Shanghai Electric (02727.HK) Hong Kong Stock Popular Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Shanghai Electric (02727.HK) has been included in the East Money App’s Hong Kong Stock Market Popularity Ranking, and its popularity mainly stems from three core factors:

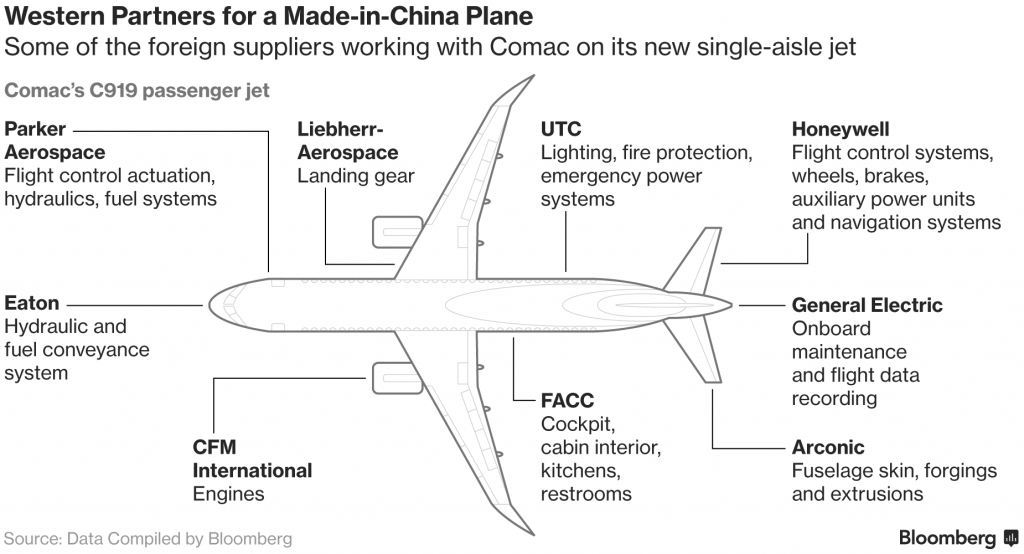

- Technology and Industry Layout: In the field of controlled nuclear fusion, the company mainly adopts the Tokamak technical route, has overcome multiple key technical challenges, and undertaken key equipment for the world’s first nuclear fusion project; its subsidiary provides high-end components for aero engines and C919, forming competitiveness in high-end equipment [2].

- Financial Performance: From January to September 2025, it achieved operating revenue of 82.276 billion yuan (+7.42%) and net profit attributable to parent company of 1.065 billion yuan (+40.49%), showing an improving fundamental trend [2].

- Policy Expectations: As a Shanghai state-owned enterprise, it benefits from the policy expectations of local state-owned enterprise reform, increasing market attention [2].

In terms of market performance, the H-share closed at HK$4.000 (a decrease of 1.235%) on December 3, 2025 [1], and the A-share (601727.SS) closed at US$8.50 (an increase of 0.83%) on December 4 [0]. The trading volume of A-shares has remained at a high level in the past 10 trading days (average daily of about 148 million shares), reaching 267 million shares on November 26 (with a 3.26% increase that day) [0].

- A-H Share Differences: The A-share P/E ratio is as high as 124.99x, indicating that the valuation may be too high [0], while the H-share price is relatively low, with a valuation spread.

- Institutional Position Changes: Hong Kong Securities Clearing Company Limited (the fifth largest tradable shareholder) increased its holdings by 28.2851 million shares, showing overseas institutions’ attention to its long-term prospects [2].

- Technical Support and Resistance: The recent support level of A-shares is US$8.32, and the resistance level is US$8.93 (the high point on November 26). Price fluctuations may unfold around this range [0][2].

- Risks: The high valuation risk of A-shares is significant; the stock price has fluctuated greatly recently (e.g., a 3.26% increase on November 26 followed by a 1.36% decrease the next day) [0]; the business is greatly affected by industry policies such as power equipment and nuclear power, and policy changes may impact performance [2].

- Opportunities: Layout in emerging fields such as controlled nuclear fusion and aviation high-end equipment may provide impetus for long-term growth; the advancement of state-owned enterprise reform may release development potential [2].

Shanghai Electric (02727.HK) has become a popular Hong Kong stock due to its technical layout, financial growth, and policy expectations. Attention should be paid to the valuation differences between A-shares and H-shares, stock price volatility, and policy risks. The increase in institutional holdings shows long-term attention, but high valuation and short-term fluctuations need to be treated with caution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.