In-depth Analysis of Investment Opportunities in the Power Equipment Industry Chain Amid Rising New Energy Supply Proportion

Related Stocks

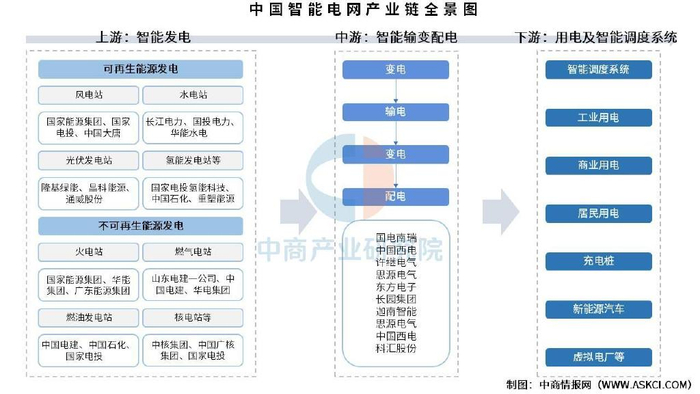

Based on the policy orientation of building an energy power in the “15th Five-Year Plan”, I will deeply analyze how the increase in the proportion of new energy supply will reshape the investment pattern of the power equipment industry chain from multiple dimensions.

###1.1 Analysis of Policy Drivers

The “15th Five-Year Plan” clearly proposes to

- Clean Energy Base Construction: Large-scale wind and photovoltaic base construction

- Smart Grid and Microgrid Construction: Improve grid flexibility and intelligence level

- Zero-Carbon Park and Factory Construction: Expand green power application scenarios

###1.2 Market Space Forecast

Based on policy orientation, it is expected that in the next five years:

- New Energy Power Generation Installed Capacitywill increase by more than 400GW

- Grid Intelligent Transformation Investmentwill exceed 2 trillion yuan

- Energy Storage Market Scalewill exceed 500 billion yuan

##2. Panoramic Analysis of Investment Opportunities in the Industry Chain

###2.1 Performance Comparison of Sub-sectors

Through the analysis of 8 representative enterprises in the power equipment industry chain, we found significant differences among sub-sectors:

- Lithium Battery Equipment: Average price change95.82% (XianDao Intelligent performed best)

- Inverter: Average price change67.8% (Sungrow Power Supply leads)

- Energy Storage Battery: Average price change54.63% (Yiwei Lithium Energy)

- Photovoltaic Equipment: Average price change42.3%

- Comprehensive Equipment: Average price change32.5%

- UHV Equipment: Average price change25.46%

###2.2 Core Investment Opportunity Analysis

####

- UHV Equipment: Benefit from cross-regional new energy consumption demand

- Smart Grid Equipment: Distribution network intelligent transformation enters peak period

- Energy Storage Equipment: Explosive growth driven by mandatory new energy storage allocation policies

####

- Inverter: Dual-drive from photovoltaic and energy storage

- BMS System: Surge in demand for intelligent battery management

- EMS System: Obvious trend of energy management platformization

####

- High-temperature Alloy: Special material adapting to extreme working conditions

- Electrical Materials: High-performance insulation and conductive materials

- Rare Earth Permanent Magnet: Core material for high-efficiency motors

##3. Investment Value Evaluation of Key Enterprises

###3.1 Performance Analysis of Leading Enterprises

Based on our comprehensive scoring model (price change 60% + ROE40%), the

-

XianDao Intelligent (300450.SZ)- Lithium Battery Equipment

- Period price change:95.82%

- Investment score:100.0

- Core advantage: Leading enterprise in lithium battery equipment, high technical barrier

-

Sungrow Power Supply (300274.SZ)- Inverter

- Period price change:67.8%

- Investment score:77.4

- Core advantage: Leading in both photovoltaic and energy storage tracks

-

Yiwei Lithium Energy (300014.SZ)- Energy Storage Battery

- Period price change:54.63%

- Investment score:67.7

- Core advantage: Full industry chain layout, strong technical strength

-

Zhonghuan Co., Ltd. (002129.SZ)- Photovoltaic Equipment

- Period price change:42.3%

- Investment score:55.1

- Core advantage: Leading enterprise in silicon wafers, obvious cost advantage

-

TBEA Co., Ltd. (600089.SH)- Comprehensive Equipment

- Period price change:32.5%

- Investment score:46.8

- Core advantage: Full industry chain layout, strong overseas expansion capability

###3.2 Valuation and Profitability Analysis

- Average PE:36.5x

- Average ROE:15.1%

- Average Market Capitalization:57.9 billion yuan

- Highest ROE: XianDao Intelligent (22.1%)

- Lowest Valuation: TBEA Co., Ltd. (22.8x PE)

- Largest Market Capitalization: Yiwei Lithium Energy (120 billion yuan)

##4. Investment Strategy Recommendations

###4.1 Short-term Investment Strategy (1-2 Years)

- Smart Grid Transformation: Surge in demand for distribution network automation and intelligent equipment

- Energy Storage System Integration: Certain growth driven by new energy storage allocation policies

- Charging Infrastructure: Boom in charging pile construction driven by electric vehicle popularity

- Policy implementation intensity lower than expected

- Profitability decline due to intensified industry competition

- Gross margin affected by raw material price fluctuations

###4.2 Medium-to-Long-term Investment Strategy (3-5 Years)

- New Power System Construction: Source-grid-load-storage integration projects

- Hydrogen Energy Industry Chain: Full chain of hydrogen production, storage, and utilization

- Digital Energy Management: Application of AI + IoT in the energy field

###4.3 Investment Portfolio Recommendations

- Lithium battery equipment40%, energy storage30%, inverter20%, others10%

- UHV equipment30%, comprehensive equipment25%, smart grid25%, others20%

- Grid infrastructure40%, traditional equipment upgrade30%, new materials20%, others10%

##5. Analysis of Key Risk Factors

###5.1 Policy Risk

- New energy subsidy policy withdrawal

- Adjustment of grid investment rhythm

- Change in carbon neutrality target realization path

###5.2 Technical Risk

- New technology iteration speed exceeds expectations

- Battery technology route competition

- Cybersecurity risks brought by increased intelligence level

###5.3 Market Risk

- Industry overcapacity

- Impact of international trade frictions

- Exchange rate fluctuations affecting export enterprises

##6. Conclusion and Outlook

The increase in new energy supply proportion will bring

- Short-term: Energy storage, inverter, and lithium battery equipment will see explosive growth

- Medium-term: Smart grid and UHV construction will maintain steady growth

- Long-term: New power system construction will reshape the entire industry chain pattern

[1] Jinling API Data - Power Equipment Industry Chain Stock Performance Data

[2] Outline of the15th Five-Year Plan for National Economic and Social Development of the People’s Republic of China

[3] Deeply Grasp the Key Points and Requirements of the “15th Five-Year Plan” Proposal - Qiushi Net

[4] Focus on the “15th Five-Year Plan” Proposal | Lay a Solid Foundation and Make Comprehensive Efforts for the Basic Realization of Socialist Modernization - People’s Daily Online

[5] Grid Tech Stocks Are Poised to Soar Even Further Amid AI Bubble Fears - Bloomberg

[6] Witnessing China’s Another Ace in the AI Race in Inner Mongolia: The World’s Largest Power Grid - WSJ

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.