NVDA Stock Decline Amid Analyst Optimism: Contrasting Catalysts & Market Sentiment

Related Stocks

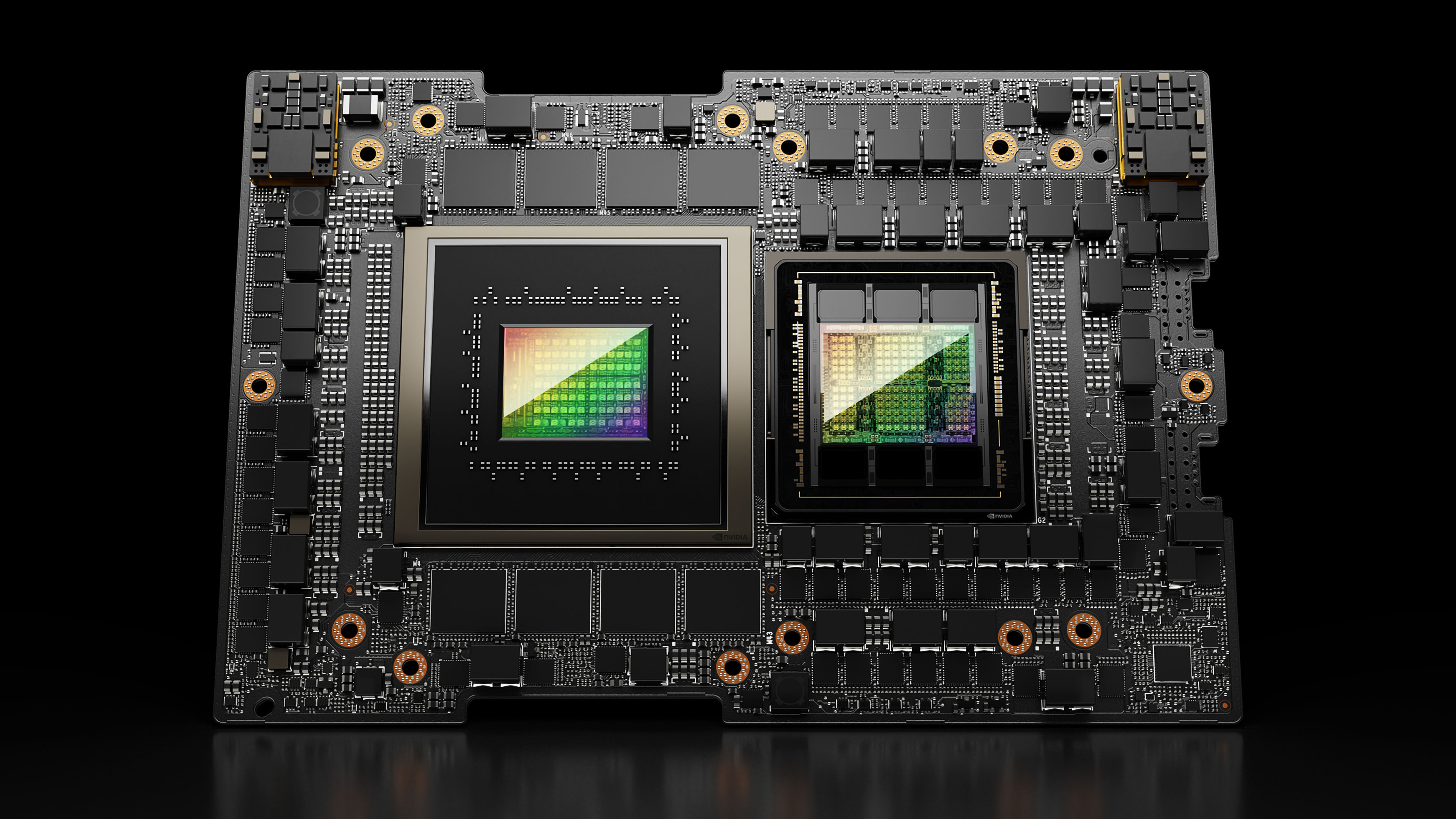

On December 11, 2025, a Reddit post highlighted a disconnect between analyst optimism and NVDA’s stock price movement [1]. Analysts praised two key developments: U.S. approvals to export H200 AI chips to China, and a new GPU tracking system to prevent smuggling [5,21]. Wells Fargo maintained an Overweight rating with a $265 target, estimating $25-30 billion in annual H200 revenue from China [17], while Bank of America retained a buy rating.

Despite this, NVDA’s stock fell 1.90% to $180.29 by 14:16 ET (6 minutes after the event) and closed down 0.14% at $180.03 [0]. Three competing catalysts drove the decline:

- Oracle’s 14% plunge (due to a revenue miss and $15 billion AI capex increase) revived AI bubble fears, dragging down NVDA and peers [14,24].

- Rivian announced it would replace NVDA chips with custom in-house AI chips for autonomous driving, starting in 2026 [2,22].

- Reports indicate China may limit H200 imports to trusted companies while promoting domestic alternatives, reducing the expected upside [7,20].

The H200 approval is expected to shift sales from informal offshore channels to transparent reporting, clarifying revenue visibility [16]. Analyst consensus remains “Strong Buy” with targets from $235 (UBS) to $265 (Wells Fargo) [17,18].

- AI Sector Sensitivity: Oracle’s negative news had a spillover effect on NVDA, demonstrating the sector’s vulnerability to individual company performance and overspending concerns.

- Automotive Segment Risks: Rivian’s switch to in-house chips may signal a broader trend among automakers, threatening NVDA’s market share in the autonomous driving space.

- Regulatory Dualism: While U.S. export approvals are positive, China’s potential import restrictions highlight the ongoing regulatory uncertainty shaping NVDA’s China revenue.

- AI Bubble Sentiment: Continued negative news from companies like Oracle could sustain pressure on NVDA and the broader AI sector.

- Customer Defection: Adoption of in-house chips by other automakers could erode NVDA’s automotive revenue.

- Regulatory Uncertainty: China’s final H200 import rules and potential political backlash from smuggling could limit sales.

- H200 Revenue Potential: The $25-30 billion annual revenue estimate from China H200 shipments presents significant upside.

- Transparent Reporting: The tracking system and formal export approvals could improve revenue visibility.

- Strong Analyst Support: Consensus “Strong Buy” ratings indicate long-term confidence in NVDA’s fundamentals.

- NVDA closed at $180.03 (-0.14%) on December 11, 2025, with a market cap of $4.39T [0].

- Analyst sentiment remains bullish due to H200 export approvals and the GPU tracking system.

- Competing catalysts (AI bubble fears, Rivian chip switch, China import limits) drove the short-term stock decline.

- Reddit users were divided, with the most support for the view that the stock drop contradicts analyst claims of a “boost”.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.