Comprehensive Analysis of the Impact of Non-Farm Payroll Data on Gold Prices

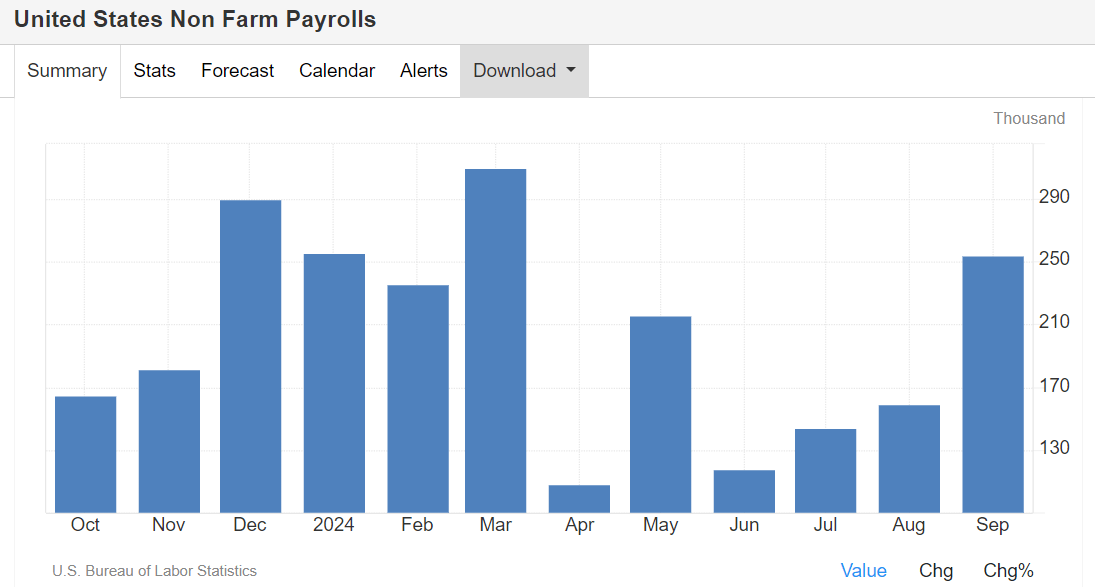

As one of the most important economic indicators, U.S. non-farm payroll data has complex and far-reaching impacts on gold prices. By analyzing 2025 market data [0], we can observe that gold prices performed strongly during this period, rising from $2,640.10 at the start of the year to $4,346.00, with a cumulative increase of 64.61%, far exceeding the 15.47% increase of the S&P 500 index and the 13.49% increase of the Dow Jones index over the same period [0].

Based on a detailed analysis of the release dates of non-farm payroll reports in 2025 [0], gold prices show the following characteristics:

- Pre-event expectation effect: In the 5 days before the release of the non-farm report, the average return of gold was 0.336%, indicating that the market had already started adjusting positions during the expectation phase

- Limited reaction on the day: The average return on the day of the report release was only 0.030%, indicating that the immediate impact was relatively mild

- Subsequent continuation effect: The average return increased to 0.402% in the 5 days after the report release, showing that the impact is persistent

The non-farm payroll report period significantly increases uncertainty in the gold market:

- Three high volatility periods were identified in 2025, occurring on May 2, June 6, and November 7 [0]

- The maximum volatility during these periods reached 25.84%-34.79%, significantly higher than the daily average [0]

- Volatility usually peaks within 2-5 days after the report is released

Non-farm payroll data affects the long-term value of gold through the following channels:

- Strong employment data → Fed hawkish stance → rising interest rate hike expectations → rising real interest rates → gold under pressure

- Weak employment data → Fed dovish stance → enhanced interest rate cut expectations → falling real interest rates → gold benefits

- Strong job market → economic optimism → falling safe-haven demand → weakened gold attractiveness

- Weak job market → recession concerns → rising safe-haven demand → prominent gold value

According to the latest market information [1], the job market in 2025 faces unique challenges:

- Data reliability issues: The Bureau of Labor Statistics found that employment data was overestimated; during the 12 months ending in March, employment was 911,000 jobs less than previously estimated [1]

- Impact of government shutdown: The October employment report was canceled for the first time in history, leading to incomplete market information [1]

- Structural changes: Multiple factors such as the adoption of AI technology, reduced immigration, and tariff policies are reshaping the job market structure [1]

- Pre-judgment layout: Adjust positions according to market expectations 3-5 days before the release of the non-farm report

- Volatility trading: Use the high volatility period after the report release for option strategies or breakout trading

- Risk management: Set strict stop-losses to control single transaction risk to no more than 2% of total capital

- Pay attention to key technical level breakouts, such as the 20-day and 50-day moving average crossover signals in the chart

- Combine volume changes to confirm the validity of price trends

- Strategic allocation: Regardless of short-term fluctuations in employment data, the long-term value of gold as an inflation hedge and safe-haven asset remains unchanged

- Regular fixed investment: Use dollar-cost averaging to smooth short-term fluctuations and reduce timing difficulty

- Asset allocation: It is recommended that gold allocation account for 5-15% of the investment portfolio; the specific ratio is adjusted according to risk preference

- Pay attention to real interest rate trends, which are the core factors affecting the long-term value of gold

- Monitor changes in the U.S. dollar index; the negative correlation provides a reference for long-term allocation

- Track central bank gold purchase demand; emerging market central banks such as China and Russia continue to increase their gold holdings

- Data surprise risk: Non-farm payroll data is often revised significantly, such as the large downward adjustment in 2024 [1]

- Policy uncertainty: The Fed’s interpretation of employment data may change

- Extreme market sentiment: Overly consistent market expectations may lead to reverse trends

- Prioritize long-term allocation and reduce short-term trading frequency

- Participate in the market through standardized products such as gold ETFs to reduce individual risks

- Avoid heavy positions before and after major data releases

- Establish a systematic trading strategy, including entry, exit, and risk management rules

- Combine other economic indicators (inflation, GDP, retail sales, etc.) for comprehensive judgment

- Pay attention to the use of derivatives such as options to improve strategy flexibility

Based on current trend analysis [0][1], the relationship between non-farm payroll data and gold prices may undergo the following changes in the future:

- Data quality improvement: The Bureau of Labor Statistics will strengthen data quality control and improve report reliability

- Market adaptability: Investors will pay more attention to the quality of employment data rather than absolute values

- Policy sensitivity: In an environment of relatively high interest rates, the impact of employment data on policy expectations may be more significant

[0] Gilin API Data - Gold prices, market indices, and technical analysis data

[1] Yahoo Finance - “U.S. September Non-Farm Payrolls Shine! Unemployment Rate Rises to Near 4-Year High; Fed May Maintain Rate Cut Option” (https://hk.finance.yahoo.com/news/美9月非農亮眼-失業率升近4年新高-fed可能維持降息選項-133959137.html)

[2] Yahoo Finance - “First Time in History! BLS Cancels October Employment Report; Market Expectations for December Rate Cut Probability Plummet” (https://hk.finance.yahoo.com/news/史上首次-bls取消10月就業場告-市報預期12月降息機率驟降-202404275.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.