Reddit Discussion: Transitioning from Manual TA to Algorithmic Trading & Real-World Realities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

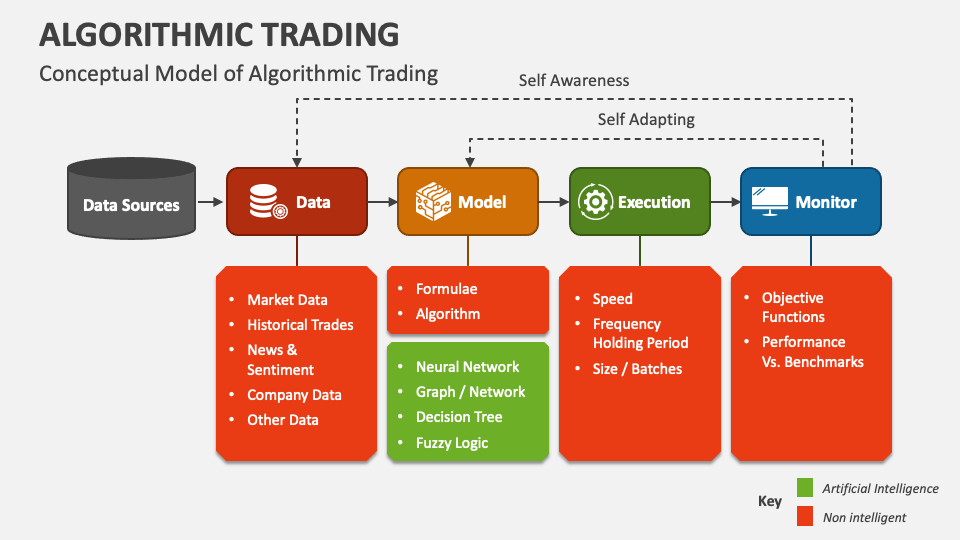

This analysis is based on a Reddit discussion [0] where an OP recounts their transition from manual TA trading to developing an algorithmic system, noting that algo trading is not easier but redirects effort from real-time decision-making to strategy design, backtesting, and continuous adaptation. Commenters with direct experience (e.g., 5 years running an algo system) confirmed that algo trading demands ongoing work rather than passive income generation [0]. For traders with C#/C++/Java backgrounds, NinjaTrader was recommended as a robust platform for futures algo trading, with its C#-based NinjaScript and backtesting capabilities validated by external reviews [1]. A commenter also shared success with a hybrid system—combining a data-driven mechanical strategy with manual execution and monthly recalibration—an approach supported by industry analysis that balances automation efficiency and human oversight [2]. The OP’s observation about increased responsibility aligns with Investopedia’s note that algo systems require constant monitoring to avoid obsolescence or technical glitches [3].

- Myth Debunking: The discussion challenges the pervasive beginner myth that algo trading is a passive “get-rich-quick” scheme, highlighting the need for continuous system maintenance and adaptation [0][4].

- Platform Suitability: NinjaTrader emerges as a targeted solution for traders with C# experience, filling a gap for actionable platform guidance in futures algo trading [1].

- Hybrid System Advantages: Hybrid approaches address limitations of both manual (emotional bias) and fully automated (lack of human judgment) trading, offering a balanced alternative validated by user experience and industry analysis [2].

- Shift in Responsibility: Algo trading transforms a trader’s role from executing intuitive trades to managing a system—requiring expertise in programming, stats, and market adaptation [0][3].

- Risks: Beginners may misinterpret algo trading as low-effort, leading to neglect of system maintenance or failure to adapt to market shifts [0][3]. The lack of detailed performance metrics for the hybrid system discussed also poses a risk of overgeneralization.

- Opportunities: The discussion provides accessible education for new traders, demystifying the transition to algo systems. The NinjaTrader recommendation offers a clear entry point for programming-savvy traders, while hybrid system insights present a flexible strategy option [1][2].

- The OP transitioned from manual TA to an algorithmic system, noting a shift from intuition to strategy design and continuous maintenance.

- Algo trading requires ongoing effort (confirmed by 5 years of user experience) and is not a “hands-off cheat code.”

- NinjaTrader is recommended for futures algo trading for users with C#/related programming backgrounds due to its C#-based NinjaScript and backtesting features [1].

- Hybrid trading systems (mechanical strategy + manual execution) can be effective, with one commenter reporting success with monthly recalibration [2].

- Information gaps include the OP’s technical background, alternative beginner platforms, and performance metrics for the hybrid system.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.