2025 Reddit Beginner Pennystock Tips: Scams, Risk Management, and Market Context

This report is based on a December 7, 2025, Reddit discussion [1] where a user shared personal pennystock trading lessons for beginners. Key themes from the discussion and their alignment with broader market data are analyzed below:

-

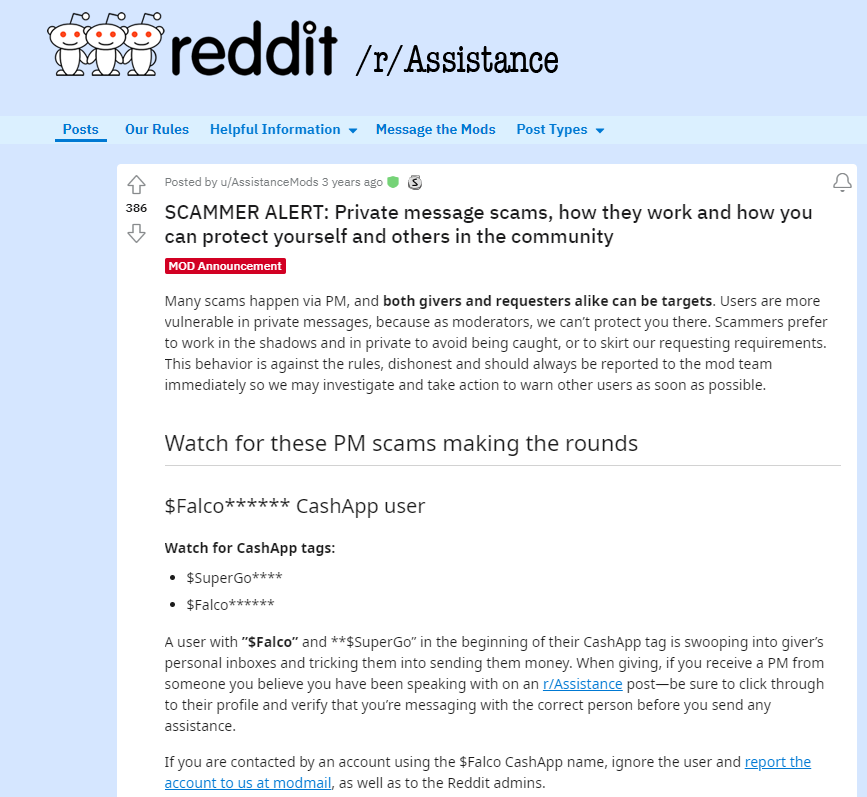

Pump-and-Dump Schemes in Unmoderated Communities: The OP’s warning (community score: 5) of rampant scams in unmoderated communities is supported by the FBI’s 2025 report noting a 300% increase in pump-and-dump fraud complaints, with social media platforms (including Reddit) as primary scammer tools [2]. A July 2025 incident saw investors lose $3.7 billion when seven Chinese pennystocks crashed over 80% post-aggressive online promotion [2]. Pennystocks’ low liquidity and limited regulation make them vulnerable to such manipulation, validating the OP’s concern.

-

Biotech Pennystock Risk: A user’s extreme warning to avoid biotech pennystocks (community score: 1) reflects the sector’s unique hazards: regulatory hurdles, binary clinical trial outcomes, thin liquidity, and minimal Wall Street coverage [3]. For example, biotech pennystock Polyrizon (PLRZ) rallied 4x in 2025 but was flagged as high-risk due to speculative froth and lack of institutional vetting [3], supporting the sentiment that biotech pennystocks are challenging for beginners to evaluate.

-

Free Tools for Premarket Movers: The OP’s claim that TradingView and Finviz suffice (community score: 2) aligns with Investopedia’s December 2025 ranking of these platforms as top stock screeners, citing Finviz’s pre-market data strength and TradingView’s global coverage [4]. These tools provide beginners with essential metrics without expensive subscriptions.

-

Reddit Recommendation Win Rate: The 50% win rate claim (community score: 2) lacks empirical verification but aligns with broader trends of low retail recommendation success rates [5]. Retail investors often lack institutional research resources, with social media recs prone to bias, hype, or manipulation.

-

Small Gains vs. Big Squeezes: The OP’s advice to prioritize 10-20% consistent gains (community score: 8), echoed by comments, is a foundational risk management principle. Short squeezes are rare and unpredictable, while securing incremental profits reduces emotional decision-making risks [6].

- Retail Trading Consensus on Risk Management: The high community score (8) for prioritizing small gains indicates strong agreement on disciplined trading [0], a critical habit for long-term retail success [6].

- Regulatory Response to Pennystock Fraud: FBI and FINRA warnings, alongside Nasdaq’s 2025 proposed rules to curb scams [2], highlight systemic concerns that validate the OP’s warnings about unmoderated communities.

- Accessibility of Trading Tools: The sufficiency of free tools (TradingView/Finviz) lowers entry barriers for beginners, addressing a common pain point of expensive subscription costs [4].

- Social Media Recommendation Limitations: The 50% win rate claim, though anecdotal, underscores the need for independent research over reliance on crowd-sourced advice [5].

- Pump-and-dump fraud in unmoderated communities, leading to significant losses [2].

- Biotech pennystock binary outcomes (e.g., FDA approval failures) resulting in steep declines [3].

- Unreliable social media recommendations with low success rates [5].

- Free tools (TradingView/Finviz) providing accessible market data for beginners [4].

- Disciplined 10-20% gain strategies building long-term trading discipline [6].

- Awareness of scams and risk management helping beginners avoid costly mistakes [0].

Pennystocks (typically defined as stocks trading under $5 per share with low liquidity and market capitalization) are a high-risk asset class. The 2025 Reddit advice emphasizes: avoiding unmoderated communities to mitigate pump-and-dump schemes; exercising caution with biotech pennystocks due to their unique risks; using free screeners like TradingView/Finviz for premarket data; questioning social media recommendations; and prioritizing small, consistent gains. This guidance aligns with broader market data and regulatory warnings, offering objective context for beginners to make informed decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.