Equity Market Analysis: Technology Leadership and Concentration Risk in November 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report “Equity Sector Rotation Chartbook, October 2025 - Nirvana” [1] published on November 6, 2025, which identifies XLK (U.S. Technology Select Sector SPDR Fund) and VEU (Vanguard FTSE All-World ex-US Index Fund) as the only two market components delivering both excess returns relative to the S&P 500 and accelerating momentum [1]. The report notes that while narrow leadership isn’t necessarily unhealthy, it creates inherent risks for investors holding broad market portfolios [1].

Market data validates these observations, with XLK delivering +3.90% returns over the past 30 days compared to SPY’s +1.64% [0]. VEU also outperformed with +2.50% returns while maintaining lower volatility (0.78% vs XLK’s 1.38%) and more reasonable valuations (P/E 17.30 vs XLK’s 40.47) [0]. However, the technology sector showed recent volatility with a -1.58501% decline on November 6, 2025 [0].

The narrow leadership pattern is evident in broader market performance, where only Healthcare (+0.42868%) and Real Estate (+0.09064%) showed positive daily performance, while most sectors including Consumer Cyclical (-2.14011%), Industrials (-2.29776%), and Financial Services (-1.83584%) were negative [0]. This concentration of returns creates significant portfolio risk for investors heavily weighted in broad market indices.

The October 2025 Equity Sector Rotation Chartbook identifies a market characterized by narrow leadership dominated by XLK (U.S. Technology) and VEU (International equities) [1]. Market data confirms XLK’s strong 30-day performance (+3.90% vs SPY’s +1.64%) but highlights elevated valuations (P/E 40.47) and recent volatility [0]. VEU offers attractive risk-adjusted returns with +2.50% performance and lower volatility (0.78%) [0].

The market shows concerning breadth deterioration, with only Healthcare and Real Estate posting positive daily performance on November 6, while most major sectors declined [0]. This concentration creates significant portfolio risk, particularly for investors heavily weighted in broad market indices without sector-specific risk management.

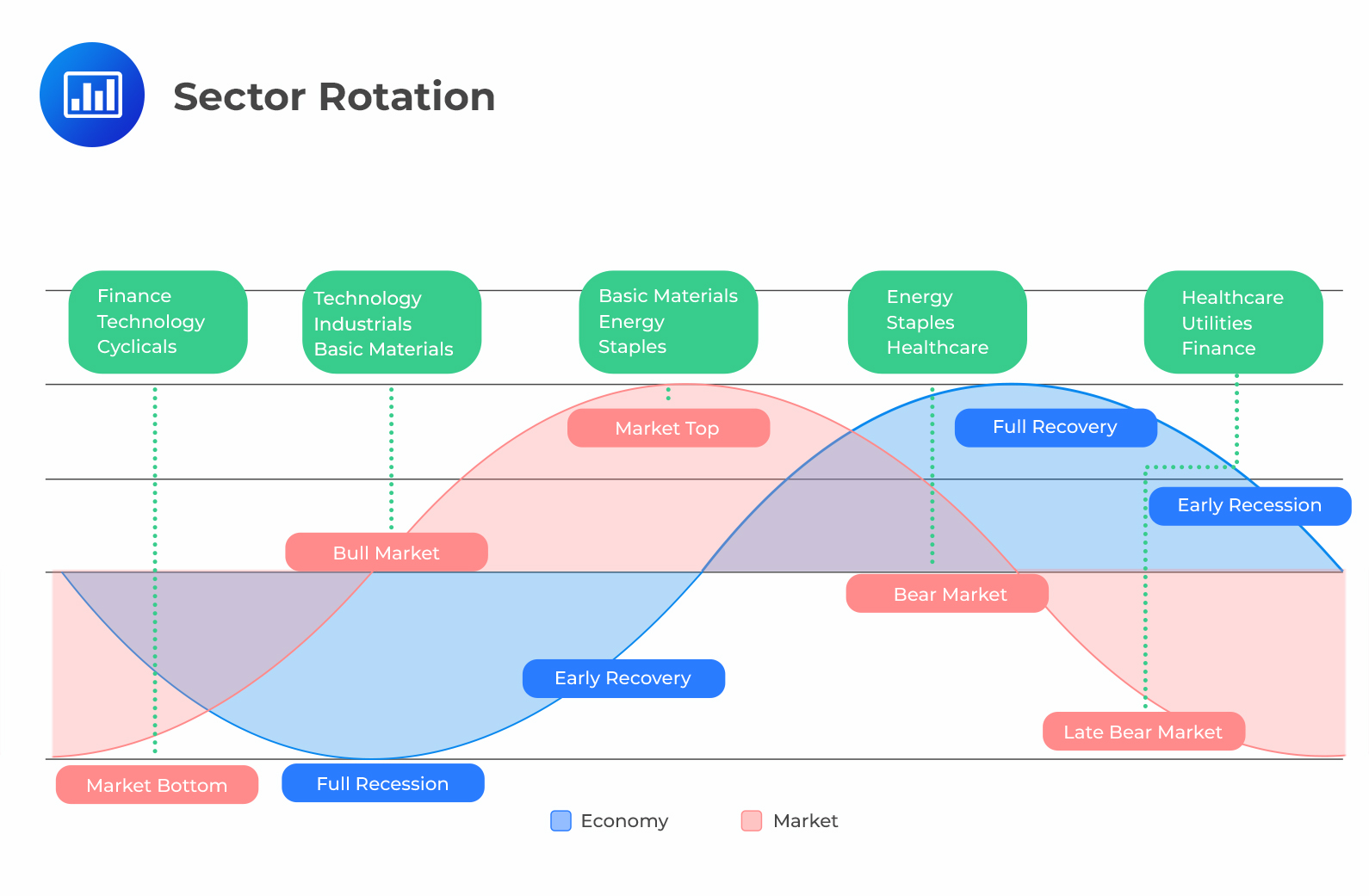

Key monitoring priorities include technology sector earnings results, interest rate sensitivity, international correlation sustainability, and early signs of sector rotation away from technology leadership. The analysis suggests that while current trends may continue, the elevated valuations and narrow market breadth warrant cautious portfolio positioning and robust risk management protocols.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.