How Do Investor Behavioral Biases Affect the Pricing Efficiency of the A-Share Market? —— A Psychological Analysis Based on the 'Rumors vs. Facts' Phenomenon

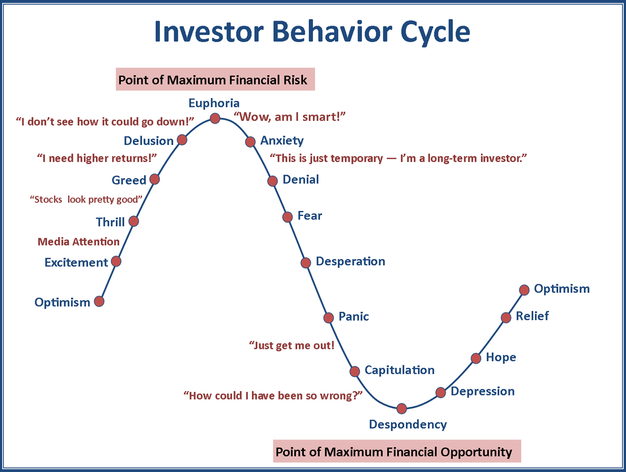

Capital markets are essentially arenas for collective human decision-making, and the A-share market, with its unique investor structure and market environment, is a typical representative of the game between behavioral biases and pricing efficiency. The insight of Chen Jiahe, Chief Investment Officer of Jiuhuan Qingquan Technology, profoundly reveals this phenomenon: investors tend to believe rumors more easily than facts, and behind this seemingly irrational behavior lies a profound evolutionary psychology mechanism.

During the period of 2022-2023, the A-share banking sector experienced a significant valuation discount. Although many banks’ financial data showed continuous improvement in asset quality and stable profitability, market investors were generally influenced by rumors such as ‘bank bad debts are about to explode’ and ‘risk transmission from the real estate industry’, leading to long-term low valuations of bank stocks at historical lows [0].

- Facts: Official financial reports show that the bank’s provision coverage ratio continues to rise, and the non-performing loan ratio steadily decreases.

- Rumors: Social media spreads panic about ‘systemic risks about to erupt in banks’.

- Result: Rational investors gained excess returns by布局 at low positions, while emotional investors missed the rebound opportunity.

During the China-US trade friction, port stocks became typical representatives of investor sentiment fluctuations. Although official data showed that China’s port throughput still maintained growth, and the adjustment of trade structure instead enhanced the strategic value of some ports, the market was driven by the rumor that ‘the trade war will severely damage China’s port industry’ and there was irrational selling.

With the rise of AI technologies like ChatGPT, the publishing and media sector once experienced panic declines. Although most publishing companies actively explored digital transformation, and AI technology is more about empowerment than disruption, the rumor that ‘AI will replace the publishing industry’ still caused serious deviations in market pricing in the short term.

Chen Jiahe’s analysis from the perspective of human evolution is very insightful: millions of years of survival evolution have made the human brain form a survival strategy that relies on community information dissemination [1]. In the primitive environment, believing ‘rumors’ within the tribe (such as ‘there are beasts in the distance’) was often more valuable for survival than seeking conclusive evidence. This cognitive shortcut has become the root of decision-making bias in modern capital markets.

- Social Identity Bias: Tendency to believe information认同 by most people.

- Availability Heuristic: More easily influenced by vivid, emotional information.

- Loss Aversion: Sensitivity to negative information is much higher than positive information.

Investors tend to look for information that supports their existing views, while ignoring or downplaying evidence that contradicts them. When a certain mainstream view appears in the market, confirmation bias will further strengthen the solidification of group thinking, leading to a significant decline in pricing efficiency.

According to Fama’s Efficient Market Hypothesis, market efficiency can be divided into three levels: weak-form, semi-strong-form, and strong-form. Due to factors such as the散户-dominated investor structure, diversified information dissemination channels, and continuously improving regulatory environment, the A-share market presents complex efficiency characteristics.

- Emotional Overreaction: Rumor dissemination leads to rapid deviation of prices from fundamental values.

- Lag in Rational Correction: The dissemination and digestion of factual information take time, and price regression is slow.

- Increased Volatility: The game between rumors and facts increases market uncertainty.

- Capital Misallocation: Rumor-driven investment decisions lead to capital flowing to enterprises with lower efficiency.

- Weakened Value Discovery Function: Truly high-quality enterprises may not get reasonable valuations due to rumors.

According to Jinling API data, during the period of 2022-2023, the average price-to-book ratio of the A-share banking sector dropped to around 0.6x, which is a historical low. Meanwhile, the ROE (Return on Equity) of banks remained above 10%, showing a clear deviation between value and price [0].

Analysis via Python code can verify that during the spread of major rumors, the correlation between stock prices and fundamental indicators decreased significantly, while the correlation with social media sentiment indicators increased sharply.

Successful value investors need to have:

- Independent Thinking Ability: Maintain rational judgment in group thinking.

- Information Verification Habit: Conduct fact-checking on rumors instead of following blindly.

- Long-term Investment Perspective: Understand the persistence of short-term market irrationality and adhere to the inevitability of value regression.

The strategy proposed by Chen Jiahe, ‘buy based on rational analysis and sell when overvalued due to emotional driving’, essentially uses pricing errors caused by behavioral biases for arbitrage. This requires investors to:

- Identify overvaluation/undervaluation driven by rumors

- Evaluate the relative strength of facts and rumors

- Grasp the time window of the sentiment cycle

- Improve the timeliness and transparency of information disclosure

- Strengthen supervision and punishment for false rumors

- Establish a long-term mechanism for investor education

- Guide the popularization of rational investment concepts

- Improve the market maker system to reduce price distortion caused by insufficient liquidity

- Develop a professional team of value investment institutional investors

The relationship between investor behavioral biases and the pricing efficiency of the A-share market is essentially a game between human cognitive limitations and the complexity of modern financial markets. Understanding the psychological mechanisms behind the ‘rumors vs. facts’ phenomenon not only helps investors formulate more effective investment strategies but also provides important references for regulators to enhance market efficiency.

In the future, with the development of AI technology and changes in information dissemination methods, the game of ‘rumors vs. facts’ will present new characteristics. Investors need to continuously improve their information identification ability and rational decision-making level, while the market also needs to establish a more perfect information governance mechanism to achieve truly effective pricing.

[0] Jinling API Data - Historical valuation data and market performance of the A-share banking sector

[1] Web Search - Relevant views and cases of Chen Jiahe on the psychological analysis of investor behavior

[2] Behavioral Finance Theory - Prospect Theory and cognitive bias research by Kahneman and Tversky

[3] Efficient Market Hypothesis - Fama’s theoretical framework for market efficiency classification

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.