Analysis of AI Bubble Concerns and Market Impact (December 5, 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

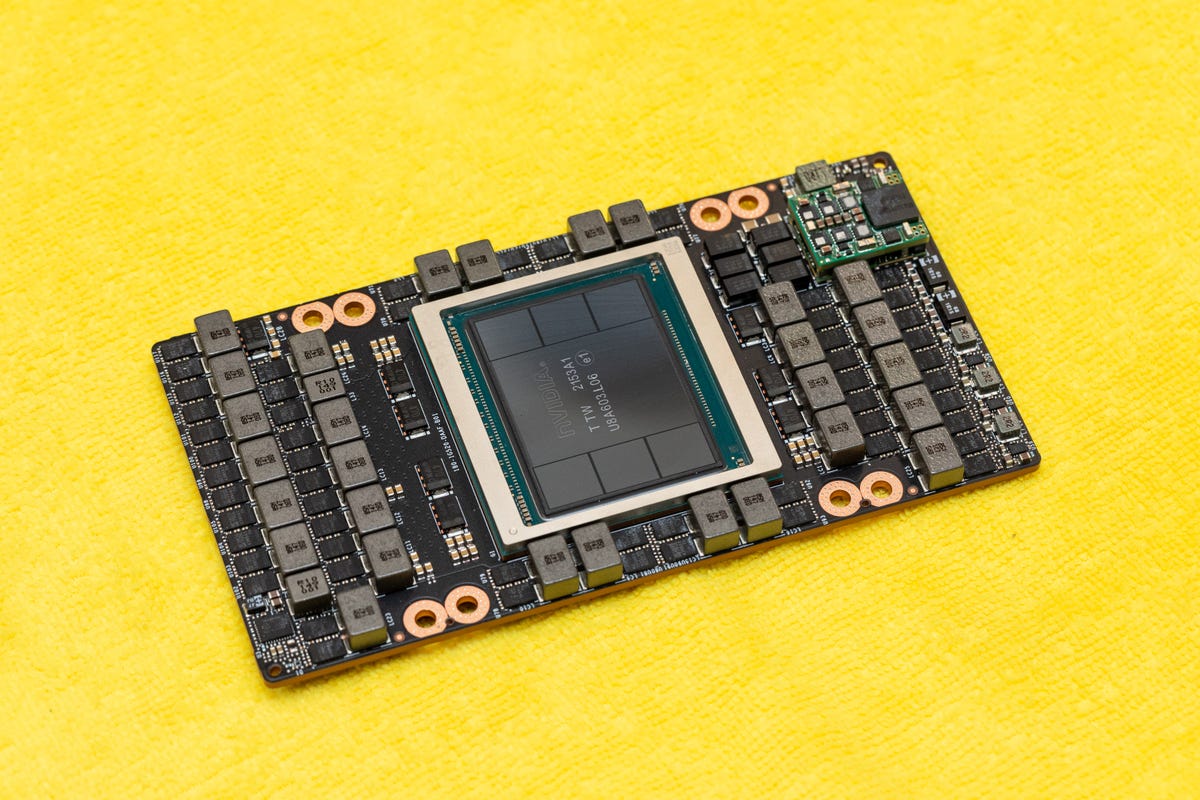

This analysis is based on the December 5, 2025 Seeking Alpha article “4 Questions For The AI ‘True Believers’” [1], which raises concerns about a potential AI bubble despite the narrative driving three years of equity gains. On the day of the article’s release, major AI-related stocks exhibited mixed after-hours performance: NVIDIA (NVDA) closed at $182.41 (-0.53%), Microsoft (MSFT) at $483.16 (+0.48%), Apple (AAPL) at $278.78 (-0.68%), and Alphabet (GOOGL) at $321.27 (+1.15%) [0]. The Technology sector underperformed other sectors, rising only 0.1955% compared to Real Estate (+1.39024%) and Communication Services (+1.04996%) [0]. A concurrent development that may have influenced NVIDIA’s decline is Google’s launch of the Ironwood TPU, which is challenging NVIDIA’s ~90% AI chip market dominance [4]; Meta is reportedly in talks to purchase billions of dollars worth of these chips. Market sentiment is divided: while 62% of U.S. stock owners could be exposed to a potential AI bubble burst [3], some contrarian views argue that a bubble collapse would benefit AI innovation by separating viable companies from overhyped ones [2].

- Mixed Stock Performance Reflects Dual Pressures: The day’s stock movements highlight both growing bubble concerns (impacting NVDA and AAPL) and positive sentiment from competitive AI hardware developments (boosting GOOGL).

- NVIDIA’s Dominance Is Under Threat: Google’s Ironwood TPU introduces significant competition, which could erode NVIDIA’s market share and long-term profit margins.

- Market Sentiment Divides Create Uncertainty: The contrast between bubble warnings and contrarian views on innovation benefits indicates a lack of consensus about the AI sector’s future trajectory.

- AI Bubble Burst: Mounting concerns about overvaluation could lead to a market correction, affecting 62% of U.S. stock owners [3].

- Competitive Erosion: NVIDIA faces increasing pressure from Google, AMD, and other chipmakers, which may undermine its market leadership [4].

- Regulatory Uncertainty: Potential future AI regulations (a persistent sector risk) could constrain growth.

- Innovation Weeding: A bubble burst could eliminate overhyped AI companies, allowing focused, innovative firms to thrive [2].

- Hardware Competition: Google’s TPU innovation may drive efficiency and cost reduction in AI infrastructure, benefiting the sector long-term.

The December 5, 2025 Seeking Alpha article [1] has brought AI bubble concerns to the forefront, even as equities trade near record highs. On the same day, AI stocks showed mixed performance, with NVIDIA facing pressure from Google’s new AI chip. Market sentiment is divided, with warnings of broad investor exposure to a potential bubble and contrarian views on innovation benefits. NVIDIA’s dominance in AI chips is increasingly challenged, adding to sector uncertainty.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.