Analysis: Microsoft’s Custom Chip Negotiations with Broadcom and Industry Implications

Related Stocks

This analysis is based on a Reddit post [original event] referencing a paywalled report from The Information, later confirmed by WebProNews [1], Techmeme [2], and industry data [0]. Microsoft’s negotiations with Broadcom occur amid a broader industry trend: the AI chip market is currently dominated by Nvidia, which controls approximately 80% of the AI accelerator market [0]. Hyperscalers like Microsoft, Google, and Amazon are shifting toward custom ASICs to address rising costs, supply constraints, and the need to optimize hardware for proprietary AI workloads.

Microsoft’s potential pivot from Marvell to Broadcom builds on its existing custom chip efforts (e.g., Azure Maia AI accelerator, Cobalt CPU) and leverages multiple strategic advantages:

- Broadcom’s proven expertise in designing high-performance ASICs for hyperscale clients including Google, Meta, and OpenAI [1][3].

- Microsoft’s access to OpenAI chip designs via IP agreements, which could complement Broadcom’s capabilities [original event context].

- A broader goal to diversify chip partners, reducing reliance on any single vendor (including Marvell and Nvidia) [3].

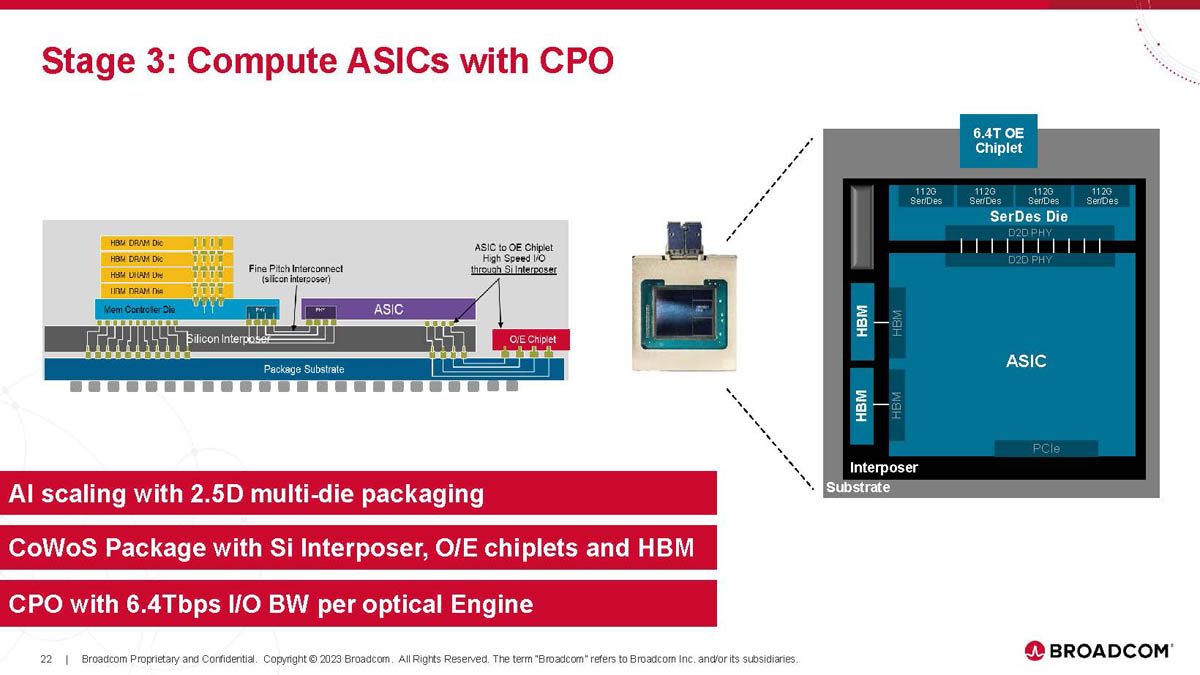

The partnership could drive innovations in energy-efficient AI computing, hardware-software integration (with Microsoft’s Azure and Copilot ecosystems), and future-proof data center infrastructure (e.g., photonics, wireless technologies) [3].

- Accelerated Hyperscaler Self-Reliance: Microsoft joins Google (TPUs) and Amazon (Trainium2) in prioritizing custom chips to optimize AI infrastructure, signaling a long-term industry shift away from general-purpose GPUs [0].

- Broadcom’s Rising AI Dominance: The company’s custom chip division has grown 45% year-over-year (2025) [0], and the Microsoft deal could further solidify its position as a top-tier custom chip partner for leading tech firms.

- Supply Chain Diversification Imperative: Microsoft’s multiple chip partnerships (Intel, Broadcom) aim to mitigate geopolitical risks associated with TSMC’s dominant fabrication position [3], a concern shared across the industry.

- IP Collaboration Precedent: The potential integration of Microsoft, Broadcom, and OpenAI chip IP could set new standards for cross-company collaboration in AI hardware development.

- Microsoft (MSFT): Enhanced long-term Azure margins and AI performance, reduced vendor reliance, and deeper integration of its software ecosystem with custom hardware.

- Broadcom (AVGO): An estimated 20% surge in AI-related custom chip revenue if the deal materializes [0], building on its existing growth trajectory.

- TSMC: Likely to remain the primary manufacturer for Microsoft-Broadcom chips, benefiting from increased fabrication demand.

- Azure Customers: Lower AI computing costs and faster performance from optimized hardware-software stacks.

- Microsoft: Execution delays in chip design/production could disrupt Azure growth plans; intellectual property complexities may arise from shared IP between Microsoft, Broadcom, and OpenAI [3].

- Marvell (MRVL): Potential 10-15% decline in data center chip revenue if it loses Microsoft’s contract [0], highlighting risks of client concentration.

- Nvidia (NVDA): Increased competition from Microsoft’s custom chips could reduce long-term GPU procurement [0], though Nvidia may pivot to AI software and cloud services to mitigate this.

Microsoft’s negotiations with Broadcom reflect a strategic shift in the AI infrastructure landscape, where hyperscalers are increasingly investing in custom chips to address efficiency, cost, and supply chain challenges. The potential partnership positions Broadcom as a central player in AI custom silicon and accelerates the trend of vendor diversification. Stakeholders, including investors and industry partners, should monitor the deal’s confirmation and subsequent execution risks, as well as broader industry moves toward custom chip adoption and supply chain resilience.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.