2026 Market Outlook: Fourth Industrial Revolution Drives S&P 500 Growth and Stock Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

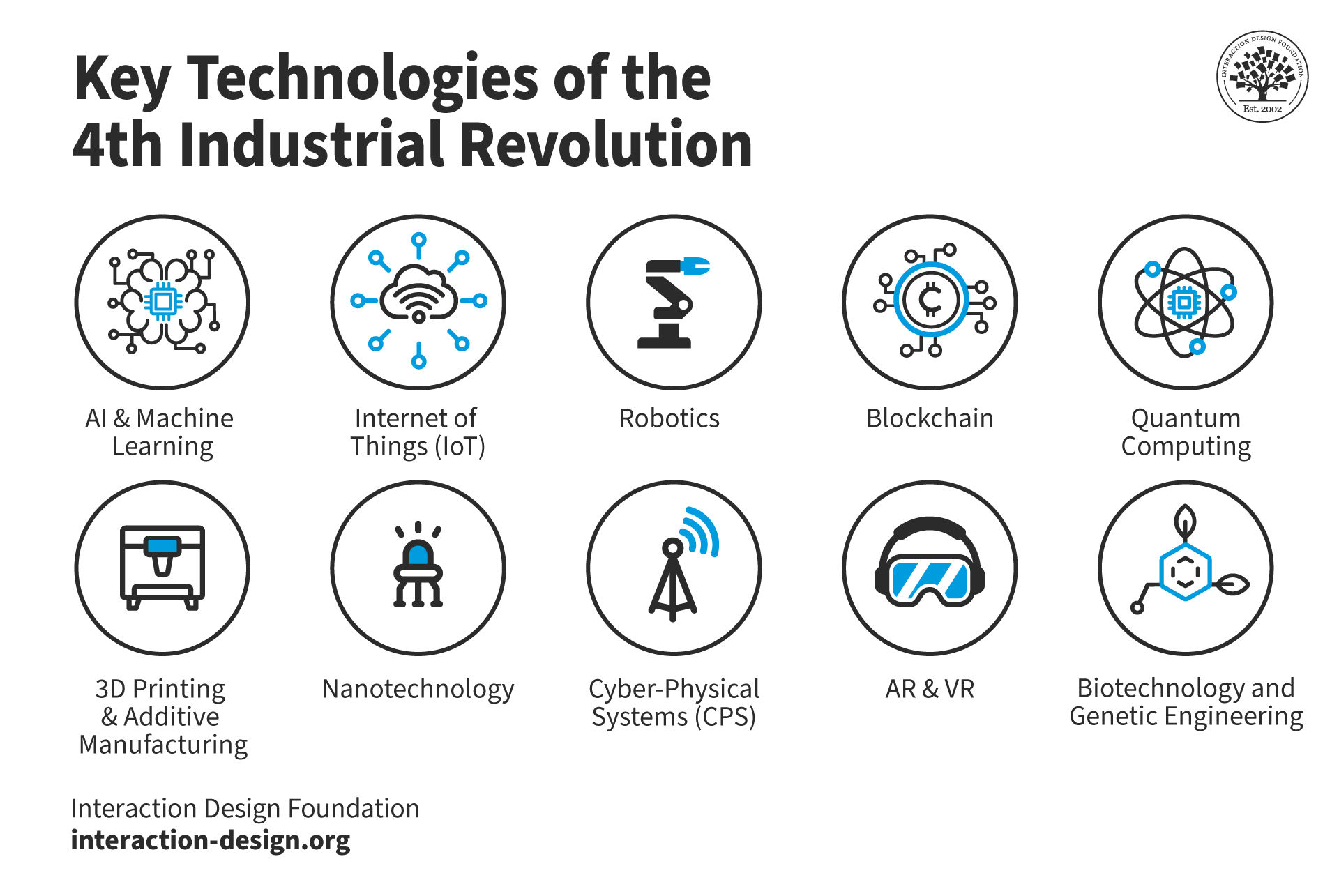

The core event is a Seeking Alpha article [1] forecasting 10% S&P 500 growth in 2026, fueled by 4IR technologies (AI, VR, IoT, blockchain) and sector rotation. Recent internal market data shows the S&P 500 has already gained ~4.62% over the past 60 days [0], aligning with the article’s positive momentum outlook. The four highlighted stocks—POWL, FLEX, STRL, PSIX—all posted after-hours gains on December 4, 2025 (POWL +4.16%, FLEX +4.12%, STRL +2.73%, PSIX +4.16%) [0]. Each stock has clear links to 4IR: FLEX (contract electronics manufacturing) presented at a UBS Technology and AI Conference [0], PSIX (power solutions) operates in the AI-driven data center UPS market [0], STRL (infrastructure) has an E-Infrastructure segment supporting 4IR operations [0], and POWL (electrical equipment) serves sectors adopting 4IR automation [0]. Analyst consensus ratings vary: FLEX and STRL are rated BUY, while POWL and PSIX are rated HOLD [0].

Cross-domain connections emerge between 4IR technology adoption and diverse sectors: electronics manufacturing (FLEX), data center infrastructure (PSIX, STRL), and industrial energy systems (POWL) are all poised to benefit from ongoing digital transformation. The stocks’ after-hours gains indicate market sensitivity to 4IR-related growth outlooks, suggesting investor interest in companies directly linked to these technologies. The article’s prediction builds on the S&P 500’s recent positive momentum [0], highlighting potential continuity in 4IR-driven market trends.

The Seeking Alpha report provides a 2026 market outlook centered on 4IR and sector rotation, predicting ~10% S&P 500 growth. POWL, FLEX, STRL, and PSIX are identified as 4IR-linked growth stocks with recent after-hours gains and varied analyst consensus ratings. The outlook is balanced by risks related to AI investment, market concentration, and macroeconomic factors. This analysis consolidates internal market data and external report insights to provide context for these trends, without making prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.