NVIDIA (NVDA) Valuation Debate: Reddit Discussion Context and Market Analysis

Related Stocks

This analysis is based on a December 10, 2025, Reddit discussion questioning NVIDIA (NVDA)’s valuation, where the user compared its forward price-to-earnings (P/E) ratio (26.6x) to higher ratios of consumer staples/retail companies (Costco [COST, 44.2x], Walmart [WMT, 40.3x], Starbucks [SBUX, 34.4x], Chipotle [CMG, 28.9x]), arguing NVDA—an AI innovator—was undervalued [1]. The discussion yielded varying viewpoints: some deemed cross-industry P/E comparisons invalid, others noted NVDA’s valuation relies on high margins (driven by limited competition), and a few cited Google’s Tensor Processing Units (TPUs) as a potential threat [2].

Market data shows NVDA closed at $183.74 on December 10, 2025, with a 0.66% after-hours decline, a 7.69% drop over one month, but strong year-to-date (+32.85%) and one-year (+36.03%) gains [0]. Its market capitalization is $4.47T, with the data center segment (AI compute focus) accounting for 88.3% of revenue [0]. Valuation metrics confirm NVDA’s forward P/E (~26.63x) is lower than or comparable to the comparison companies (COST: 45.87x, WMT: 33.67–36.63x, SBUX: 31.65x, CMG: ~28.49–29.96x) [1][3][4][5][6]. Analysts hold a 73.4% “Buy” consensus with a $250 price target, implying 36.1% upside [0].

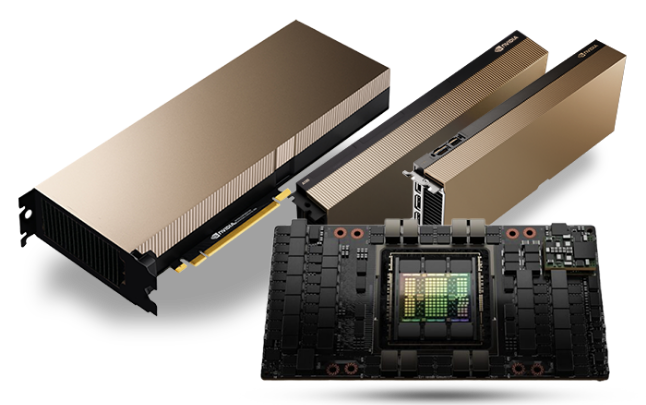

Competitive analysis reveals Google’s TPU v7 Ironwood (2025) has better performance (4,614 TFLOPS) and efficiency (2.8x per watt) than NVDA’s B200 (2,250 TFLOPS) [2]. However, analysts do not view this as an existential threat, citing NVDA’s robust CUDA ecosystem and market leadership [7].

- Cross-industry P/E comparisons, while debated, highlight that NVDA’s valuation is modest relative to stable consumer-facing companies, which may reflect market underappreciation of its AI growth potential versus more mature sectors.

- The 7.69% one-month stock decline suggests near-term investor concerns over Google TPU competition, despite long-term analyst optimism (73.4% Buy ratings, 36% upside).

- NVDA’s 53.01% net profit margin and 88.3% data center revenue concentration show its dominance in AI compute, but also its vulnerability to shifts in that segment’s competitive landscape.

- The Reddit discussion’s mixed opinions mirror broader market sentiment—some see undervaluation amid AI innovation, others focus on competitive and margin sustainability risks.

- Competitive Risk: Google TPUs and other custom accelerators could erode market share, especially in inference workloads [2][7].

- Margin Compression: NVDA’s high margins (53.01% net, 58.84% operating) depend on limited competition; increased rivals could reduce profitability [0].

- Volatility: The stock’s 7.69% one-month decline and AI sector hype-driven swings may continue [0].

- Analyst Upside: The $250 consensus price target offers significant potential upside (36.1%) [0].

- AI Growth: NVDA’s data center dominance positions it to benefit from ongoing AI adoption [0].

- Profitability: Strong margins provide a buffer against short-term competitive pressures [0].

- NVDA’s forward P/E ratio (~26.63x) is lower than or comparable to COST (45.87x), WMT (33.67–36.63x), SBUX (31.65x), and CMG (~28.49–29.96x) [1][3][4][5][6].

- The stock closed at $183.74 on December 10, 2025, with a 7.69% one-month decline, but +32.85% YTD and +36.03% one-year returns [0].

- 73.4% of analysts rate NVDA as “Buy” with a $250 price target (+36.1% upside) [0].

- Google TPU v7 outperforms NVDA B200 in performance and efficiency, but analysts view NVDA’s ecosystem as a competitive moat [2][7].

- NVDA’s data center segment contributes 88.3% of revenue, with 53.01% net profit margin [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.