Wall Street Institutions Compete for Roles in the Federal 'Trump Accounts' Program for Infants

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

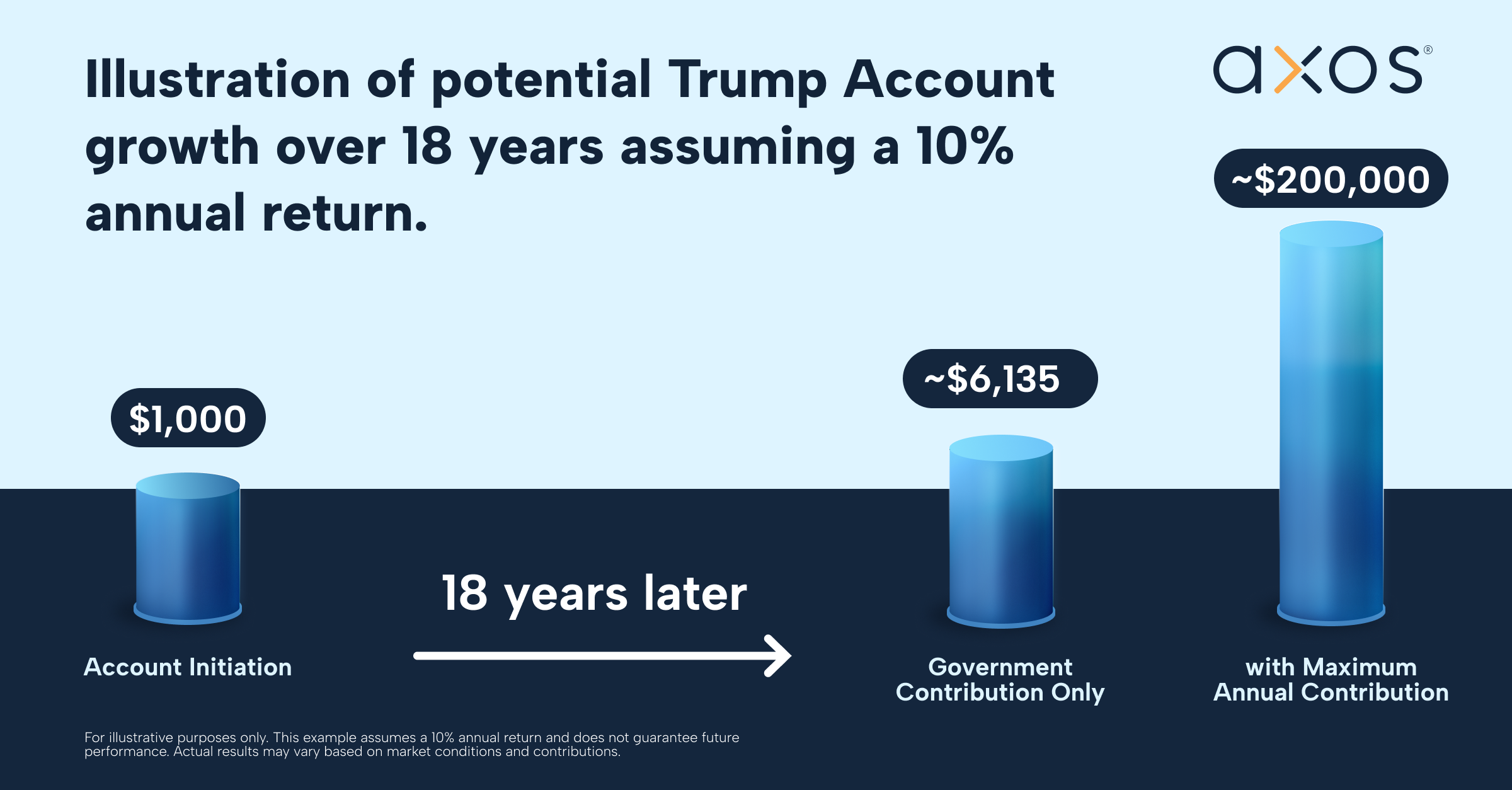

This analysis is based on the Wall Street Journal report [1] published on December 3, 2025, which details Wall Street financial institutions’ eagerness to participate in the federal “Trump Accounts” program. The program, part of the 2025 “One Big Beautiful Bill Act”, offers a $1,000 one-time federal seed contribution to investment accounts for all U.S.-born children between January 1, 2025, and December 31, 2028 [2]. Automatically enrolled at birth, accounts allow parents/custodians to contribute up to an additional $5,000 annually (post-tax), with employers, state/local governments, nonprofits, and philanthropists eligible to contribute toward this cap [3][4]. All funds must be invested in low-fee (<0.10%) U.S. equity index funds managed by private firms [4].

Major Wall Street institutions, including JPMorgan Chase, Charles Schwab, Robinhood Markets, and BlackRock, are actively vying for roles in managing the accounts [0][1]. The Dell Foundation’s $6.25 billion pledge will provide $250 to 25 million American children under 10 (born 2016-2024) who do not qualify for the federal seed money [5]. The program is structured as a hybrid between an IRA and 529 college savings account, with funds accessible at age 18 for education, home purchase, or starting a business [7]. Set to launch in 2026 with the first contributions made after July 4, 2026 [2], the program targets over 3.5 million annual U.S. births, presenting a long-term opportunity for institutions to acquire lifelong clients [6].

- Demographic Customer Acquisition Opportunity: The program’s focus on newborns and children under 10 provides Wall Street institutions with a rare chance to capture clients at the earliest stage of their financial journey, potentially fostering lifelong relationships [6].

- Public-Private-Philanthropic Collaboration: The combination of federal seed funding and the Dell Foundation’s contribution expands program access, addressing gaps for older children and demonstrating multi-sector alignment on early financial literacy [2][5].

- Regulatory Efficiency Mandate: The <0.10% fee cap drives competition among institutions to optimize operational efficiency, ensuring low-cost access for families while challenging firms to balance scale and profitability [4].

- Long-Term Economic Behavioral Shift: By introducing children to investing and compound interest early, the program may increase long-term stock market participation, contributing to greater financial stability for future generations [6].

- For Wall Street institutions: Access to a massive, untapped customer base (3.5 million annual births) with long-term revenue potential [6].

- For American families: Low-cost investment accounts with a government seed contribution, promoting financial literacy and long-term savings [3].

- For the economy: Increased participation in the U.S. equity market, potentially leading to more stable long-term investments [6].

- Institutional Uncertainty: The selection process for account management roles remains undefined, creating ambiguity for competing firms [0].

- Profitability Constraints: The strict fee cap may limit immediate profitability, requiring institutions to innovate on cost management [4].

- Inequality Concerns: Affluent families may be better positioned to make additional contributions, potentially widening the wealth gap despite the program’s inclusive goals [6].

- Market Volatility: Long-term exposure to equity markets carries inherent risk, which could affect account returns over time [0].

This analysis synthesizes the following critical details about the “Trump Accounts” program:

- Launched under the 2025 “One Big Beautiful Bill Act”, it provides a $1,000 federal seed contribution to U.S.-born babies (2025-2028) [2].

- Wall Street institutions including JPMorgan Chase (JPM), Charles Schwab (SCHW), Robinhood Markets (HOOD), and BlackRock (BLK) are competing for account management roles [0][1].

- The Dell Foundation pledged $6.25 billion to support 25 million children under 10 (2016-2024) with $250 each [5].

- Funds are invested in low-fee (<0.10%) U.S. equity index funds and accessible at age 18 for education, home purchase, or entrepreneurship [4][7].

- The program launches in 2026, with first contributions post-July 4, 2026 [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.