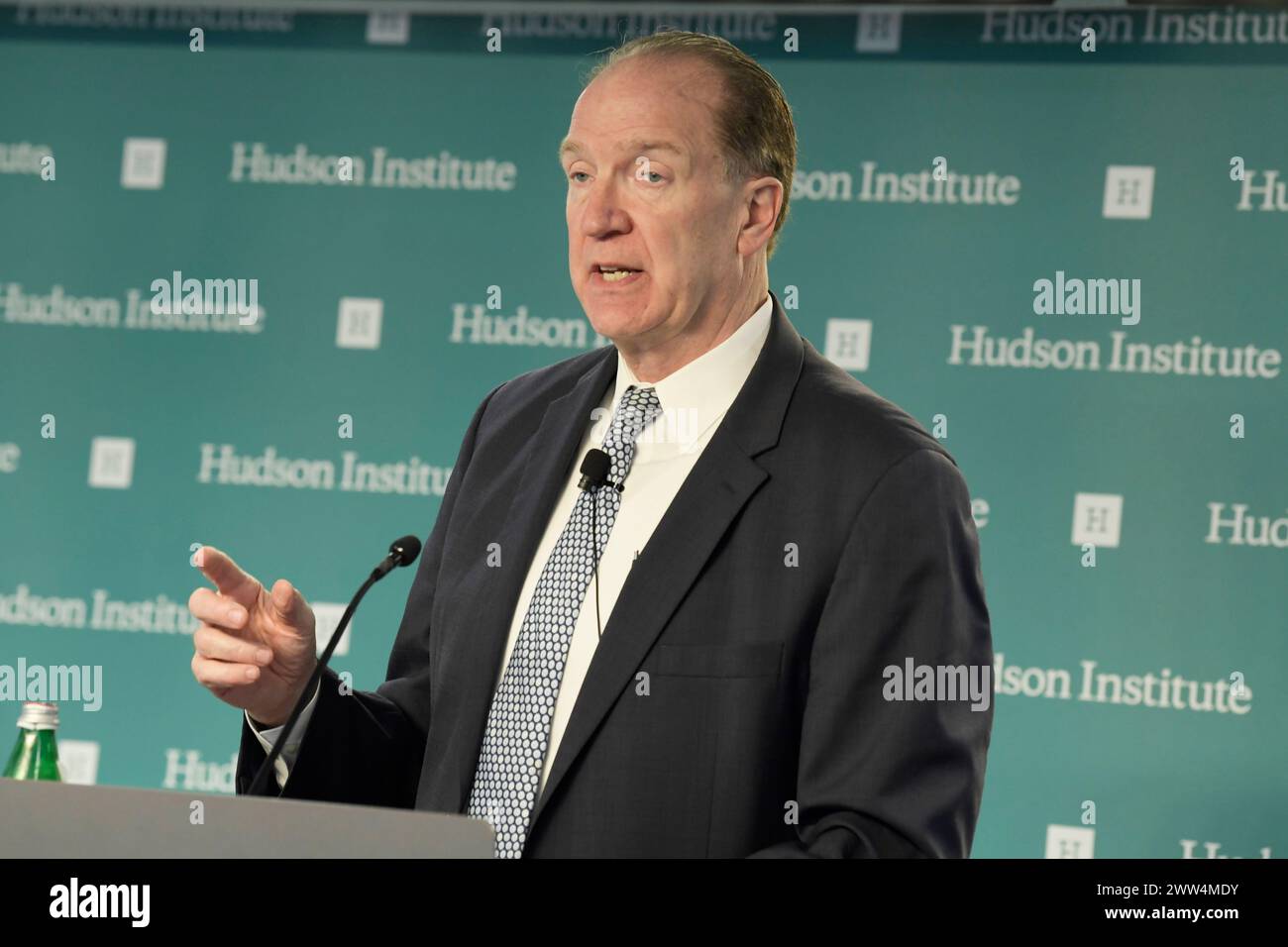

Analysis of Former World Bank President David Malpass’s Fed Rate Cut Warning and Economic Growth Concerns

This analysis originates from a December 11, 2025, YouTube interview [1] featuring former World Bank President David Malpass on Fox Business’s “Mornings with Maria.” Malpass, leveraging his expertise in global macroeconomic policy, criticized the Federal Reserve for relying on outdated models, arguing this has led to delayed interest rate cuts. He linked these delays to two key economic impacts: slowed overall growth and persistently high mortgage rates.

High mortgage rates, in particular, strain the housing market by reducing affordability, which can dampen residential investment and consumer spending—both critical drivers of U.S. economic activity. While a web search could not locate the specific interview via additional external sources [0], the core event is the published YouTube content [1], which captures Malpass’s direct warnings about the Fed’s policy approach and its real-world economic consequences. The Fed’s monetary policy decisions have broad ripple effects, so Malpass’s critique highlights potential misalignment between policy and current economic needs.

- Credibility of the Critique: Malpass’s background as a former head of a major global financial institution (World Bank) amplifies the significance of his warning, as he brings experience assessing macroeconomic policies’ domestic and global impacts.

- Model Vulnerability: The link between outdated policy models and tangible economic pain (high mortgage rates, slower growth) underscores the need for the Fed to adapt its frameworks to evolving economic conditions.

- Housing Market Sensitivity: The housing market’s vulnerability to prolonged high interest rates suggests sustained mortgage rate levels could further cool housing activity, risking broader economic headwinds.

- Prolonged slow economic growth if Fed rate cuts remain delayed, as high borrowing costs discourage business investment and consumer spending [1].

- Persistent housing affordability challenges, which could reduce homeownership rates and strain household budgets [1].

- Increased market volatility if investor concerns about Fed policy misalignment grow, leading to fluctuations in asset prices [0].

- If the Fed revises its models and adjusts rate policies in response to incoming economic data, it could support faster growth and lower mortgage rates, boosting the housing market and consumer confidence [0]. However, this outcome depends on future Fed decision-making and economic indicators.

This analysis contextualizes former World Bank President David Malpass’s December 2025 warning about the Federal Reserve’s outdated models and delayed interest rate cuts, which he contends are slowing U.S. economic growth and keeping mortgage rates elevated [1]. Malpass’s expertise adds credibility to his critique, highlighting potential risks to the economy’s strength, particularly in the housing sector. The report presents these findings for decision-making context without providing investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.