Analytical Report: Widening 2025 U.S. Economic Divide – Working-Class Struggles vs. Wall Street Gains

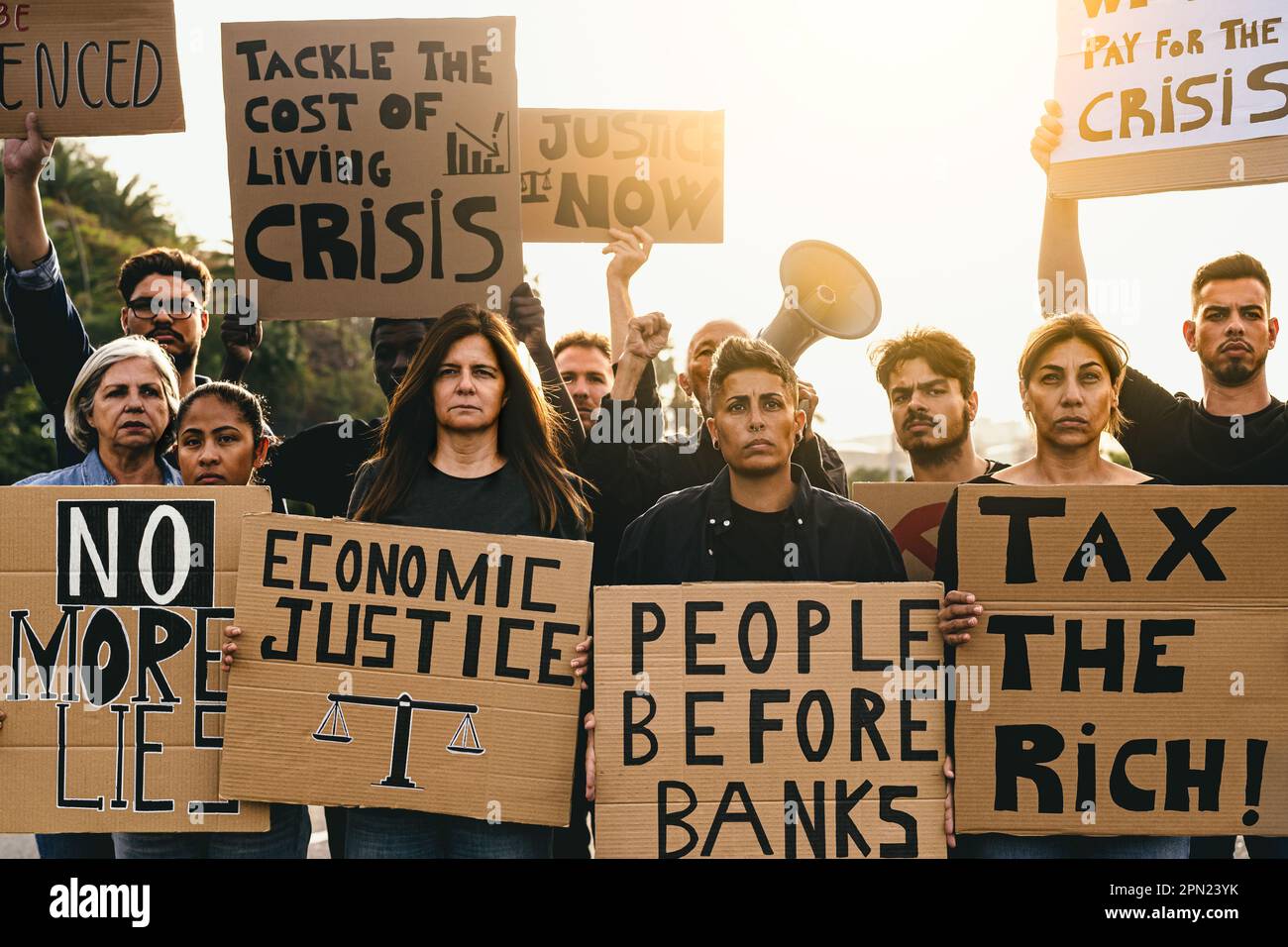

On December 5, 2025, ‘The Big Money Show’ panel debated the widening U.S. economic divide—contrasting working-class struggles with Wall Street celebrations—published online later that day [3]. This divide is supported by quantifiable data: major U.S. indices (S&P 500, NASDAQ Composite, Dow Jones Industrial Average) gained 2.32%, 3.40%, and 1.95% respectively from November 17 to December 5, 2025 [0], driven by corporate profits, AI sector growth, and low-interest-rate expectations [2]. Concurrently, U.S. household debt hit a record $18.59 trillion in Q3 2025, up $197 billion quarter-over-quarter [1]. Real wages for workers aged 25–54 grew by only 1.6% annually (October 2025), lagging behind September 2025’s 3% inflation rate [2][4], eroding household purchasing power. A viral post further highlighted the cost-of-living gap, claiming a family of four needs $140,000/year to avoid “deep poverty”—a stark contrast to the official Federal Poverty Level ($32,150) and 2024 median household income ($83,730) [2]. The panel’s debate over media-driven fear vs. real struggle is grounded in both anecdotal frustration and hard data showing financial market gains are not translating to household well-being.

- Market-Household Disconnect: Wall Street gains are driven by corporate and sector-specific growth (e.g., AI) that has not trickled down to working-class households, where real wage growth lags inflation and debt rises [0][1][2][4].

- Metrics vs. Lived Experience: The $140k “new poverty line” claim, while unofficially defined, reflects widespread public distrust in traditional economic metrics that may undercount modern cost-of-living realities (e.g., housing, healthcare, childcare) [2].

- Broader Economic Implications: The divide is not just a perceptual issue—stagnant wages and high debt could fundamentally weaken U.S. GDP, as consumer spending (70% of economic activity) may slow [2][4].

- Consumer Spending Slowdown: Stagnant real wages and rising debt may reduce holiday and 2026 consumer spending, threatening U.S. economic growth [2][4].

- Political Polarization: The divide could amplify populist rhetoric, as working-class voters perceive economic gains as concentrated among Wall Street and elite groups [2][4].

- Market Volatility: If reduced consumer spending pressures corporate earnings, the current Wall Street rally may be unsustainable [0][1].

The panel’s discussion could prompt policy reforms targeting wage growth, cost-of-living adjustments, or debt relief to address the divide [2][4], though specific actions are not yet visible.

This analysis synthesizes data and debate on the 2025 U.S. economic divide, covering Wall Street gains, record household debt, lagging real wages, and public frustration with cost-of-living. The panel’s focus on perception vs. reality highlights tensions between official economic indicators and lived working-class experiences.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.