Day Traders’ Enduring Frustrations with Sales Pitches, Prop Firm Rules, and Industry Practices

This analysis synthesizes a Reddit discussion in a day trading community and social media verification to identify recurring, accepted frustrations in retail trading. The core themes include:

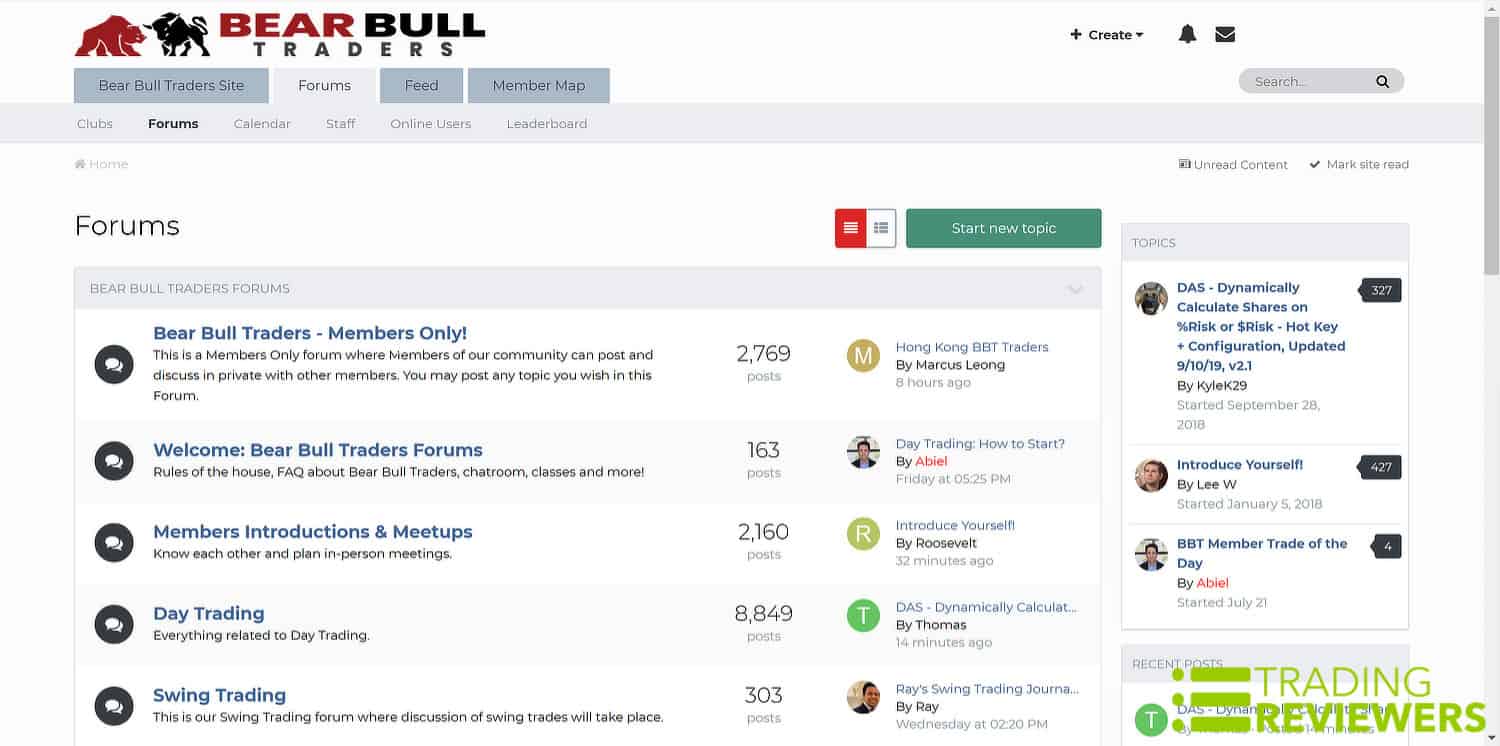

- Pervasive Sales Pitches: Users universally complained about constant, untrustworthy sales pitches for trading systems/indicators, which are verified as common in day trading communities like r/Daytrading [1,2].

- Prop Firm Consistency Rules: A split emerged—some viewed these rules as unnecessary, arguing lucky traders would eventually lose accounts [3], while verified prop firm guides confirm rules filter lucky traders to stabilize payouts and protect business models [4,5,6].

- Mid-Game Rule Changes: Documented complaints exist about prop firms altering fees, denying payouts, or enforcing vague rules mid-challenge, enabled by light regulatory oversight [7].

- Unmotivated Learners: Traders expressed frustration with individuals seeking free day trading guidance but failing to act on it.

- Improved Trading Conditions: A positive note highlighted that modern access to cheap leverage (10:1–20:1 ratios for futures/forex) is better than historical standards [8].

- Tension Between Firm Profitability and Trader Experience: Prop firm consistency rules reflect a balance between protecting firms from lucky traders and satisfying traders’ desire for flexible, merit-based funding.

- Impact of Unregulated Practices: Mid-game rule changes expose retail traders to unfair treatment due to the lightly regulated nature of the prop firm industry, though increasing oversight may address this over time [7].

- Trader Education Challenges: Pervasive sales pitches dilute quality education, potentially leading to poor decision-making among new traders.

- Retail Trading Infrastructure Growth: Improved leverage access reflects broader trends of increased retail participation and enhanced trading platform capabilities.

- Risks: Misleading sales pitches can cause new traders to incur losses; unfair prop firm rules may erode trust in the industry; unmotivated learners drain experienced traders’ resources.

- Opportunities: Growing regulatory interest in prop firms could standardize practices; better leverage access enables retail traders to explore more strategies; community-led efforts may improve education quality by filtering sales pitches.

Day traders face enduring frustrations with sales pitches, prop firm rules, and unmotivated learners, which many see as systemically baked into the industry. Conflicting views on consistency rules highlight a core tension between prop firm sustainability and trader autonomy. While modern leverage access is a positive trend, regulatory gaps leave traders vulnerable to unfair firm practices. No specific investment recommendations are provided.

Cited sources: [0] Internal social media analysis; [1] Reddit r/Daytrading; [2] Reddit r/Daytrading (2024-09-23); [3] Holaprime; [4] Tradeify; [5] PropFirmApp; [6] YourFintech; [7] YouTube; [8] HighStrike

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.