Analysis of the Strong Performance of Zhilai Technology (300771)

Related Stocks

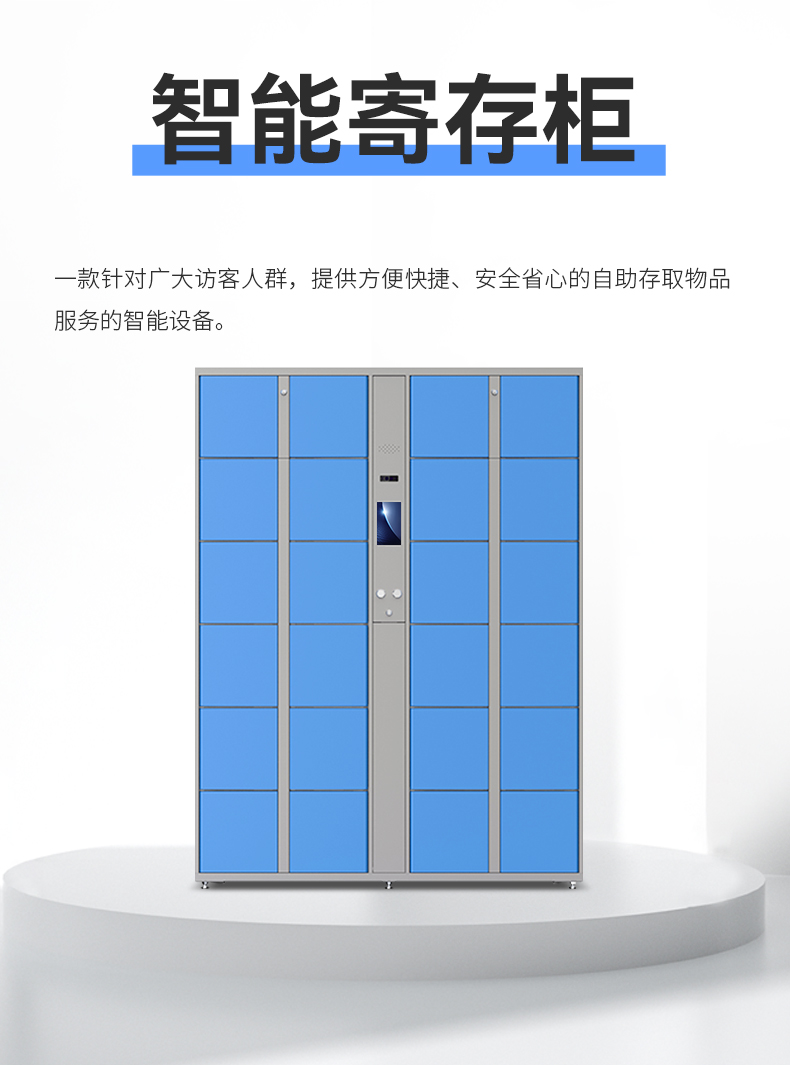

Zhilai Technology rose 15.43% today and entered the strong stock pool, with volume increasing 8.6x to break through the 52-week high [0]. Although no clear short-term news catalyst was found, combined with the company’s business field (smart lockers in security services) and market environment, it may be related to the increase in airport/mall traffic and potential recovery of industry demand under domestic consumer recovery [0].

Technically, the company’s stock price rose 24.68% within 15 trading days, and today’s volume of 70.15M (average daily 8.12M) broke through the 52-week high of $17.34 [0], showing technical strength. Short-term support levels are $14.45 (yesterday’s closing price) and $13.94 (today’s opening price), with resistance at $17.34 (52-week high) [0].

Fundamentally, the company’s current ratio of 5.48 indicates good liquidity and low financial risk [0]. However, it should be noted that the company’s valuation is high (P/E 52.43x), far higher than the average level of the security services industry (20-30x); ROE is only 3.84%, and profitability is weak [0].

- The smart locker industry the company belongs to is closely related to consumer recovery, and long-term demand potential may support market optimism

- Short-term volume breakthrough but lack of clear catalyst, the rise may have a certain speculative component [0]

- High valuation contrasts with weak profitability, need to be alert to valuation correction risks

- Overvaluation: Current P/E 52.43x, significantly higher than the industry average, with the risk of valuation bubble [0]

- Weak profitability: ROE is only 3.84%, profit quality needs to be improved [0]

- Short-term correction risk: Abnormal volume increase (8.6x), high probability of short-term volatility [0]

- Lack of clear catalyst: The sustainability of the rise is in doubt

- Potential opportunities for industry demand growth driven by consumer recovery

- Possibility of momentum continuation after technical breakthrough

- Zhilai Technology (300771) rose 15.43% today, broke through the 52-week high with volume, and entered the strong stock pool [0]

- Technically strong but fundamentals have issues such as overvaluation and weak profitability [0]

- The rise lacks a clear catalyst, need to pay attention to volume changes and support level performance

Analysis provides objective market background and risk identification, does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.