ETF Mechanisms and Investing Strategies: Reddit Discussion Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit discussion (2025-12-06) [0] where users debated ETF functionality, focusing on consistent investing (DCA), growth drivers, and performance expectations.

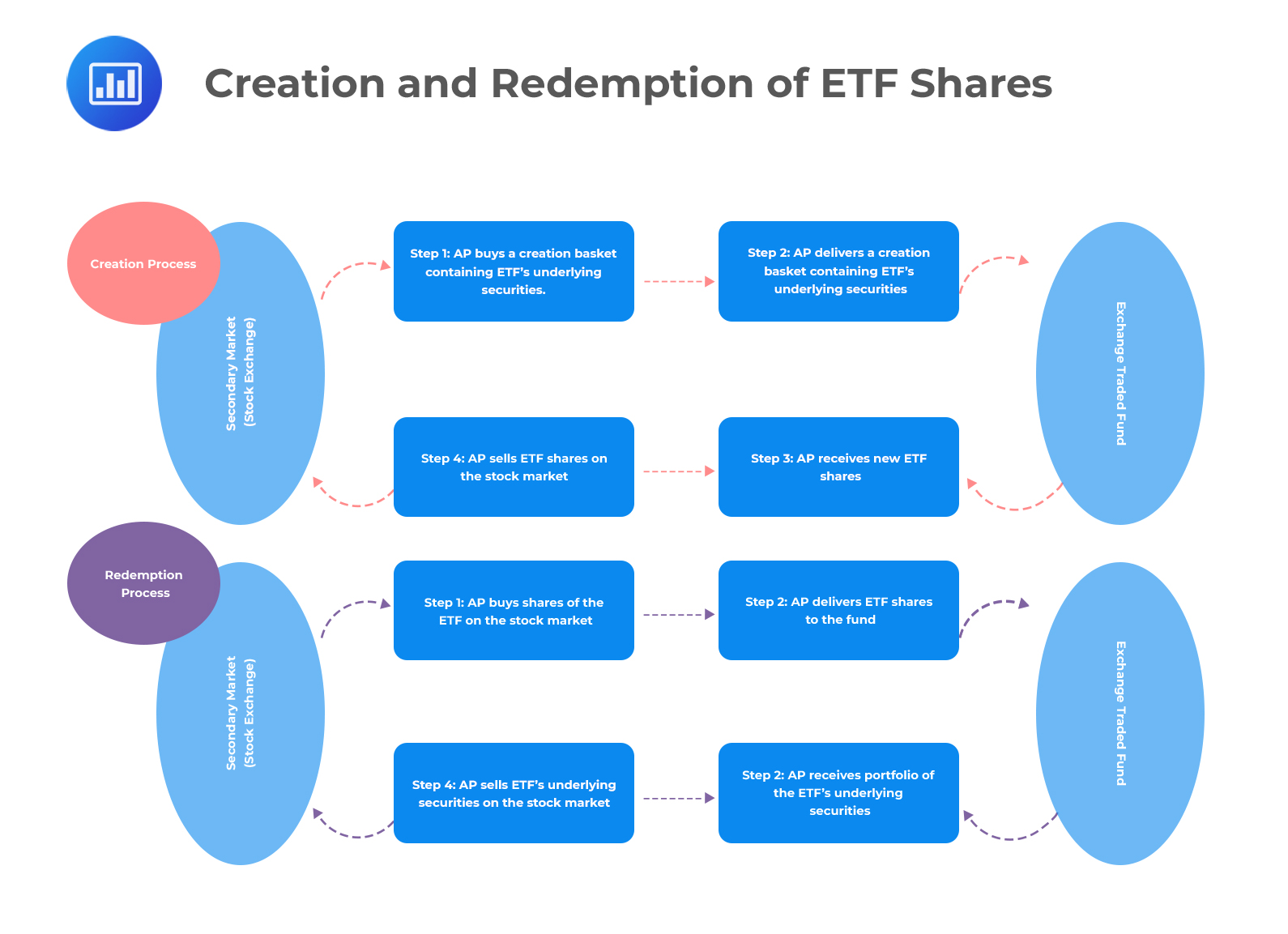

ETFs are structured as managed baskets of assets (stocks, bonds, etc.) traded like individual stocks. Their value rises/falls proportionally with the underlying assets they hold. Unlike mutual funds, ETFs use an in-kind creation/redemption mechanism that reduces capital gains distributions, offering tax benefits for frequent sellers [2]. The discussion references popular ETFs including VOO, VXUS, SMH, and QQQM—broad or sector-specific index funds aligned with long-term investing strategies.

Users emphasized DCA as an effective ETF strategy, with external sources confirming it reduces volatility and emotional decision-making by spreading investments over time [4][5]. Two return metrics were debated:

- Nominal returns: ~10% annually (including inflation and dividends), supported by long-term S&P 500 data [0]

- Inflation-adjusted returns: ~8% annually (likely the basis for the lower estimate mentioned in the discussion)

A 20-30 year time horizon was repeatedly highlighted as critical to realizing these returns, as short-term volatility and potential “lost decades” require discipline—especially during bear markets when many investors abandon DCA.

Contrary to some misconceptions, ETFs themselves do not compound; compound growth occurs when dividends are reinvested to purchase additional shares, which then generate more dividends. This aligns with external guidance on dividend reinvestment plans (DRIPs) as a key driver of long-term ETF growth [6].

- Return Metrics Context: The 8% vs. 10% return discrepancy stems from failing to distinguish inflation-adjusted (real) vs. nominal returns, a critical detail for setting realistic expectations.

- Discipline Over Formula: While DCA is mathematically sound, its success depends on investor resilience during bear markets—an often-underestimated factor.

- ETF Tax Efficiency: The in-kind mechanism delivers tax benefits for frequent sellers, but long-term investors may not see significant advantages over low-turnover individual stock portfolios.

- Compounding Requirement: Dividend reinvestment is not automatic; investors must actively enable DRIPs to unlock compound growth potential.

- Risks: High current valuations (unspecified metrics cited), short-term volatility, and investor discipline failure during market downturns [1].

- Opportunities: DCA’s ability to reduce average cost basis during market dips, long-term compounding via dividend reinvestment, and tax efficiency for active traders [4][5][6].

- Urgency Assessment: No immediate action required, but investors should clarify return expectations (real vs. nominal) and set up DRIPs to maximize long-term growth.

- ETFs are tradable asset baskets with tax benefits for frequent sellers.

- DCA reduces volatility and encourages discipline in ETF investing.

- Long-term returns average ~10% nominal or ~8% inflation-adjusted, depending on calculation.

- Compounding requires active dividend reinvestment.

- A 20-30 year time horizon is critical to weather market volatility.

Information gaps identified include:

- Lack of expense ratio analysis (a key driver of net returns)

- Limited context on “historical high valuations” (no specific metrics like P/E ratios)

- No discussion of ETF-specific traits (sector exposure, fees) for the mentioned funds (VOO, VXUS, SMH, QQQM)

- Omission of asset allocation and rebalancing as strategies to maximize holdings

All findings are based on the Reddit discussion [0] and external sources [2][4][5][6] verifying ETF mechanics and investing principles.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.