Analysis of Reddit’s Claim That Google Is NVIDIA’s Greatest Long-Term Threat

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

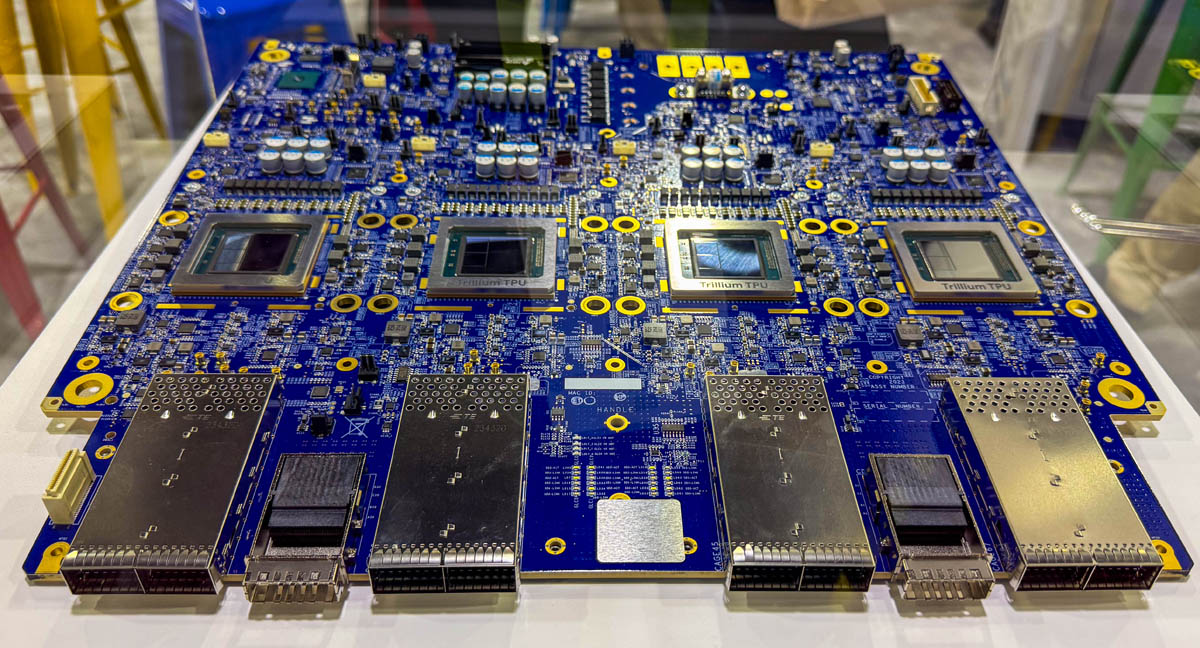

The analysis is based on a Reddit post [0] asserting Google (not AMD) is NVIDIA’s most significant long-term threat due to its full-stack AI ecosystem—encompassing models like Gemini, cloud infrastructure, and Tensor Processing Units (TPUs)—and AlphaEvolve, an AI agent that optimizes hardware and models. On the event date (2025-12-05), NVDA closed down 0.80% (-$1.47) with volume of 142.16M, while GOOGL rose 0.56% (+$3.65) [0]. Key metrics include: NVDA’s 44.73x P/E ratio (vs. GOOGL’s 31.25x, TSLA’s 276.51x), Google’s TPU v6e offering 4.7x better performance-per-dollar for production inference than NVDA’s H100, and AlphaEvolve recovering 0.7% of Google’s global compute resources in data centers [0]. Counterarguments in the Reddit thread criticized the thesis as late (noting Google’s 100% gain), lacking credibility, and highlighting that Nvidia-TSMC’s collaboration on chip manufacturing and AI frameworks outpaces Google’s efforts [0]. Some users defended Google’s reasonable P/E compared to peers [0].

- Google’s full-stack AI integration (models, hardware, cloud) creates a structural long-term threat, as efficiency becomes a critical priority for AI deployment [0].

- While NVDA currently holds 90% of the AI chip market share and remains short-term dominant, Google’s TPU commercialization could erode this position over time [0].

- AlphaEvolve’s current 0.7% compute recovery impact is modest, but its AI-on-AI optimization capability has potential for a long-term flywheel effect, improving Google’s infrastructure efficiency continuously [0].

- NVDA’s higher P/E ratio (44.73x vs. GOOGL’s 31.25x) makes it more vulnerable to valuation corrections if Google’s competitive threats materialize [0].

- Risks for NVDA: Google’s TPU advancements could disrupt NVDA’s data center revenue, which accounts for 88.3% of its FY2025 revenue [0]. The company may need to accelerate GPU architecture updates and software ecosystem enhancements to maintain its lead [0].

- Opportunities for GOOGL: Leveraging its full-stack AI and TPU performance advantages to expand market share in the AI chip and cloud AI sectors [0].

- Market Risks: The AI chip market’s high valuation (exemplified by TSLA’s 276.51x P/E) could lead to broader sector volatility if competitive dynamics shift [0].

The Reddit discussion underscores a debate about Google’s long-term competitive threat to NVIDIA, driven by Google’s full-stack AI capabilities and TPU performance. Short-term, NVIDIA’s dominant market share and established ecosystem provide stability, but long-term, Google’s integrated approach and AI optimization tools like AlphaEvolve warrant close monitoring. Market data shows relative valuation differences (NVDA’s higher P/E) that could amplify risks if Google makes further inroads in the AI chip market.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.