, as well as regulatory developments related to AI.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.