Transwarp-U (688031) Analysis of Strong Performance and Sustainability Judgment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on information from tushare_strong_pool on December 5, 2025 (UTC+8) [0], showing that Transwarp-U (688031) entered the strong stock pool due to its strong performance on that day.

Transwarp-U’s strong performance is mainly driven by the benchmarking effect of MongoDB’s better-than-expected results. US database giant MongoDB released its third fiscal quarter report on December 2, with revenue and profit far exceeding market expectations, and its post-market stock price soared by more than 20% [4]. As a leading domestic enterprise-level big data basic software developer, Transwarp’s business model is highly similar to MongoDB and is regarded by the market as the “domestic MongoDB” [3], so MongoDB’s positive performance has had a significant benchmarking effect on Transwarp.

Technically, Transwarp-U rose 17.02% on the day, closing at 72.96 yuan, close to its 52-week high of 78.90 yuan [1]. Trading data shows that the main capital net inflow was 1.45 billion yuan [2], turnover rate was 14.52%, and turnover was 8.15 billion yuan [5], all significantly higher than the recent average, indicating active market trading and sufficient short-term upward momentum.

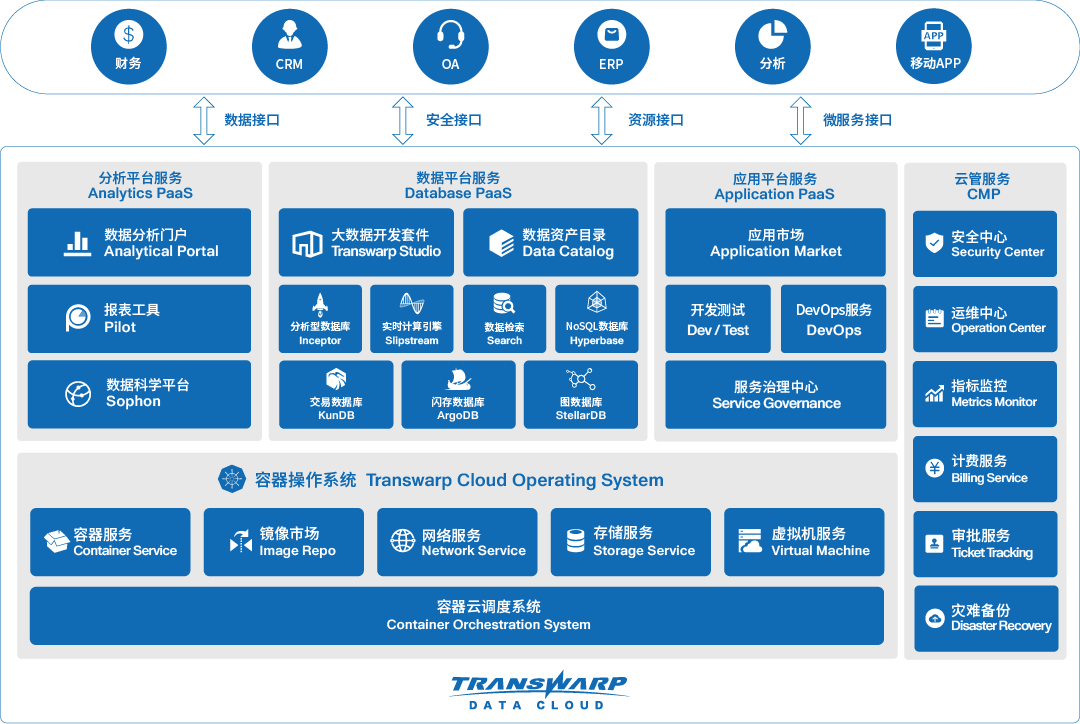

Transwarp is a leading enterprise in domestic enterprise-level big data and AI infrastructure software fields, with products covering the full data lifecycle [1]. The company has core technical advantages in distributed databases and big data basic software, has passed international authoritative technical benchmark tests many times, and has high market recognition. In addition, the company is included in popular concept plates such as “Huawei Industry Chain” and “Digital Economy” [6], and has received institutional attention (e.g., Galaxy Zhilian Hybrid Fund holds it heavily, accounting for up to 9.43%) [1].

- International Benchmark Spillover Effect: As a leading enterprise in the global big data basic software field, MongoDB’s better-than-expected results have directly transmitted sentiment and valuation to domestic enterprises in the same track, reflecting the relevance of the global technology industry and the sensitivity of the Chinese market to the dynamics of international leaders.

- Tech and Concept Dual Drive: The superposition of Transwarp’s technical advantages and popular concepts such as digital economy and Huawei Industry Chain has made it gain dual attention from investors, driving its strong stock price performance.

- Valuation and Profit Contradiction: Despite the strong stock price performance, the company’s current price-to-book ratio is 8.69 times (higher than the industry average) and has continued to lose money since its IPO (2025 H1 net loss of 143 million yuan) [1], indicating that the market has high expectations for its future profits, while there is a risk of valuation bubble.

- Profitability Risk: The company has not yet achieved profitability, and continuous losses may affect investor confidence [1].

- Valuation Risk: The high price-to-book ratio and current stock price close to the 52-week high bring great correction pressure [1].

- Industry Competition Risk: Facing fierce competition from domestic giants such as Huawei and Tencent, as well as international manufacturers such as Snowflake and MongoDB, market share may be squeezed [3].

- Digital Economy Policy Dividends: The development of the digital economy promotes the growth of demand for enterprise-level big data and AI infrastructure, providing a broad market space for the company.

- Huawei Industry Chain Cooperation: As a member of the Huawei Industry Chain, it is expected to expand its business relying on Huawei’s technical and market advantages [6].

In the short term, MongoDB’s positive impact and the company’s technical advantages will continue to support the stock price, but attention should be paid to the resistance level of 78.90 yuan (52-week high) [1]. In the long term, the company’s sustainable performance depends on profit inflection points, changes in industry policies, and the performance of international competitors.

Transwarp-U (688031)'s strong performance on December 5, 2025 is mainly supported by MongoDB’s performance benchmarking effect, active technical trading, and fundamental industry status. Investors need to pay attention to risks such as profit pressure, high valuation, and fierce competition, and continue to follow the company’s profit progress, industry dynamics, and market sentiment changes.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.