Analysis of CATL (03750.HK)'s Status as a Hot Stock in Hong Kong Stock Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

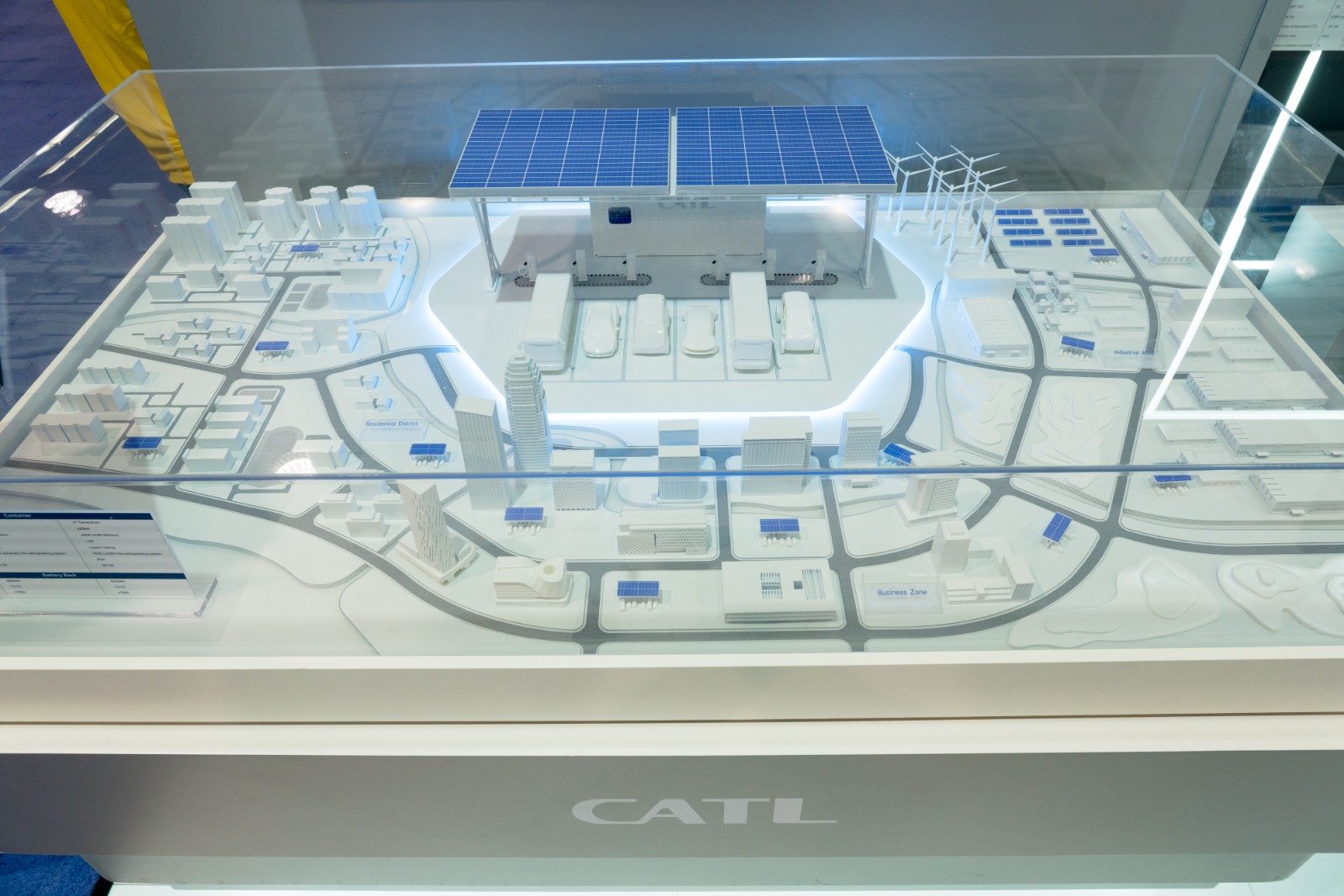

As a global leader in power batteries, CATL (03750.HK) has become a hot stock in the Hong Kong market this time, with drivers covering multiple dimensions such as business expansion, shareholder signals, and market performance:

- Strategic Business Enhancement: Signed a deep cooperation agreement in the energy storage sector with Haibo Sichuang (688411.CH) [1], further consolidating its market position in the energy storage track and providing new impetus for long-term growth.

- Shareholder Confidence Signal: The inquiry transfer price of the company’s shareholder Huang Shilin was set at RMB 376.12 per share, close to the A-share’s closing price of RMB 383.35 on the same day [0], indicating the shareholder’s recognition of the current valuation.

- Strong Market Performance: Since its Hong Kong listing in May 2025, the stock price has risen by 92% cumulatively [1], becoming a typical representative of high-growth targets in the new energy sector.

- Lock-up Release and Market Sentiment: Approximately 77.5 million Hong Kong-listed restricted shares were released from lock-up on December 4 [1]. Although this may increase short-term supply pressure, the A-share still rose by 1.93% on the same day [0], reflecting relatively optimistic investor sentiment.

- Energy Storage Layout Highlights Long-Term Value: The cooperation with Haibo Sichuang indicates that while consolidating its core power battery business, CATL is actively expanding new growth poles such as energy storage, which aligns with the long-term development trend of the new energy industry.

- Shareholder Actions Strengthen Market Confidence: The shareholder transfer price close to the market price played a role in stabilizing market expectations during the sensitive period of restricted share lock-up release, avoiding the short-term selling pressure usually brought by lock-up release.

- Significant Cross-Market Linkage Effect: The rising performance of the A-share had a positive transmission effect on the Hong Kong share, reflecting investors’ consistent recognition of the company’s overall value.

- Short-term lock-up release pressure: The release of 77.5 million Hong Kong-listed restricted shares may lead to short-term stock price fluctuations [1].

- Industry competition pressure: The power battery sector has rapid technological iteration, and pressure from cost control and capacity expansion persists.

- Policy uncertainty: Changes in new energy industry policies may affect the company’s business development.

- Expansion of energy storage business brings new growth space.

- As an industry leader, its scale advantages and technological accumulation will support its long-term competitiveness.

This analysis, based on real-time market data [0] and industry dynamics [1], explains the reasons why CATL (03750.HK) has become a hot stock in the Hong Kong market from dimensions such as business expansion, shareholder signals, market performance, and the impact of lock-up release. The report only presents objective analysis results and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.