Deepening K-Shaped U.S. Economy (2025 Q4) – Labor Weakness Amid Strong Consumer Spending & Home Price Growth

#k_shaped_economy #labor_market #consumer_spending #home_prices #2025_q4_economy #retail_industry #real_estate

Mixed

A-Share

December 14, 2025

Related Stocks

NWS

--

NWS

--

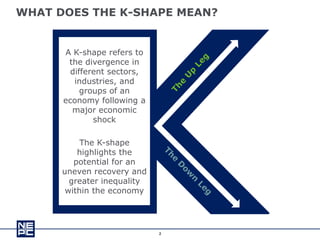

Integrated Analysis

This analysis is based on a December 13, 2025 YouTube video by Chris Maxey [1], which details a growing K-shaped divergence in the U.S. economy in late 2025. A K-shaped recovery refers to uneven performance across economic segments, and the data confirms this pattern:

-

Labor Market Weakness: Private sector employment declined by 32,000 jobs in November 2025 (ADP [2]), with 60% of losses concentrated in small businesses (<50 employees). Initial jobless claims jumped to 236,000, pushing the unemployment rate to 4.4%—the highest in four years [3]. Major corporations like UPS, General Motors, and Amazon also announced layoffs to be implemented in 2026, signaling structural restructuring.

-

Strong Consumer Spending: Black Friday 2025 online sales reached $18 billion (3% year-over-year), with overall retail sales up 4% (Mastercard SpendingPulse [4]). The National Retail Federation (NRF) forecasted 2025 holiday sales to surpass $1 trillion, growing 3.7–4.2%. AI tools (Walmart’s “Sparky,” Amazon’s “Rufus”) influenced $3 billion in online sales, boosting efficiency for tech-enabled retailers.

-

Rising Home Prices: Existing-home median prices rose 1.6% YoY to $409,667 in Q3 2025—3.9% above 2022 peaks [5]. Miami-Dade single-family home sales increased 6.87% YoY in October due to supply constraints and demand from high-income buyers [6]. Anticipated Fed rate cuts (December 10, 2025 [7]) have increased mortgage application activity, further driving demand.

The K-shaped dynamic is evident: high-income households (sustaining consumer spending and home purchases in coastal markets) form the “upward leg,” while low-wage workers and small businesses (facing job losses and economic uncertainty) form the “downward leg.”

Key Insights

-

AI Adoption Widens Retail Divide: Tech-enabled retailers (Walmart, Amazon) with AI-powered personalization and supply chain tools captured significant market share from traditional brick-and-mortar stores, aligning with the K-shaped consumer profile (luxury and discount segments outperforming mid-tier brands [4]).

-

Small Business Vulnerability: 72% of small business owners reported “high concern” about economic uncertainty (NFIB survey [2]), and the labor market contraction is likely to increase this vulnerability without targeted support.

-

Geographic Real Estate Divergence: Coastal markets like Miami-Dade see rising sales and prices, while inland markets face stagnation due to weaker job growth, exacerbating regional economic inequalities.

Risks & Opportunities

Risks

- Prolonged Labor Weakness: Continued job losses could reduce consumer spending for low-income groups, leading to a broader economic slowdown.

- Small Business Closures: Limited access to credit and weak demand may force small businesses to shut down, further concentrating market power among large corporations.

- Home Affordability Crisis: Rising home prices and interest rates (before anticipated cuts) could exclude low- to moderate-income households from homeownership.

Opportunities

- AI in Retail: Investment in AI infrastructure can boost efficiency and sales for retailers, particularly in luxury and discount segments.

- New Construction Growth: Stabilized new-home prices ($451,337 in Q3 2025 [5]) and incentives make new construction competitive, offering opportunities for real estate developers in high-demand markets.

- Fed Rate Cuts: Eased borrowing costs could support small business investment and homebuyer demand, potentially mitigating some K-shaped dynamics.

Key Information Summary

- Labor Market: 32,000 private sector job losses (November 2025), 4.4% unemployment rate (four-year high), and rising jobless claims.

- Consumer Spending: $18 billion Black Friday online sales (3% YoY), $1 trillion+ holiday sales forecast, and AI-driven retail efficiency gains.

- Home Prices: 3.9% above 2022 peaks, 6.87% YoY sales growth in Miami-Dade (October 2025), and supply constraints driving demand.

- Industry Impacts: Tech-enabled retailers outperform mid-tier brands; coastal real estate grows while inland markets stagnate; small businesses face disproportionate challenges.

References

Ask based on this news for deep analysis...

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

Related Stocks

NWS

--

NWS

--