RNWF (Renewal Fuels, Inc.) Hot Stock Analysis: Fusion RTO Catalyst and Market Sentiment

Related Stocks

RNWF (Renewal Fuels, Inc.) is an OTC energy stock undergoing a potential transformative shift via a reverse takeover (RTO) with Kepler Fusion Technologies, a company developing compact aneutronic fusion power systems. The non-binding letter of intent (LOI) signed on November 30, 2025, targeted definitive agreements by December 10-11, 2025, positioning RNWF as the first publicly traded fusion energy company—an event that has attracted significant investor attention amid growing U.S. government support for fusion research [1].

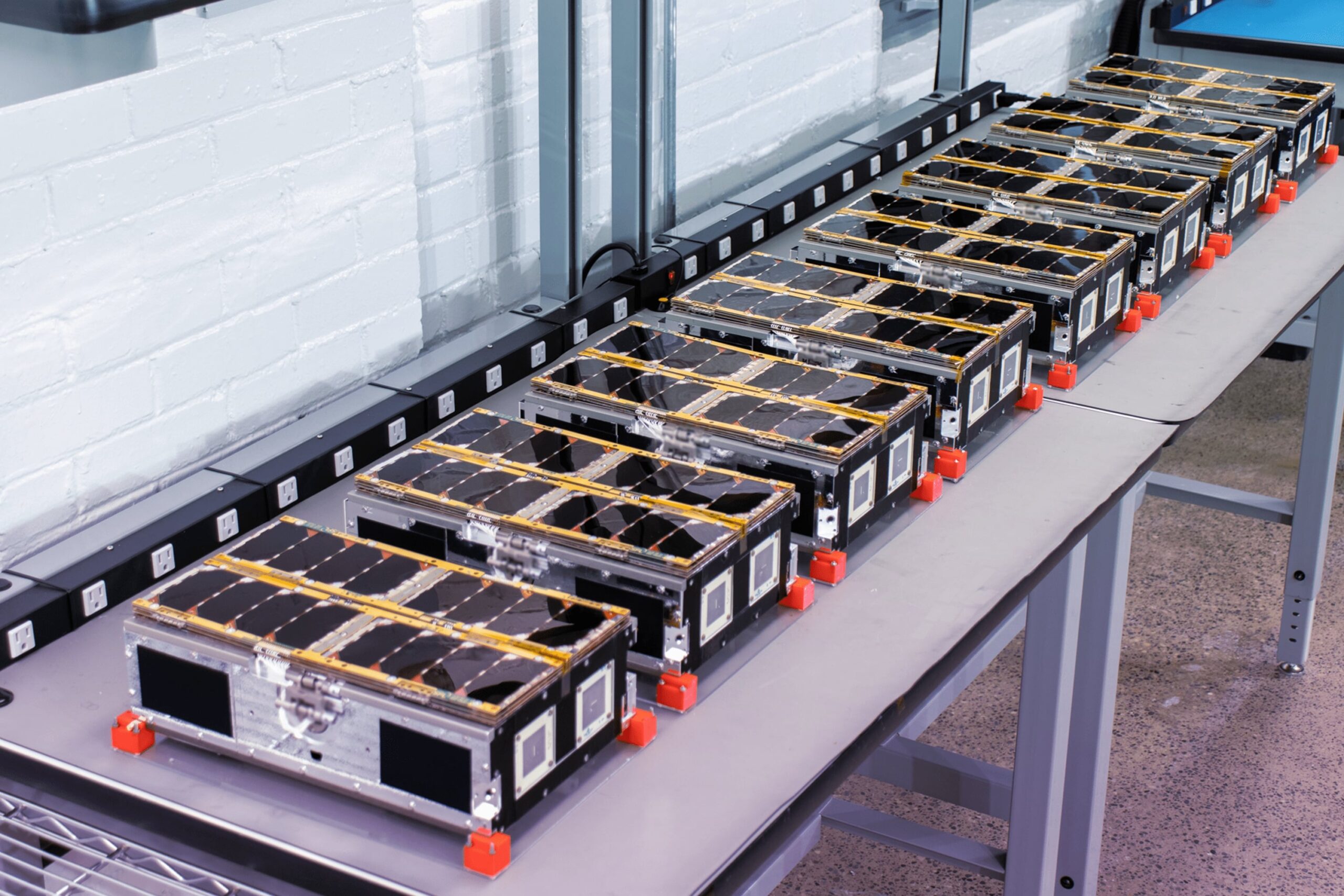

Kepler Fusion claims 238+ patents for its Texatron™ fusion technology, which uses a proprietary Deuterium-Helium-3 (D-He3) process to produce zero-emission electricity with minimal radioactive waste [1]. The company aims to target high-growth sectors like AI data centers and manufacturing with a power-as-a-service model [1]. However, critical concerns persist: Kepler has not demonstrated successful sustainable energy production from its technology, and the RTO remains non-binding with no guarantee of closure [2].

-

Market Sentiment Division: Investors are split between bullish enthusiasm for RNWF’s potential as a first-mover in fusion energy (comparing it to OKLO, a private fission firm with a $14B valuation) and bearish skepticism about unproven technology, legacy business issues (past involvement in hemp/psychedelics), and unrealistic hypothetical $25B revenue projections [2].

-

Volatility Drivers: The stock’s extreme volatility (19.17% drop on December 11, 37.65% gain on December 10) is amplified by its low nominal price ($0.01, rounded from sub-cent values) and elevated trading volume (2-5x average) since the RTO announcement [0].

-

Execution and Technology Risks: The RTO’s non-binding nature, coupled with the billions in R&D needed to commercialize fusion and Kepler’s unproven testing track record (testing limited to hundreds of microseconds), creates significant uncertainty [2].

- Technology Uncertainty: Fusion energy remains unproven at scale; Kepler has not demonstrated a working reactor [2].

- RTO Execution Risk: The LOI is non-binding, and definitive agreements may fall apart [1].

- Funding Gap: Billions in R&D are required to commercialize fusion—Kepler has not disclosed its funding plans [2].

- Legacy Governance Concerns: RNWF’s past in unrelated industries (hemp/psychedelics) raises red flags [2].

- OTC Volatility: The stock’s low float and speculative trading history contribute to extreme price swings [0].

- First-Mover Advantage: Becoming the first public fusion stock could attract significant investor interest amid clean energy tailwinds [2].

- Government and Industry Support: U.S. government fusion funding and tech giants’ nuclear investments create a favorable macro environment [2].

- AI Data Center Demand: Kepler’s target market (high-energy data centers) presents long-term growth potential [1].

RNWF’s recent volatility stems from a proposed RTO with Kepler Fusion, positioning it as a potential first public fusion stock. The market sentiment is divided, with bullish arguments focusing on first-mover advantage and industry tailwinds, while bearish concerns center on unproven technology, legacy business issues, and execution risk. The RTO’s outcome and demonstration of Kepler’s fusion technology will be critical drivers of future performance.

[0] Ginlix Analytical Database - RNWF Real-Time Quote & Daily Price Data

[1] Nasdaq - Kepler Fusion Technologies Releases Investor Fact Sheet (December 3, 2025)

[2] Reddit Discussion - RNWF: Catalyst Imminent, The Future of US Power (December 11, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.