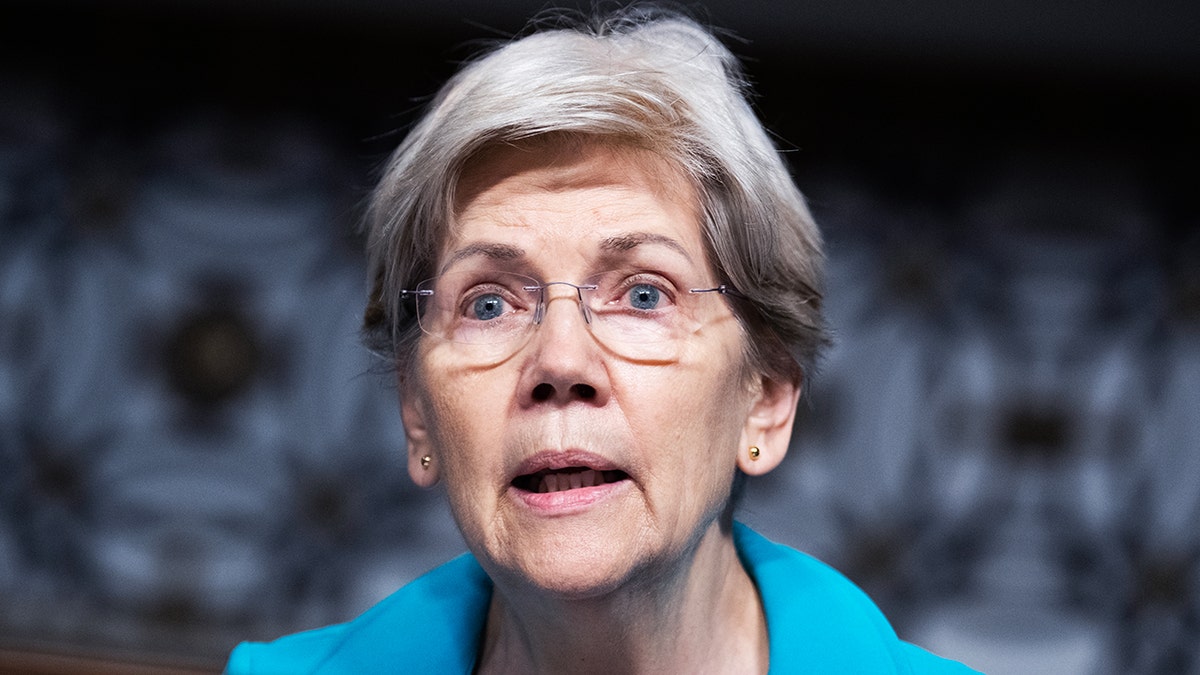

Sen. Elizabeth Warren Criticizes Fed Policies Amid Third Consecutive Rate Cut, Citing Economic "Red Flashing Lights"

On December 11, 2025, Sen. Elizabeth Warren (D-Mass.), a long-standing critic of Federal Reserve policies perceived to prioritize Wall Street over Main Street, joined CNBC’s “Squawk Box” to discuss monetary policy and the state of the U.S. economy [1]. Note: At the time of analysis, the full transcript of the interview was not available; this analysis draws on Sen. Warren’s known policy stances, the Fed’s recent actions, and broader economic context [0].

The day prior (December 10), the Fed implemented a quarter-point rate cut—the third consecutive reduction in as many meetings. The decision was not unanimous: two Fed members favored keeping rates unchanged, while one advocated for a larger cut. Fed projections also indicate only one additional rate cut is anticipated in 2026 [0].

Sen. Warren’s characterization of the economy as having “red flashing lights” likely reflects concerns about unaddressed structural challenges facing workers and consumers, including stagnant wages, persistent high housing costs, and lingering inflationary pressures. Her criticism of the Fed is rooted in long-standing beliefs that the central bank’s policies often fail to address these Main Street struggles while prioritizing corporate interests [0].

- Fed Policy Division: The dissent in the Fed’s rate cut decision highlights internal disagreement over the appropriate pace of monetary easing, suggesting uncertainty about the effectiveness of current policies [0].

- Main Street vs. Fed Projections: Sen. Warren’s “red flashing lights” comment signals a growing gap between the Fed’s economic outlook and the concerns of policymakers focused on inequality and household financial strain [1].

- Monetary Policy Limitations: Her criticism underscores ongoing debate about whether interest rate adjustments alone can solve structural economic issues like housing affordability and wage stagnation, which may require coordinated fiscal policy [0].

- Risks: Continued public disillusionment with Fed policies if Main Street economic challenges persist despite rate cuts, as emphasized by Sen. Warren’s comments [1]. The Fed’s internal dissent also raises risks of inconsistent policy communication, potentially increasing market volatility [0].

- Opportunities: The Fed could incorporate broader economic metrics (e.g., wage growth, housing affordability) into its decision-making process, aligning with Sen. Warren’s critiques and addressing unmet Main Street needs [1].

- Sen. Elizabeth Warren appeared on CNBC’s “Squawk Box” on December 11, 2025, calling the U.S. economy “red flashing lights” [1].

- The Federal Reserve implemented its third consecutive quarter-point rate cut on December 10, 2025, with internal dissent [0].

- Sen. Warren’s criticism is consistent with her long-standing stance that Fed policies often prioritize Wall Street over Main Street economic struggles [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.