Analysis of SpaceX 2026 IPO Speculation and Impact on SATS

Related Stocks

This analysis is based on Bloomberg News’ report [2] that SpaceX is pursuing a 2026 IPO to raise over $30 billion at a $1.5 trillion valuation. The report cites Starship progress and Starlink’s direct-to-mobile business as key drivers, even though Musk has historically denied IPO plans [3].

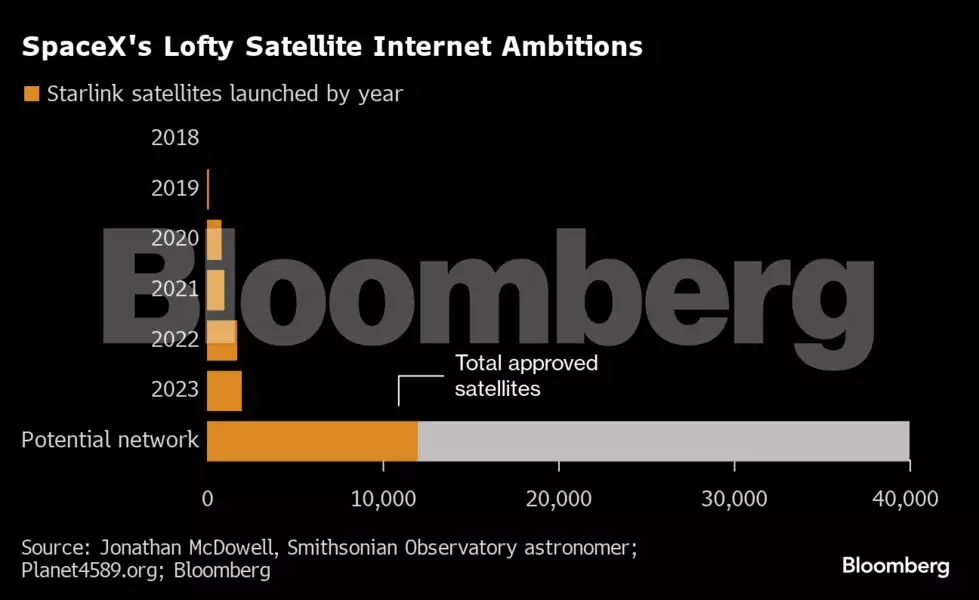

EchoStar (SATS), which holds $11.1 billion in SpaceX stock, experienced significant price movement: +6.42% on December 9, 2025, and +27.39% over 5 days [0]. The bullish sentiment towards SATS stems from its direct exposure to potential SpaceX IPO upside [2]. However, skepticism persists: insiders question the IPO’s validity (citing Musk’s denial and SpaceX’s private funding capabilities [3]), while industry analysts note rising competition in space launches and satellite constellations by 2026 (e.g., Amazon’s Project Kuiper [2]).

- SATS Valuation Link to SpaceX: SATS’ recent price surge directly correlates with its SpaceX share holdings, indicating that investors are pricing in potential IPO-related valuation gains [0].

- IPO Credibility Concerns: Musk’s 15-year history of opposing a SpaceX IPO, combined with the company’s access to private funding, creates significant uncertainty about the Bloomberg report’s accuracy [3].

- Long-Term Industry Risks: By 2026, increased competition is expected to pressure SpaceX’s market share, which could limit valuation upside post-IPO [3].

- Risks:

- IPO cancellation could lead to a sharp SATS price correction [0].

- Rising competition may reduce SpaceX’s future profitability [3].

- Opportunities:

- A successful SpaceX IPO could unlock substantial value for SATS shareholders [0].

- The IPO may attract broader investor interest in the space industry [2].

- SpaceX IPO details (2026, $30B raise, $1.5T valuation) are based on Bloomberg’s insider sources [2].

- SATS holds $11.1B in SpaceX stock, driving recent price gains [0].

- Skepticism exists due to Musk’s past statements and SpaceX’s private funding access [3].

- Industry competition is expected to intensify by 2026 [3].

[0] Internal quantitative data on SATS’ price movements and SpaceX share holdings.

[2] Bloomberg News report on SpaceX’s planned 2026 IPO.

[3] Reddit community discussions highlighting IPO skepticism and industry competition.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.