Analysis of Ed Yardeni’s Recommendation to Underweight Magnificent Seven Tech Stocks

Related Stocks

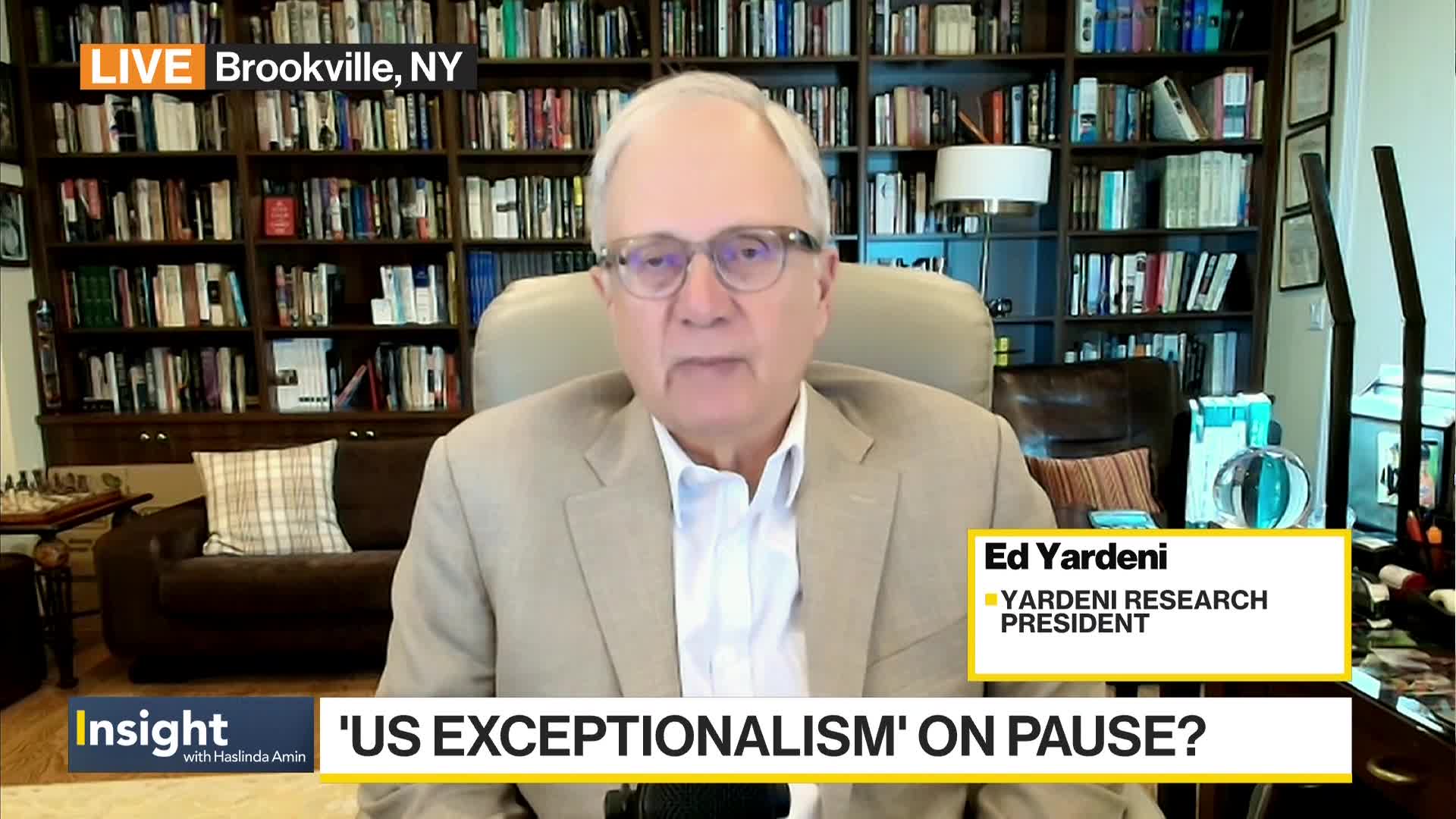

On December 7, 2025 (a non-trading day), veteran strategist Ed Yardeni recommended underweighting the Magnificent Seven tech stocks and shifting focus to a broader range of companies that utilize these technologies [1]. Prior to this announcement, market data as of December 5 showed mixed performance among the Magnificent Seven: Apple (AAPL) was down 2.56% week-over-week, while Meta (META) and Tesla (TSLA) posted robust gains of 6.65% and 5.84%, respectively [0]. The Technology sector closed 0.195% higher on December 5, with the Real Estate sector leading market gains at 1.39% [0]. Since the event occurred outside trading hours, the direct market impact on the Magnificent Seven remains to be seen once markets open on December 8.

- Yardeni’s shift signals a potential market rotation away from megacap tech dominance, which has been a defining trend in recent years.

- His emphasis on companies “using all these technologies” rather than just developing them highlights opportunities in sectors beyond traditional tech (e.g., industrials, healthcare, consumer goods) that adopt innovative technologies.

- The mixed pre-announcement performance of the Magnificent Seven could amplify investor reaction if Yardeni’s guidance resonates with institutional and retail participants.

- Risks: Short-term volatility may emerge for Magnificent Seven stocks when markets open on December 8, particularly if large investors align with Yardeni’s underweight recommendation. Uncertainty remains regarding the specific sectors or companies Yardeni views as viable alternatives, creating information gaps for portfolio adjustments.

- Opportunities: Investors may identify undervalued opportunities in non-megacap companies across diverse sectors that leverage tech innovations. This could drive capital flow to previously overlooked segments of the market.

This analysis contextualizes Ed Yardeni’s December 7 recommendation to underweight Magnificent Seven tech stocks and broaden portfolios. As of December 5, the Magnificent Seven showed mixed weekly performance, with the Technology sector posting modest gains while Real Estate led the market [0]. Since the announcement was made on a non-trading day, the direct market reaction is pending the December 8 trading session. Investors should monitor upcoming market data and any additional commentary from Yardeni for more clarity on recommended alternative investments.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.