PIANUO (002853) Limit Up Reason and Market Outlook Analysis

Related Stocks

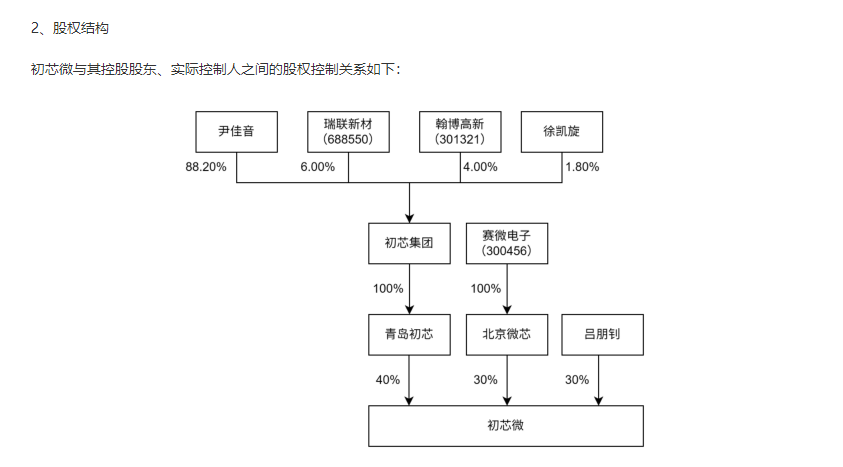

PIANUO (002853)'s limit up today is the result of the joint effect of the change of actual controller and the expectation of business transformation. The company issued a resumption announcement on December 15, 2025, stating that controlling shareholder Ma Libin will transfer 17.8884 million shares (accounting for 9.78% of the total share capital) to Chuxin Micro, while waiving the voting rights of 19.34% of the shares. Yin Jiayin, the ultimate actual controller of Chuxin Micro, plans to increase the shareholding ratio to 29.99% through private placement [1]. Chuxin Group controlled by Yin Jiayin has rich resources in the semiconductor display field, and the market is full of expectations for the company’s business transformation [2]. In terms of price, after the stock resumed trading, it directly hit a one-word limit up at 17.86 yuan, with a trading volume of 26,100 lots, which is lower than the recent average. The turnover rate has not been announced, indicating that the buying power is far greater than the selling power, and there is a strong sentiment of reluctance to sell [0].

- Business Transformation Brings Valuation Reconstruction Opportunities: The company is shifting from custom home furnishing to the semiconductor display field; the change in industry attributes will reconstruct the valuation system. The semiconductor display industry has great growth potential; if the transformation is successful, the company’s valuation is expected to rise significantly [2].

- Signs of Early Capital Layout Are Obvious: Before the suspension (December 8), the company’s stock price rose by 8.05%, showing that some funds had learned the news in advance and laid out their positions [3].

- One-Word Limit Up Reflects Sentiment Intensity: The absence of transaction price fluctuations indicates that the real market demand has not been fully released, and short-term optimistic sentiment will continue to affect the stock price trend [0].

- Resource support in the semiconductor display field may bring opportunities for the company’s performance reversal [2].

- After the change of control, the governance structure will be optimized, and the new management may promote business innovation [1].

- The business transformation span is large, and the success rate is uncertain [2].

- The company’s financial situation is worrying; the net profit in the first three quarters of 2025 was -7.5252 million yuan, and the revenue in 2024 decreased by 40% [2].

- If the one-word limit up is broken, there may be large price fluctuations [2].

- The price-earnings ratio is -8.55; if the transformation is not as expected, the valuation will face adjustment [0].

PIANUO (002853)'s limit up today stems from the change of actual controller and the expectation of transformation to semiconductor display, with extremely optimistic market sentiment. The support level is 16.24 yuan (closing price before suspension), the short-term resistance level is 19.65 yuan (next limit up price), and the medium-term resistance level is 22.00 yuan (near the previous historical high) [0]. Future trends need to be closely monitored: ① Specific plans and implementation progress of business transformation; ② Improvement of the company’s financial situation; ③ Changes in market capital flow and whether the limit up board is broken.

[0] Jinling Analysis Database

[1] Sina Finance - PIANUO Resumes Trading with Limit Up, Actual Controller to Change to Yin Jiayin

[2] Securities Times - Actual Controller to Change, 002853, Resumes Trading with “One-Word” Limit Up!

[3] International Finance News - After Two Failed Stock Sales, PIANUO Boss to “Clear Out” and Leave

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.