Fed Rate Cut Prospects Linked to Systemic Job Count Overcount: CNBC Analysis

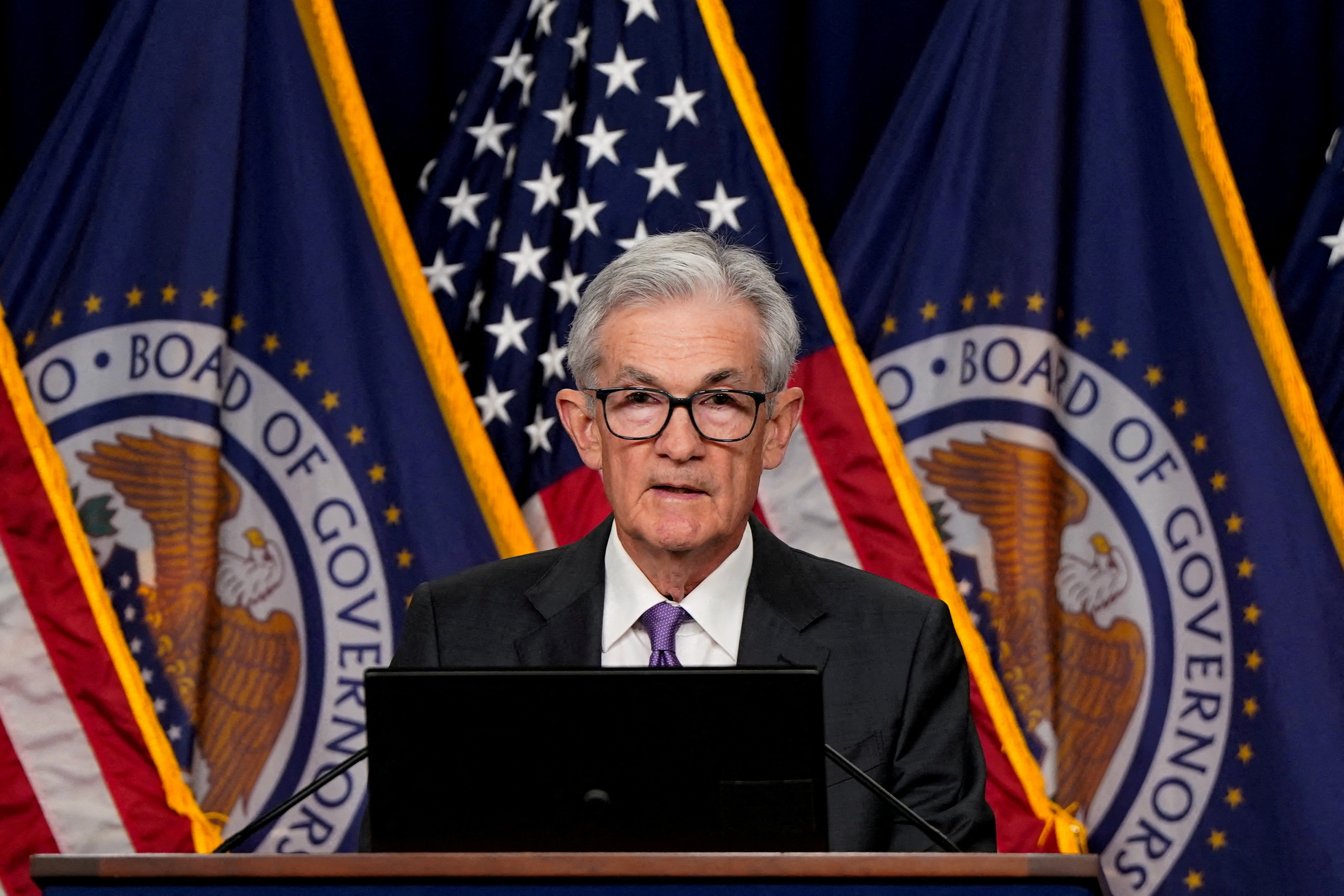

This analysis is based on a CNBC report [1] published on December 11, 2025, which highlights Fed Chair Jerome Powell’s comments about a potential systemic overcount of jobs numbers. Powell noted at a Wednesday news conference that recent months likely saw negative job growth—a condition supporting easier monetary policy (rate cuts).

Market overview data [0] identifies upcoming catalysts that will shape this outlook: 2025 jobs data revisions (to confirm or refute the overcount), upcoming Fed meeting minutes, and holiday season retail sales. Technical levels to monitor include resistance at 48,722.98 for the Dow Jones Industrial Average and the S&P 500 trading near its 52-week high of 6,920.34.

- Policy Shift Trigger: The suspected jobs overcount suggests the labor market may be weaker than officially reported, which could accelerate the Fed’s pivot from fighting inflation to supporting employment and economic growth.

- Critical Data Revision: The upcoming 2025 jobs data revisions will be a defining factor—confirming a overcount could strengthen the case for rate cuts, while disputing it may delay policy easing.

- Market Sensitivity: With the S&P 500 near record highs and the Dow at key resistance levels, market sentiment is particularly sensitive to Fed policy signals tied to labor market health.

- Risks: Unexpectedly strong revised jobs data could reverse rate cut expectations, leading to market volatility. Additionally, other factors like inflation trends could counteract the labor market argument for easing.

- Opportunities: If jobs data revisions confirm the overcount and rate cuts materialize, it could boost stock markets, particularly interest-sensitive sectors. However, the window for this opportunity depends on the timing and clarity of data and Fed communications.

The case for 2026 Fed rate cuts hinges on verifying a systemic overcount of recent jobs numbers, as highlighted by Jerome Powell’s comments [1]. Upcoming catalysts include jobs data revisions, Fed minutes, and retail sales [0]. Technical market levels show the Dow at resistance (48,722.98) and the S&P 500 near its 52-week high (6,920.34) [0], emphasizing market sensitivity to policy shifts tied to labor market health. No specific investment recommendations are made.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.