Reddit Bearish Argument on Adobe (ADBE) Post-Q4 2025 Earnings: Growth Drivers and Market Reaction

Related Stocks

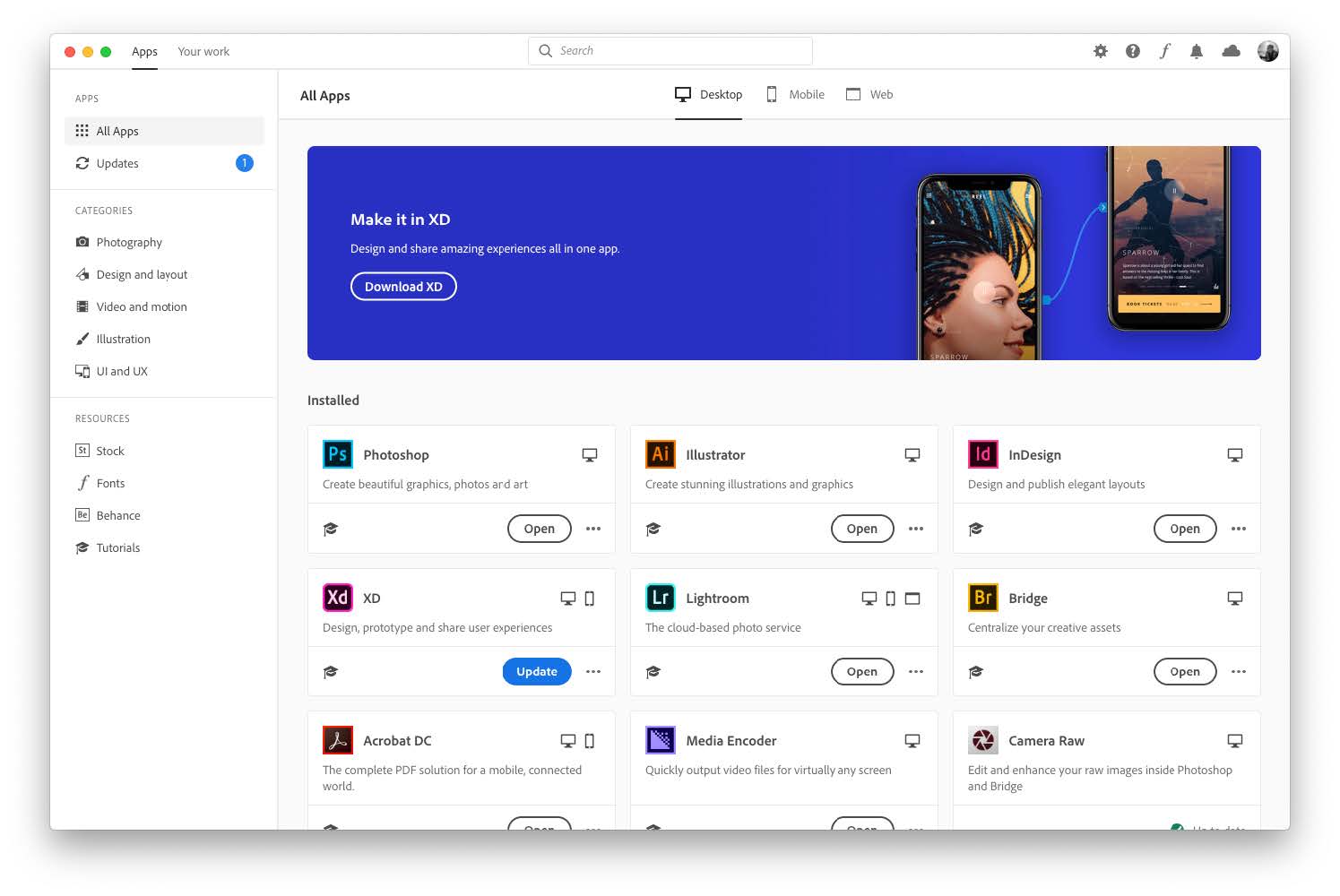

This analysis is based on a Reddit post [2] published on Dec 11, 2025 (08:12:14 EST) expressing bearish sentiment on Adobe (ADBE) after its Q4 2025 earnings report. The OP argued that ADBE’s revenue and ARR growth stemmed from price hikes (value-based pricing) rather than user expansion, alleging the company intentionally omitted user growth metrics amid aggressive pricing for Creative Cloud and generative AI credits.

From the earnings report, Adobe posted FY2025 revenue of $23.77B, a 11% YoY increase, with Q4 revenue at $6.19B (10.5% YoY, beating estimates) [3]. Digital Media ARR reached $19.2B (+11.5% YoY), where 75% of net new ARR came from subscriptions, cross-sell, and upsell activities, and 25% from value-based pricing—the “price hikes” referenced in the Reddit post [3]. Regarding user metrics, Adobe reported strong freemium MAU growth (35% YoY to over 70M) and Acrobat/Express MAU growth (20% YoY to over 750M) [3], but did not quantify paid seat growth in prepared remarks, only describing it as “strong” in the Q&A session [3].

The market reacted relatively flatly: ADBE closed at $343.13 on Dec 10 (the day earnings were released post-market), down 0.35% to $343.13 on Dec 11 with moderate trading volume (5.23M shares, above the 4.34M average) [0]. Counterarguments from Reddit commenters included ADBE’s consistent earnings beats, professional market dominance, corporate lock-in, and AI revenue growth with a reasonable valuation [2].

- Disclosure gap amplified bearish sentiment: The lack of quantified paid seat growth in prepared earnings remarks (despite “strong” Q&A mentions) aligned with the OP’s concern about omitted metrics, overshadowing the company’s positive freemium MAU and AI performance data [2][3].

- Pricing-driven growth is a minority contributor: While 25% of net new ARR came from value-based pricing, the majority (75%) stemmed from subscription growth and cross-sell/upsell—mitigating the OP’s claim of “unsustainable” growth dependent solely on price hikes [3].

- AI growth counters bearish claims: Adobe’s generative AI metrics (Firefly first-time subscriptions doubled QoQ, generative credit consumption tripled QoQ [3]) support bullish arguments about emerging AI revenue streams, addressing concerns about competitive pressures from cheaper AI tools [2].

- Corporate lock-in as a stabilizing factor: Commenters’ emphasis on ADBE’s dominance in professional creative workspaces and corporate suite integration suggests long-term user retention potential, even amid pricing adjustments or competitive offerings [2].

- Pricing dependence risk: The 25% contribution of value-based pricing to net new ARR could pressure user retention if competitors offer more cost-effective alternatives [3].

- Paid user conversion uncertainty: While freemium MAU (70M+) grew 35% YoY, the rate of conversion to paid plans remains an unquantified metric, creating uncertainty about future growth sustainability [3].

- AI tool competition: Long-term risk exists from cheaper AI tools disrupting ADBE’s market share, particularly if they gain traction among individual users or small businesses [2].

- Semrush acquisition risks: The pending $1.9B Semrush acquisition carries integration challenges and regulatory approval uncertainties, which could impact future performance [3].

- AI revenue expansion: Strong generative AI metrics indicate growing demand for Adobe’s AI-enabled features, offering a high-growth revenue stream [3].

- Freemium conversion potential: The 70M+ freemium MAUs represent a large pool of potential paid subscribers, supported by ADBE’s product ecosystem [3].

- Professional market stability: ADBE’s dominance in professional creative workspaces and corporate lock-in provide a stable revenue base amid market fluctuations [2].

Adobe reported record FY2025 revenue driven by a mix of subscriptions, cross-sell/upsell, and value-based pricing. The company disclosed strong MAU growth but limited paid seat metrics, sparking bearish concerns about growth drivers. The market reacted flatly, reflecting mixed sentiment between the OP’s concerns and counterarguments about AI growth, market dominance, and reasonable forward P/E (~14.7, based on FY2026 EPS guidance) [3]. Investors and stakeholders should monitor paid user conversion rates, AI revenue trends, and the Semrush acquisition process for further clarity on long-term growth prospects.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.