Reddit Trading Community Evaluates Chart for Confluence, Concludes No Alignment

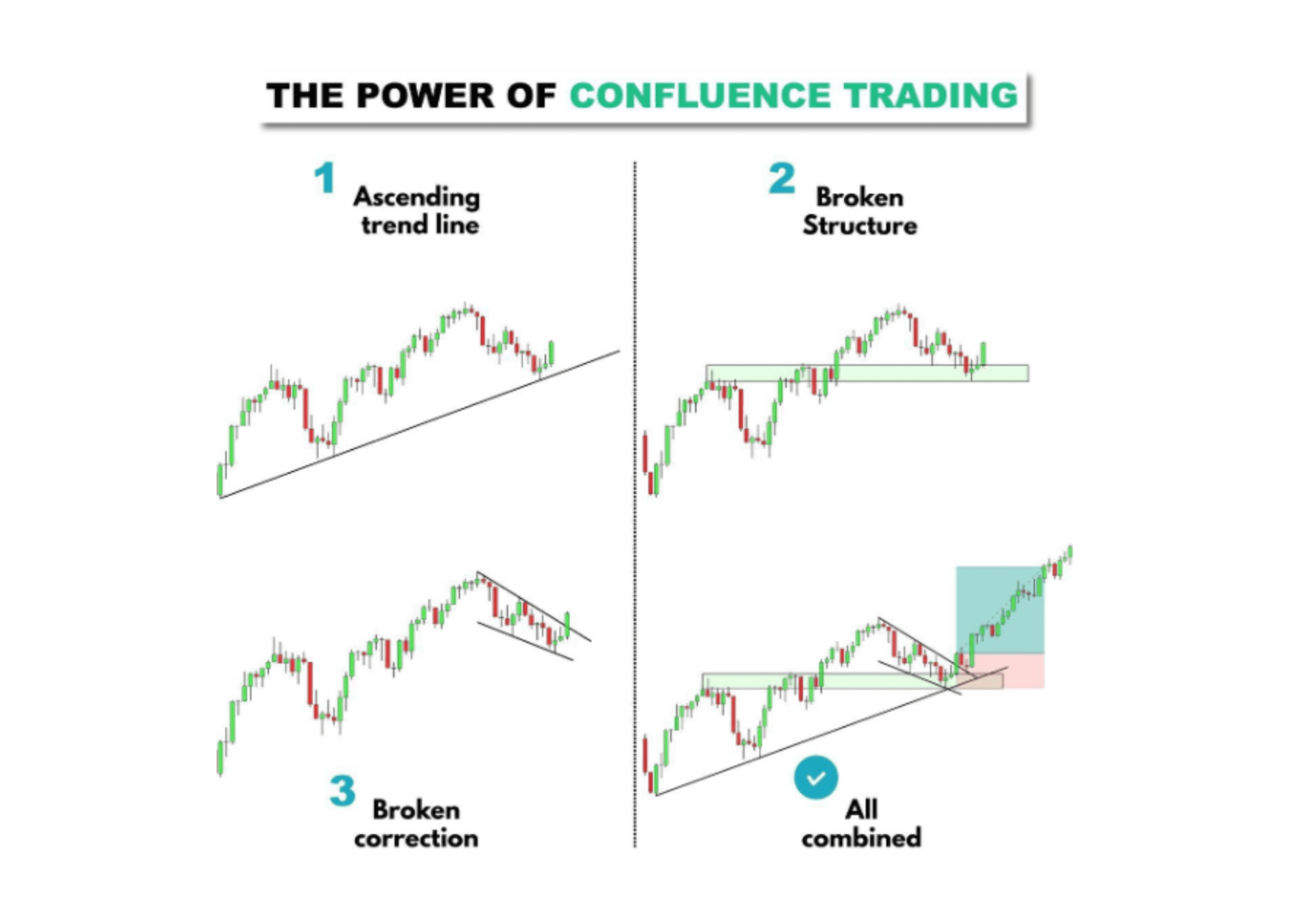

Confluence in trading refers to the alignment of multiple technical indicators, chart patterns, or analysis tools to confirm trade signals, creating “confluence zones” that increase the probability of reliable outcomes [1][2][3]. The Reddit thread involved an original poster (OP) asking about confluence in a price chart, with the community’s top-scoring (18 points) feedback being that the chart does not exhibit confluence [0]. This means no multiple independent signals (e.g., moving averages, volume spikes, support/resistance levels) were observed to align. Secondary community observations included the chart being range-bound, peaks reacting to resistance/supply zones (e.g., the third peak responding to the supply zone created by the first peak), topping tails indicating potential price direction, and guidance that take profits in range trading should be placed below range highs/lows (not at the extremes) [0]. In a range-bound market, confluence would typically require combining range boundaries with additional signals—such as moving average intersections or volume surges at range extremes—but no such alignment was identified [1][3].

- The community’s strong consensus (high score for the “no confluence” conclusion) highlights a common trader pitfall: overvaluing single technical features without verifying alignment across multiple signals [0][1].

- Confluence is a cornerstone of technical analysis for filtering high-probability trades, emphasizing that cross-verification across indicators, patterns, and timeframes is critical for signal reliability [1][2][3].

- Information gaps (missing chart, asset type, and timeframe details) limit definitive analysis, underscoring that full context is essential for accurate confluence assessment [3].

- Risks: Traders who ignore confluence and rely solely on single signals face reduced trade reliability, potentially increasing loss risk [1][2]. The absence of the actual chart, asset class, and timeframe also means the community’s conclusions cannot be fully verified independently.

- Opportunities: The discussion serves as an educational moment for traders to reinforce best practices: prioritizing confluence to enhance signal confidence, using strategic take profit placement in range trading, and interpreting topping tails for price direction clues [0].

- The chart under discussion lacks trading confluence, meaning no multiple technical signals are aligned to confirm trade setups [0].

- The chart exhibits range-bound conditions, with peaks reacting to resistance zones and topping tails indicating potential price direction [0].

- A key range trading best practice is to place take profits below range highs/lows to avoid false reversals [0].

- Confluence in trading requires the alignment of multiple independent signals (e.g., indicators, patterns, support/resistance) to boost signal reliability [1][2][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.