Analysis of Asset Allocation Strategies Under the Background of Sino-US Structural Reforms in 2026

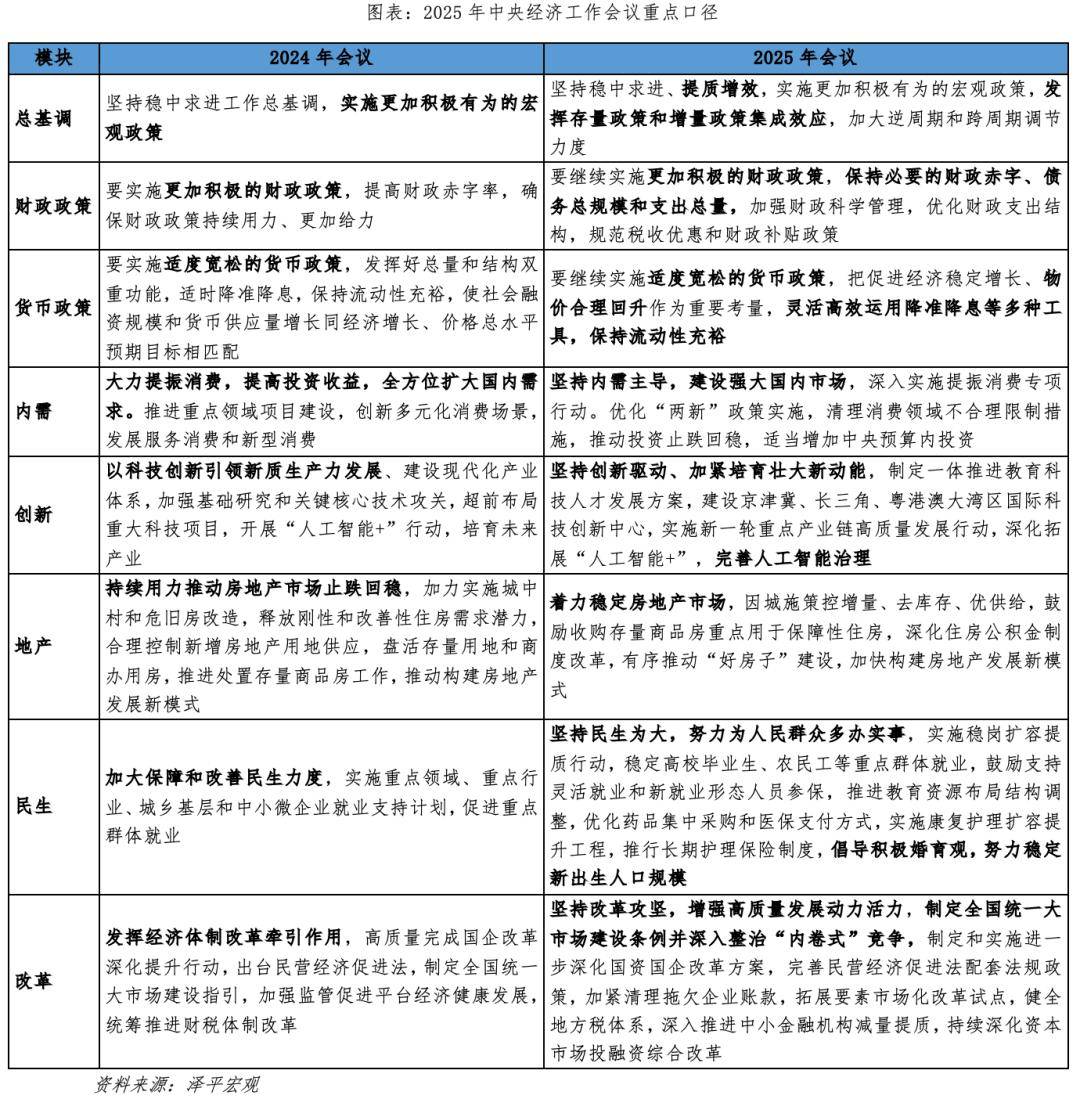

According to Goldman Sachs’ interpretation of the Central Economic Work Conference, China’s macro policy will be prudent in 2026, with a GDP growth target of about 5% and a CPI inflation target of about 2%[3]. Monetary policy will remain moderately loose, and fiscal policy will maintain a proactive stance, but compared to last year’s “unconventional counter-cyclical adjustment”, the pace of policy easing in 2026 will be more cautious and prudent.

- Consumption Stimulus: Domestic demand-oriented, boosting consumption in multiple aspects

- Real Estate Stability: Strengthening market stabilization measures, optimizing new supply

- Technological Innovation: Promoting the development of core technologies such as artificial intelligence

- Structural Reforms: Solving problems such as anti-involution and clearing arrears owed to enterprises

The US will pursue a dual fiscal and monetary easing path against the backdrop of mid-term elections, with AI becoming the main growth driver[5]. The Federal Reserve is expected to pause interest rate cuts after June 2025 until mid-2026[4]. Growth in technology spending, interest rate cuts, deregulation, and tax incentives will collectively shape the investment landscape in 2026[5].

- Growth Slowdown: Both China and the US face economic增速放缓压力

- Structural Contradictions: China needs to solve deep-seated problems such as technological innovation and tax reform

- Policy Constraints: Traditional monetary fiscal policy space收窄

- Market Volatility: Policy uncertainty increases market波动性

- AI Technology Revolution: AI becomes the main growth driver of the US economy

- Consumption Upgrade: China’s domestic demand market has huge potential

- Commodities: Have allocation value in a low-inflation environment

- Cross-market Arbitrage: Opportunities brought by Sino-US policy differences

- High-leverage real estate-related assets

- Cyclical traditional manufacturing

- Interest rate-sensitive financial assets

- High-growth valuation tech stocks

Current market data shows that the tech sector is the weakest (-1.40%), and the financial services sector is down 1.18%[6], reflecting market concerns about the macroeconomy.

- US AI Industry Chain: Chip design, cloud computing, software services

- China Digital Economy: AI applications, digital infrastructure, intelligent manufacturing

- Global Tech Leaders: Mature tech companies with cash flow and profitability

Gold as a safe-haven asset has performed prominently, rising 10.74% in the past 60 trading days, showing good anti-inflation and safe-haven properties[7]. In a low-growth low-inflation environment, commodities have unique allocation value.

- Precious Metals: Gold, silver as inflation hedging tools

- Industrial Metals: Benefiting from AI infrastructure construction demand

- Energy Commodities: Geopolitical risks supporting prices

The healthcare sector is currently the best-performing industry (+0.73%)[6], with defensive characteristics in a low-growth environment.

- US Market:40-50% (Technology, AI, Consumption)

- China Market:20-30% (Consumption, Healthcare, Structural Reform Beneficiary Stocks)

- Other Developed Markets:15-20% (European, Japanese Value Stocks)

- Emerging Markets:5-10% (Markets with potential for structural reforms)

- Equities:45-55% (Structural growth opportunities)

- Fixed Income:15-20% (High-grade bonds, inflation-protected bonds)

- Commodities:15-20% (Gold, industrial metals)

- Cash and Equivalents:5-10% (Liquidity management)

- Alternative Investments:5-10% (Private equity, hedge funds)

- Core Portfolio:65% (Broad-based index ETFs, high-quality stocks)

- Satellite Portfolio:35% (Thematic investment, regional investment, alternative assets)

- Quarterly Review: Adjust allocations based on economic data and policy changes

- Risk Control: Set stop-loss mechanisms to control portfolio volatility

- Rebalancing: Regularly rebalance the portfolio to maintain target allocations

- AI Theme: US AI technology companies, Chinese AI application enterprises

- Consumption Upgrade: China’s domestic demand consumption, high-end manufacturing

- Green Transition: Clean energy, environmental protection technology

- Healthcare: Biotechnology, medical devices

- Policy Overshoot Risk: Sino-US policy coordination failure leading to severe market volatility

- Technology Bubble Risk: Excessive AI investment leading to valuation bubbles

- Geopolitical Risk: Further deterioration of Sino-US relations

- Inflation Rebound Risk: Supply chain tensions or energy price increases

###应对策略

- Diversification: Cross-market, cross-asset, cross-industry diversification

- Risk Management: Set reasonable stop-losses to control position sizes

- Dynamic Adjustment: Adjust strategies timely based on market changes

- Long-term Perspective: Adhere to long-term investment philosophy and avoid short-term emotional decisions

- January-February: China’s provincial two sessions, observe local policy orientations

- March: National Two Sessions, clarify annual policy tone

- June: Federal Reserve meeting, assess interest rate policy direction

- November: US mid-term elections, focus on policy changes

- First Quarter: Adjust regional allocations based on policy signals

- Second Quarter: Adjust commodity allocations based on inflation data

- Third Quarter: Adjust technology allocations based on technological developments

- Fourth Quarter: Annual review and next year’s planning

In 2026, against the backdrop of Sino-US structural reforms, investors need to abandon traditional macroeconomic-driven investment logic and shift to structural opportunity-driven allocation strategies. The key points are:

- Avoid Risks: Avoid traditional assets with high macro exposure

- Seize Opportunities: Focus on structural opportunities such as AI, consumption upgrade, and commodities

- Diversify Allocations: Cross-market, cross-asset, cross-industry diversification

- Dynamic Management: Adjust timely based on policy changes and market conditions

Through this systematic asset allocation strategy, investors can achieve stable investment returns in the low-growth low-inflation new normal while effectively controlling investment risks.

[0] 金灵API Data - Market Index, Stock Price, Sector Performance Data

[1] Yahoo Finance - “PBoC: Continue to Implement Moderately Loose Monetary Policy and Do a Good Job in Real Estate Financial Macro-Prudential Management”

[2] Yahoo Finance - “Break 7 next year! Morgan Stanley: RMB is expected to appreciate in the next two years and will be symbolic…”

[3] Yahoo Finance - “Goldman Sachs Interprets China’s Central Economic Work Conference: 2026 Macro Policy is Prudent, Focusing on Consumption and Real Estate”

[4] Zhihu - “Barclays expects the Federal Reserve to pause interest rate cuts after June 2025 until mid-2026”

[5] Yahoo Finance - “Wells Fargo Investment Institute: 2026 Poised for Markets Growth”

[6] 金灵API Data - Sector Performance Data

[7] 金灵API Data - Gold Price Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.