2026 Global Economic Outlook: Cross-Country Divergences and Employment Risks

The original December 11, 2025 (EST) Seeking Alpha article [1] highlighted two core themes for 2026: potential global growth acceleration and meaningful risks from employment weakness. Full access to the article was restricted, so complementary 2026 economic outlooks provide critical context.

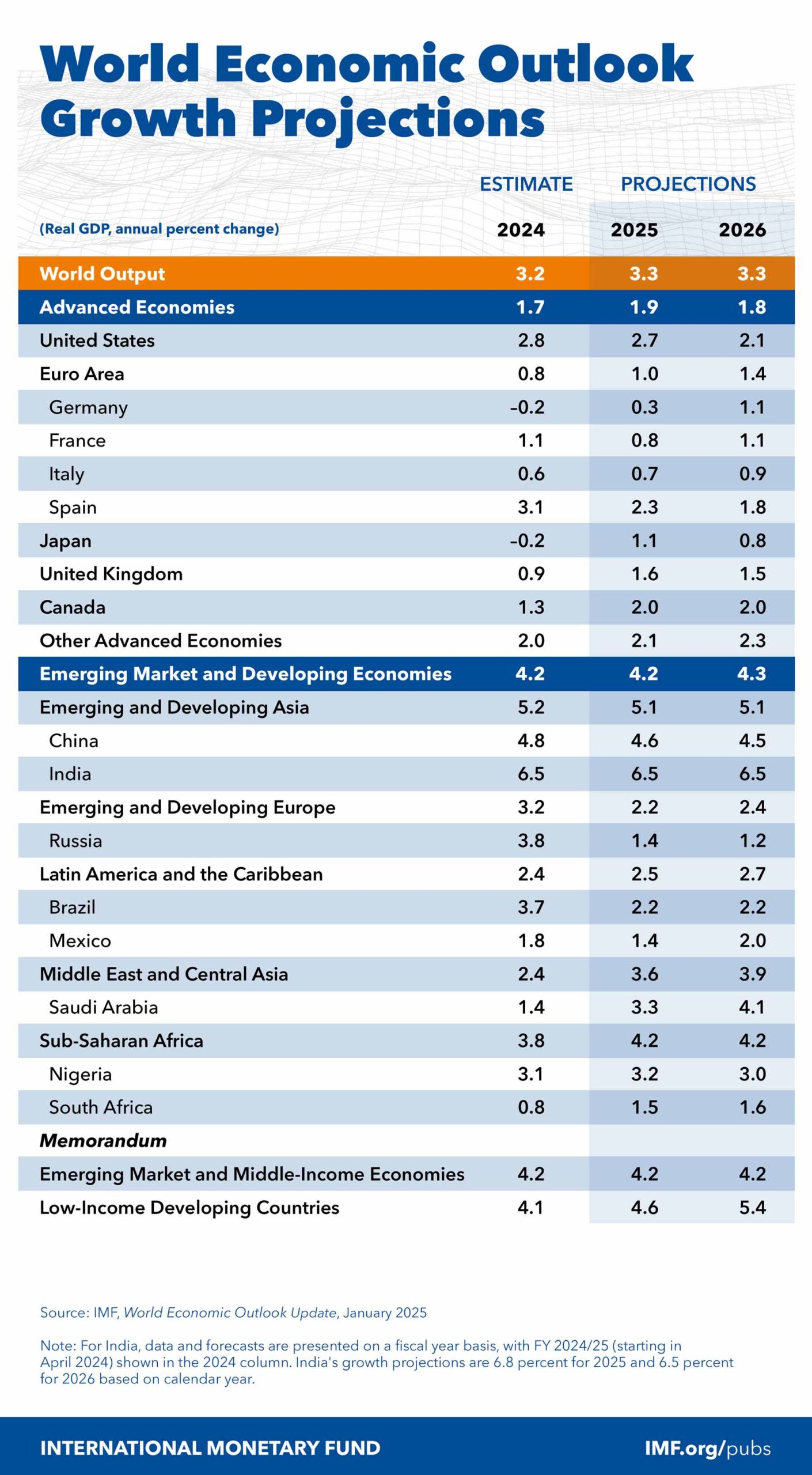

Allianz Global Investors [2] projects cross-country divergence: developed economies growing near trend pace, while emerging markets (led by India and Southeast Asia) maintain a “clear growth premium.” Mastercard Economics Institute [3] quantifies this: U.S. GDP growth is expected to rise to 2.2% (from 2025’s 2.0%, driven by R&D/manufacturing tax cuts), while China’s growth slows to 4.5% (from 4.8%, due to reduced U.S. demand). Global real GDP growth is projected at 3.1%, slightly below 2025’s 3.2%.

Wellington Management [4] links the employment weakness highlighted in the Seeking Alpha article to a 2026 tail risk: stagflation (rising inflation with weak employment), which would be “very negative for risk markets.” These findings align with the original article’s caution, framing employment weakness as a threat to the projected growth acceleration.

- Policy-Driven Regional Shifts: U.S. growth is supported by targeted policy (tax cuts), while emerging markets benefit from regional momentum [3]. China’s slowdown reflects structural shifts (reduced U.S. export dependency) [3].

- Divergence Risks: Stagflation from weak employment could undermine growth acceleration [4], while divergent growth may lead to monetary policy divergence between developed and emerging markets [2], increasing financial market volatility.

- Investment Alignment: Cambridge Associates [5] recommends overweighting global ex-U.S. equities, while Allianz advises “selective duration and credit positioning across regions” to capitalize on divergences [2].

- Risks: Stagflation risk from weak employment [4], global market volatility due to policy divergence [2], and China’s structural slowdown [3].

- Opportunities: Growth premiums in India/Southeast Asian emerging markets [2], policy-driven U.S. sector growth [3], and potential outperformance of global ex-U.S. equities [5].

- Event Timestamp: December 11, 2025 (EST 23:50)

- Core Themes: 2026 global growth acceleration prospects, cross-country economic divergences, employment weakness as a key risk

- Complementary Sources: Allianz Global Investors, Mastercard Economics Institute, Wellington Management, Cambridge Associates

- Information Gaps: Full content of the original Seeking Alpha article, specific regions for employment weakness, detailed drivers of projected global growth acceleration from the article

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.