Impact of Differentiated Provincial Electricity Price Mechanisms on Power Industry Investment Value

Based on the latest policy documents and market analysis data I have obtained, I will provide you with a comprehensive analysis of the impact of provincial electricity price mechanism differentiation on the investment value of the power industry.

According to the latest data, provinces show obvious differences in new energy bidding prices:

- Provinces with higher bidding caps: Shanghai (0.4155 CNY/kWh), Sichuan (0.4012 CNY/kWh), Guangdong (0.40 CNY/kWh) [3]

- Provinces with benchmark price levels: Jiangsu, Zhejiang, Anhui and other provinces use local coal-fired benchmark prices as bidding caps [3]

- Provinces with lower bidding floors: Shandong, Xinjiang, Jilin set lower floors; Tianjin has no floor temporarily [3]

- Officially operational provinces: Shanxi, Guangdong, Shandong, Gansu, Mengxi have officially launched spot markets [5]

- Continuous settlement trial operation: Hubei, Zhejiang, Anhui, Shaanxi are in continuous settlement trial operation [5]

- Planning stage: Fujian, Jiangsu, Hunan, Ningxia are expected to switch to continuous settlement trial operation [5]

- Distributed PV grid-connected electricity is usually settled at the local coal-fired power benchmark price

- Project returns are relatively stable and predictable [2]

- In principle, all new energy project grid-connected electricity must enter the power market [4]

- Revenue is significantly affected by spot market price fluctuations [2]

- For example, in Shandong, return uncertainty increased sharply after participating in the spot market [2]

- Jiangsu: Distributed PV new installed capacity led the country in 2024, up 48% year-on-year, becoming the main force of new installations (accounting for over 80%) [1]

- Guangdong, Zhejiang: As major electricity-consuming provinces, distributed PV investment value is relatively high due to strong green power demand [1]

- Shanghai: Bidding cap is 0.4155 CNY/kWh (coal-fired benchmark price), with a high electricity price level [3]

- Henan: Due to grid constraints, distributed PV new installed capacity decreased by more than 50% in 2024, and household new installations plummeted by over 90% [2]

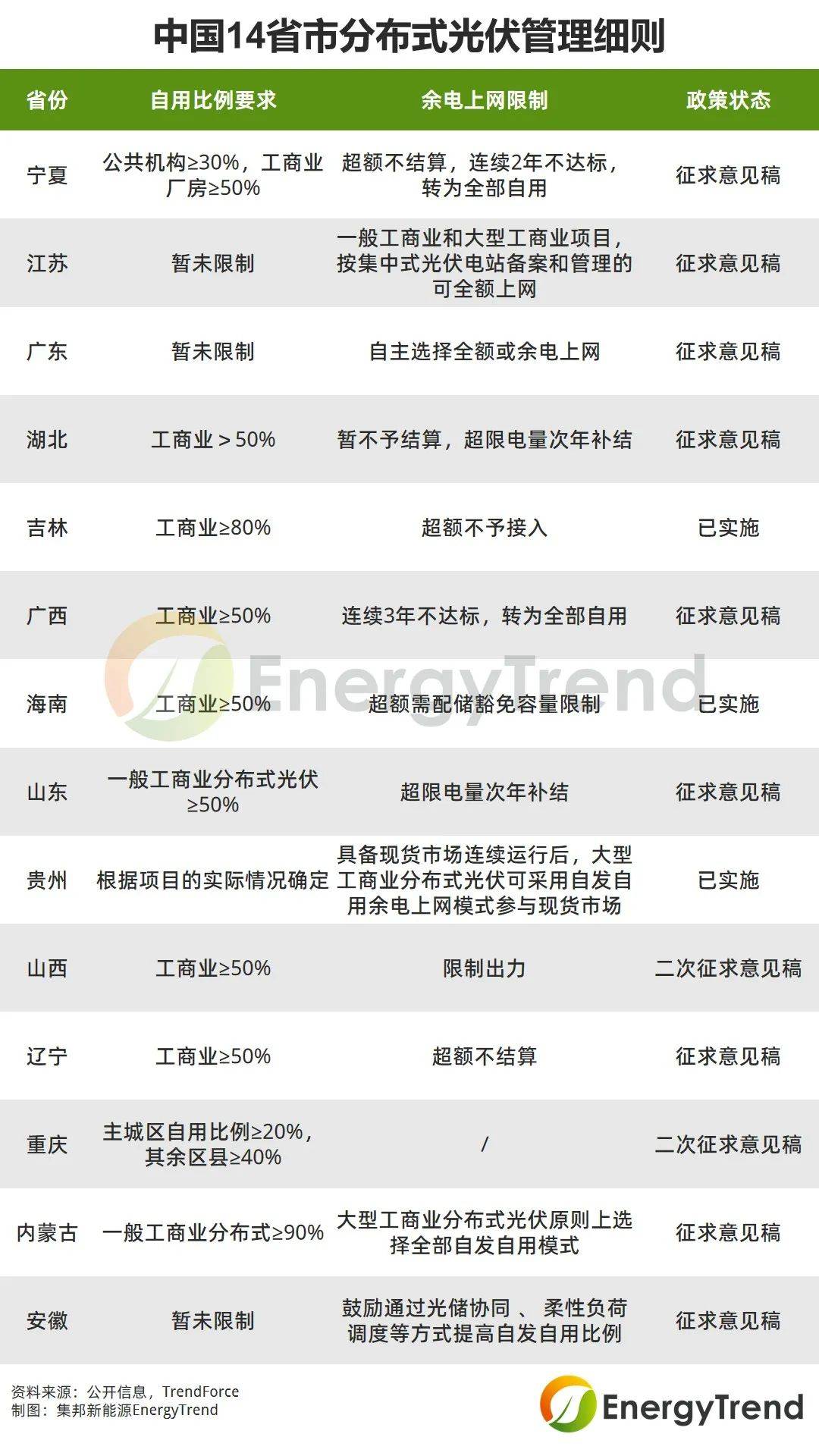

Provinces show obvious differences in self-consumption ratio requirements for distributed PV:

- Provinces with strict requirements: Shanxi, Shandong, Guangxi and other 7 provinces require general industrial and commercial PV self-consumption ratio of more than 50%; Inner Mongolia requires over 90%, Jilin requires over 80% [6]

- Provinces with loose requirements: Fujian, Zhejiang, Anhui and other 6 provinces have no temporary self-consumption ratio requirements [6]

- Special regions: Sichuan’s “Three Prefectures and One City” requires industrial and commercial PV self-consumption ratio of more than 50%, while other regions have no temporary requirements [6]

- Spot market prices fluctuate greatly due to supply and demand changes, making it difficult to ensure stable returns [2]

- In 2025, proxy purchase prices in many places decreased year-on-year: Guangdong (-73.76 CNY/MWh), Guangxi (-106.81 CNY/MWh), Jiangsu (-40.49 CNY/MWh) [6]

- Distributed PV projects need to bear costs caused by electricity quantity deviations [2]

- Even if participating in the market through aggregators, deviation impacts cannot be completely eliminated [2]

- New projects must have “observable, measurable, adjustable, controllable” capabilities [6]

- Existing projects need to increase investment in transformation, raising operating costs [6]

- Projects need to enhance power generation and consumption prediction capabilities [2]

- Need to optimize energy production and consumption management [2]

- Can choose to participate in the market by reporting both quantity and price or reporting quantity without price [4]

- Can choose to participate directly or through agent aggregation [4]

- Traditional grid-connected electricity price income

- Spot market transaction income

- Green certificate income

- Sustainable development price settlement mechanism income [4]

- Coastal provinces with strong electricity demand: Jiangsu, Guangdong, Zhejiang, Shandong

- Economically developed regions with strong willingness to consume green power

- Regions with sufficient grid carrying capacity

- Regions with limited grid absorption capacity

- Provinces with strict self-consumption ratio requirements

- Regions with large spot market price fluctuations

- Prioritize provinces with loose or no temporary self-consumption ratio requirements

- Focus on projects with high load matching

- Improve local consumption capacity

- Pay attention to policy-friendly regions

- Household PV new installed capacity decreased by 32% year-on-year in 2024, so more caution is needed [1]

- Actively participate in medium and long-term transactions to lock in part of the revenue

- Consider participating in the sustainable development price settlement mechanism

- Explore multi-year power purchase agreement models [4]

- Strengthen power generation forecasting capabilities

- Establish a “Four Capabilities” technical system

- Improve deviation electricity quantity management capabilities

- Closely follow the implementation plans of Document No.136 in various provinces [4]

- Dynamically adjust investment strategies

- Strive to connect existing projects to the grid before May 31, 2025 [4]

Provincial electricity price mechanism differentiation is reshaping the investment value pattern of the power industry. Distributed PV and new energy project operators are facing a fundamental shift from fixed electricity prices to market-oriented pricing, and the certainty of profitability has decreased significantly. However, enterprises with technical advantages, management capabilities and regional selection capabilities will gain more development space. The key to successful investment in the future lies in precise regional selection, flexible market participation strategies and strong risk management capabilities.

[1] Rocky Mountain Institute - 2025 Power Market Reform and Electricity Price System Insights (https://rmi.org.cn/wp-content/uploads/2025/05/final-0508-2025电力帎场化改革与电价体系洞察.pdf)

[2] Soochow Securities - 2025 China Power Market Outlook: 10 Trends Market Participants Need to Pay Attention To (https://pdf.dfcfw.com/pdf/H3_AP202507011701079714_1.pdf?1751398158000.pdf)

[3] Energy Storage Industry Network - Understand the Implementation of Document No.136 in 29 Provinces and Cities Nationwide! 6 Provinces Announce First Bidding Results (https://mchuneng.in-en.com/html/chunengy-49761.shtml)

[4] Zhonglun Law Firm - Notice on Deepening the Market-oriented Reform of New Energy Grid-connected Electricity Prices to Promote High-quality Development of New Energy (https://www.zhonglun.com/research/articles/54184.html)

[5] Soochow Securities - Domestic Energy Storage Depth: Storage Matching Exits, Independent Storage Debuts, High-quality Demand Explodes and Continues (https://pdf.dfcfw.com/pdf/H3_AP202509261750810071_1.pdf?1758880981000.pdf)

[6] Cinda Securities - Power Reform Enters a New Stage, Market Entry and Spot Trading Usher in New Opportunities (https://pdf.dfcfw.com/pdf/H301_AP202507181711187856_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.