Analysis: AI Trade Consolidation, Not Bubble, Amid Nasdaq and Magnificent Seven Profit-Taking

Related Stocks

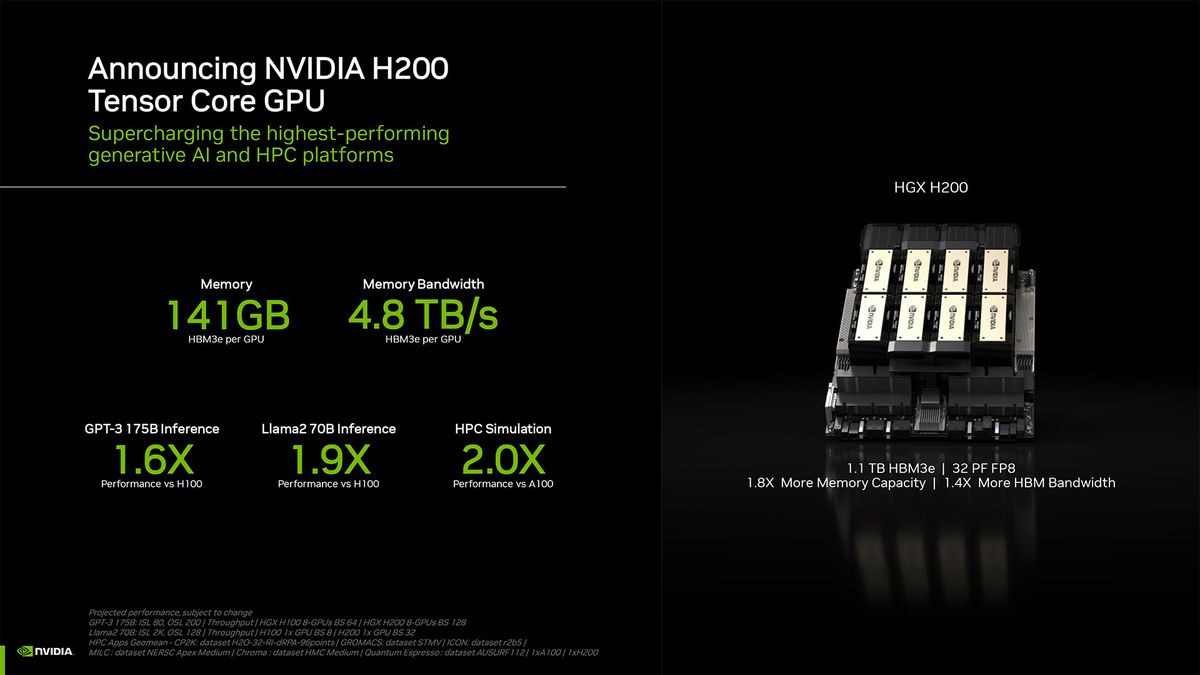

This analysis is based on the Seeking Alpha article published on December 13, 2025, which argues the AI trade is not a bubble and recent Nasdaq weakness represents healthy consolidation [1]. Market data shows the Nasdaq Composite (^IXIC) declined 1.25% on December 12, 2025, closing at 23,195.17, following mixed early-December performance [0]. Most Magnificent Seven stocks experienced moderate declines from December 1–12: Amazon (AMZN: -3.3%), NVIDIA (NVDA: -2.7%), Apple (AAPL: -1.7%), Microsoft (MSFT: -1.7%), and Alphabet (GOOGL/GOOG: ~1–2% declines) [0]. Tesla (TSLA) was the exception, gaining 6.7% during this period, indicating selective profit-taking [0]. NVDA closed at $175.02 on December 12, down 5.7% from its December 8 peak of $185.55 [0], but news of massive demand for its H200 AI GPUs in China following a partial U.S. ban lift supports the article’s claim of robust demand [2]. With NVDA up 38% year-to-date as of December 13 [3], the moderate declines align with the article’s consolidation narrative rather than a bubble burst.

- Consolidation After Strong Gains: The dip in AI stocks and the Nasdaq follows significant year-to-date growth (e.g., NVDA’s 38% YTD rise), making the current pullback a likely healthy consolidation phase [0][3].

- Selective Profit-Taking in Magnificent Seven: While most top tech stocks saw declines, TSLA’s 6.7% gain indicates profit-taking is not universal, reflecting divergent investor sentiment across the group [0].

- NVDA’s Resilient Demand: The continued strong demand for NVDA’s AI GPUs in China, despite geopolitical uncertainties, underscores its dominant market positioning [2].

- Correction Extension: The recent dip could deepen if profit-taking accelerates or macroeconomic concerns (e.g., interest rate expectations) resurface [0].

- Increased Competition: AMD, Intel, and tech giants like Alphabet and Amazon developing custom AI chips may erode NVDA’s market share [0].

- Geopolitical Tensions: U.S.-China relations could still impact NVDA’s sales in China, even with the partial ban lift [0].

- Valuation Pressures: NVDA’s market cap of ~$4.5 trillion warrants ongoing assessment of future growth prospects to justify current valuations [0].

- Healthy Consolidation as Entry Point: The dip may present opportunities for investors to enter AI stocks at more attractive prices amid ongoing industry demand [1].

- AI Demand Momentum: The strong demand for AI infrastructure (e.g., NVDA’s GPUs) remains a long-term growth driver [2][3].

The AI trade remains intact, with recent Nasdaq and Magnificent Seven weakness reflecting healthy consolidation rather than a structural reversal. NVDA and other AI leaders retain robust demand and dominant positioning, supported by factors like strong GPU sales in China. However, investors should be aware of risks including potential correction extension, increasing competition, geopolitical tensions, and valuation pressures. No prescriptive investment recommendations are made.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.