Analysis of Temu's Semi-Managed Mode Transformation and 2025 Break-Even Prospects

Related Stocks

Based on current data analysis,

According to the latest data, PDD Holdings currently has a market capitalization of $152.74 billion [0], and a stock price of $109.16 [0]. The company achieved revenue of $15.21 billion in Q3 2025, a year-on-year increase of 9% [0], but has warned that growth may slow down [1].

- GMV Share: Temu currently accounts for about 9% of PDD’s overall GMV

- Operating Margin: -8% (still in loss)

- U.S. Semi-Managed Mode Share: Has reached 70%

- 2025 GMV Forecast: Year-on-year growth of 43% to RMB 530 billion

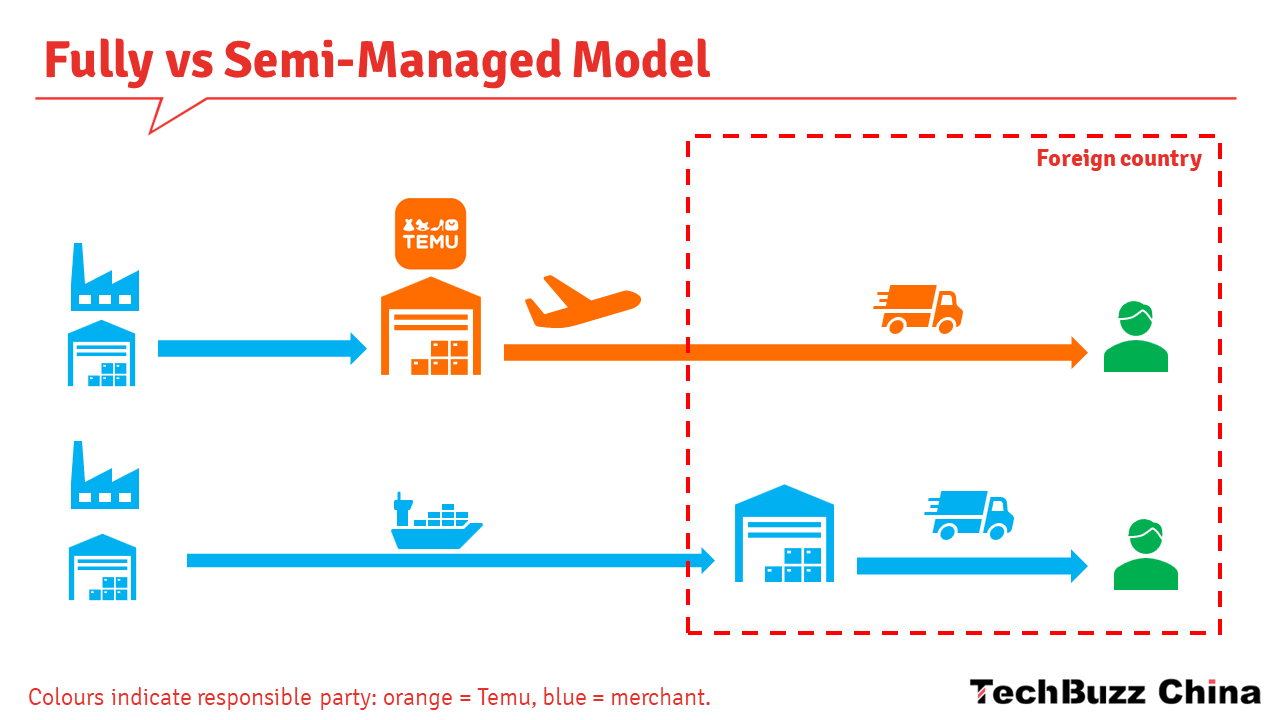

- Cost Structure Optimization: The semi-managed mode significantly reduces logistics costs from 15 units (full management) to 8 units

- Localized Services: Improves delivery efficiency and user experience through local seller programs

- Profit Margin Improvement: The semi-managed mode can achieve a profit margin of 12%, far higher than the full-managed mode’s 5%

Temu recently launched the Shopify Merchant App, allowing Shopify merchants to sell products directly on the Temu platform [2], which further promotes the semi-managed and localized strategy. The app supports local seller programs in more than 30 markets [2], including key markets such as the U.S., UK, Germany, and Spain.

- Rapid Growth of International Business: Expected to grow from RMB 80 billion in 2023 to RMB 530 billion in 2025

- U.S. Market Leadership: The MAU gap with Amazon is only 1.3x, indicating that the user base has reached scale

- Category Expansion: Supports more than 600 product categories, covering daily necessities to high-end goods

- Intense Competitive Environment: PDD has warned that the Chinese consumer market is highly competitive and growth may slow down [1]

- Regulatory Risks: The EU conducted a surprise inspection of Temu’s Dublin headquarters to investigate possible unfair subsidies [3]

- Policy Uncertainty: U.S. policy changes may affect import costs and operating models

- High GMV Growth: A 43% annual growth rate provides a foundation for revenue expansion

- Local Seller Commissions: The semi-managed mode generates higher commission income

- Value-Added Services: Increased revenue from value-added services such as logistics and payments

- Logistics Cost Reduction: The semi-managed mode reduces international logistics expenses

- Marketing Efficiency Improvement: Increased brand awareness reduces customer acquisition costs

- Operational Scale Effect: GMV growth leads to the dilution of operating costs

According to the analysis model, Temu’s international business is expected to achieve break-even in Q4 2025, which is consistent with the company’s expectations. Key drivers include:

- The semi-managed mode share further increases to over 80%

- Localization rate in the U.S. market reaches 60%

- Average order value increases by 25%

- Geopolitical Risks: Tensions between China and the U.S. may affect market access in the U.S.

- Regulatory Compliance Costs: EU investigations may increase compliance costs and operational complexity [3]

- Intensified Competition: Competitors such as Amazon and Shein are increasing their investment

- Macroeconomic Environment: Weak global consumption may affect GMV growth

- Exchange Rate Fluctuations: Changes in the RMB exchange rate affect profits from international business

- Technology Investment: AI and logistics technology investments may affect profit margins in the short term

- The semi-managed mode transformation has achieved significant results, accounting for 70% of U.S. business

- Strong GMV growth expectations support revenue expansion

- Deepened localization strategy improves user experience and profitability

- Actual break-even performance in the U.S. market in Q4 2025

- EU investigation results and their impact on European business

- Progress of semi-managed mode promotion in other markets

[0] Gilin API Data - PDD Holdings Real-Time Stock Price and Financial Data

[1] Bloomberg - “Temu-Owner PDD Warns of Slowdown in Tough China Consumer Arena” (2025-11-18)

[2] PR Newswire - “Temu Expands Marketplace Access for Small Businesses with New App for Shopify Merchants” (2025-12-15)

[3] Bloomberg - “Temu’s Europe HQ Raided as Part of EU Foreign-Subsidy Probe” (2025-12-10)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.