U.S. Futures Taxation: Key Differences Between Personal Brokers and Prop Firms

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit discussion [4] dated December 5, 2025, where a U.S. futures trader (first-year trading) asked if futures gains are taxed without withdrawals, hoping to avoid a tax consultant initially. Key findings include:

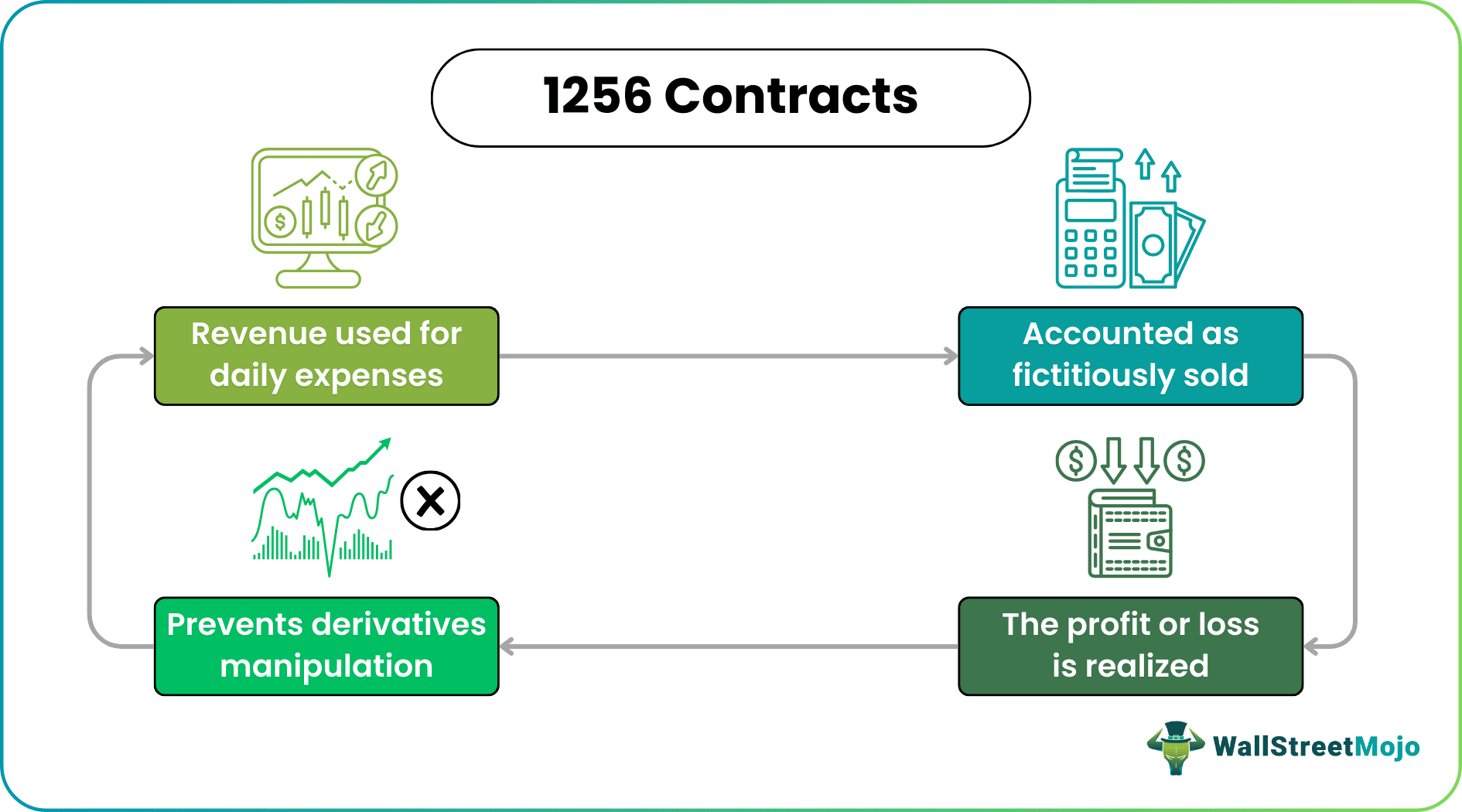

- Personal Brokerage Futures (Section 1256 Contracts): Gains are taxable upon position closure and at year-end via mark-to-market (MTM) rules, regardless of withdrawal status [1]. These contracts benefit from the 60/40 tax rule, where 60% of gains are treated as long-term capital gains and 40% as short-term (with favorable tax rates) [1]. The wash sale rule does not apply to futures [0].

- Trader Tax Status (TTS): TTS is required to deduct trading-related expenses (e.g., internet, PC). Eligibility criteria include: substantial volume (minimum 4 trades/day, 15/week, 60/month, 720/year per Poppe court [3]), trading on 75% of available days, and average holding period under 31 days (Endicott court [2]). TTS is determined by facts and circumstances, not formal election [0].

- Prop Firm Futures: A Reddit claim suggests prop firm gains are taxed only on withdrawal, but formal sources (including IRS guidelines) do not clearly confirm this [0]. Tax treatment may depend on the firm’s structure, constructive receipt rules, and whether traders have a beneficial interest in gains before withdrawal [0].

- Reliability of Advice: Users emphasized Reddit is an unreliable source for tax advice; professional consultation is recommended to navigate complex tax laws [4].

- Personal brokerage futures face stricter taxation timelines (closure and year-end MTM) compared to ambiguous prop firm rules, highlighting the need for firm-specific clarification.

- TTS eligibility relies on judicial benchmarks (Poppe/Endicott courts) rather than informal rules, making qualification a high-bar process.

- The 60/40 tax rule offers meaningful tax advantages for futures traders, a critical benefit not universal to other investment vehicles [1].

- Misinformation on platforms like Reddit underscores the risk of self-filing without verifying rules against official IRS resources.

- Risks: Incorrectly assuming no tax liability until withdrawal in personal accounts could lead to underpayment penalties [0]. Misapplying TTS criteria may result in disallowed expense deductions [0]. Reliance on Reddit advice increases the likelihood of non-compliance [4].

- Opportunities: The 60/40 tax rule allows for lower effective tax rates on futures gains compared to short-term stock gains [1]. Proper TTS qualification can reduce taxable income by deducting trading expenses [0].

- Personal U.S. brokerage futures (Section 1256) are taxed on closed gains and year-end MTM, with 60/40 tax treatment and no wash sale rule [1].

- TTS requires meeting strict volume, frequency, and holding period criteria to deduct trading expenses [2][3].

- Prop firm futures taxation remains unconfirmed by formal sources; tax liability may depend on firm structure and constructive receipt [0].

- Professional tax consultation is recommended over Reddit advice to ensure compliance and maximize benefits.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.