Analysis of Victor Khosla's K-Shaped Economy Warning and Credit Spread Risks

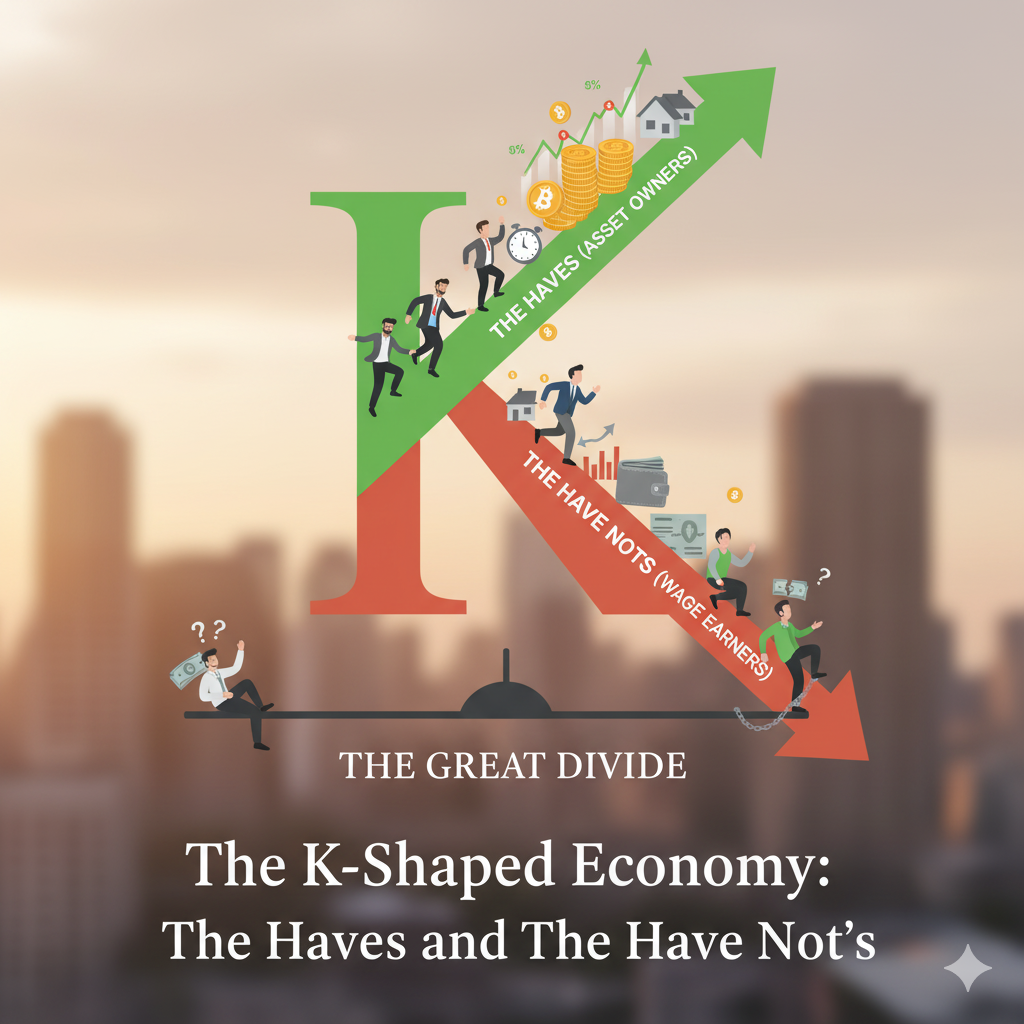

On December 11, 2025, Victor Khosla, founder of credit investor Strategic Value Partners, warned the U.S. is in a “truly K-shaped economy” with many sectors in recession, and credit spreads may widen sharply from historic lows [1]. This aligns with recent mixed economic signals: as of December 8, 2025, corporate credit spreads were near record lows [5], but the Fed’s November 2025 Beige Book confirmed a deepening K-shaped split [3]. Sector performance on December 10, 2025, showed divergence, with Basic Materials (+1.46%) and Industrials (+1.21%) leading, while Consumer Cyclical (-0.08%) and Technology (-0.02%) lagged [0]. Recession indicators are prevalent: 22 U.S. states were in recession as of late 2025 (Mark Zandi) [9], and layoffs exceeded 1.1 million (highest since COVID-19) [8], with a Fed official warning of broader recession risk [7]. Economist Nouriel Roubini also highlighted the K-shaped consumer economy [4].

- Cross-domain risk linkage: Credit spread widening would increase corporate borrowing costs, affecting both fixed-income (bond prices) and equity markets (sector investment) [2,5].

- Structural economic divergence: The K-shaped economy is a persistent trend, confirmed by assessments from the Fed and Roubini, indicating ongoing sector and regional splits [3,4].

- Regional spillover potential: Recession in 22 states could amplify credit stress in local and sector-specific markets, exacerbating divergence [9].

- Credit spread volatility: A sudden widening of spreads would hurt leveraged companies and bond investors [5].

- Sector underperformance: Continued weakness in sectors like Technology and Consumer Cyclical could lead to further selling pressure [0].

- Broader recession risk: High layoffs and state-level recessions raise the probability of a national economic slowdown [7,8,9].

- Selective sector exposure: Outperforming sectors such as Basic Materials and Industrials may offer hedges against economic divergence, though caution is advised due to recession risks [0].

- As of December 8, 2025, corporate credit spreads were near record lows [5].

- Sector performance is divergent: Basic Materials and Industrials are outperforming; Technology and Consumer Cyclical are lagging [0].

- 22 U.S. states were in recession as of late 2025, with 2025 layoffs exceeding 1.1 million (highest since COVID-19) [8,9].

- The Fed, Roubini, and Khosla confirm K-shaped economy dynamics, indicating persistent economic splits [1,3,4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.