AAII Sentiment Survey Shows Neutral Sentiment Jump Amid Market Weakness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

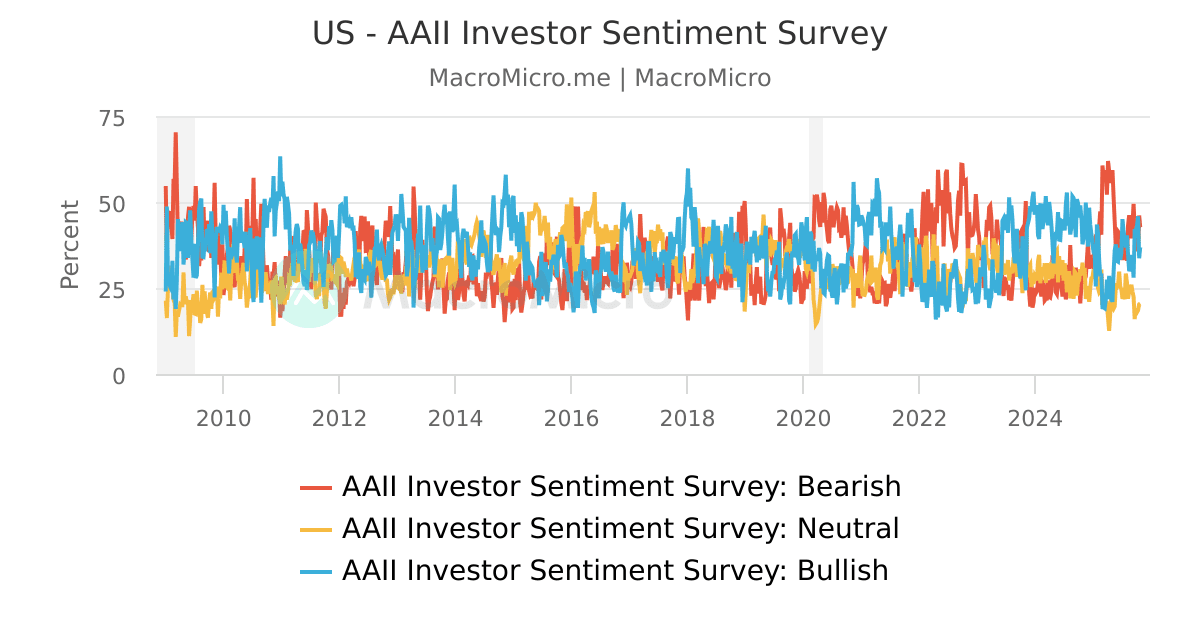

This analysis is based on the Seeking Alpha report [1] published on November 6, 2025, which detailed the latest AAII sentiment survey results. The survey revealed a notable shift in individual investor psychology, with neutral sentiment jumping 6.7 percentage points to 25.8% while bullish sentiment declined 6.1 percentage points to 38.0% [1]. Bearish sentiment decreased slightly by 0.6 percentage points to 36.3% [1].

The sentiment shift occurred during a day of significant market weakness, with major indices posting substantial declines. The S&P 500 fell 0.99% to 6,720.31, the NASDAQ Composite dropped 1.74% to 23,053.99, the Dow Jones declined 0.73% to 46,912.30, and the Russell 2000 lost 1.68% to 2,418.82 [0]. Sector performance analysis revealed a clear defensive rotation, with Healthcare (+0.43%) and Real Estate (+0.09%) being the only gainers, while Consumer Cyclical (-2.14%) and Industrials (-2.33%) suffered the steepest losses [0].

Historical context provides important perspective on these sentiment levels. Compared to the previous week (October 30, 2025), bullish sentiment has fallen from 44.0% to 38.0%, while neutral sentiment has risen from 19.1% to 25.8% [4]. Against historical averages, current bullish sentiment at 38.0% remains slightly above the long-term average of 37.5%, while neutral sentiment at 25.8% stays below its historical average of 31.5% [4].

- Labor Market Deterioration: The record October job cuts (153,074) represent a significant economic warning sign that could further depress sentiment if the trend continues [2].

- Monetary Policy Uncertainty: Fed commentary about rate easing to provide labor market insurance creates uncertainty about future policy direction [2].

- Money Market Stress: Wall Street banks are warning of potential fresh stress in US money markets, which could impact liquidity and investor confidence [2].

- Sentiment Momentum Risk: The sharp decline in bullish sentiment could accelerate if economic data continues to disappoint, potentially leading to more pronounced market weakness.

- Defensive Sector Strength: Healthcare and Real Estate’s resilience during the market decline suggests continued relative strength potential [0].

- Contrarian Positioning: If neutral sentiment continues to rise toward historical averages, it could create opportunities for strategic positioning ahead of potential sentiment reversals.

- Volatility Management: The current environment may benefit from strategies that capitalize on increased market uncertainty while managing downside risk.

The AAII sentiment survey data [1] reveals a significant psychological shift among individual investors, with neutral sentiment rising to 25.8% (+6.7 points) and bullish sentiment declining to 38.0% (-6.1 points). This sentiment evolution occurred alongside broad market weakness, with all major indices declining between 0.73% and 1.74% [0]. The defensive sector outperformance, particularly in Healthcare (+0.43%) and Real Estate (+0.09%), confirms the risk-off sentiment [0].

The sentiment shift reflects broader economic concerns, including record job cuts and Fed policy uncertainty [2]. While current bullish sentiment remains slightly above historical averages, the rapid moderation from 44.0% the previous week suggests waning investor conviction [4]. The combination of rising neutral sentiment and defensive sector positioning indicates investors are adopting a wait-and-see approach amid increased uncertainty.

Key monitoring indicators include next week’s AAII survey for trend confirmation, weekly jobless claims data, Fed communications, and technical support levels on major indices. The current sentiment environment suggests heightened near-term volatility potential as investors assess economic and policy developments.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.