Reviva Pharmaceuticals (RVPH): Reddit Analysis of FDA Approval Prospects for Brilaroxazine and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

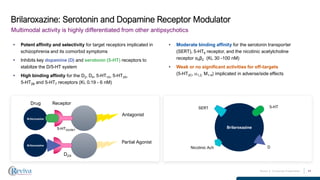

The event centers on a December 3, 2025, Reddit discussion analyzing Reviva Pharmaceuticals (RVPH)’s regulatory path for brilaroxazine, a dopamine-serotonin system modulator for schizophrenia [1]. The OP argued for strong FDA approval chances based on phase 2/3 trial results, a one-year OLE study with durable efficacy, biomarker evidence (BDNF, inflammatory cytokines), and FDA flexibility on single pivotal trials with confirming data. User sentiment was positive, with comments noting the pre-NDA meeting as a sign of FDA confidence and linking the analysis to positive market activity that day.

RVPH’s stock closed at $0.59 on December 3 with a 6.49% gain, aligning with the Reddit comment about “today’s activity” [1]. Over the prior 7 trading days, the stock exhibited significant volatility: a -11.83% drop on December 2, +7.44% gain on December 1, and +6.13% gain on November 28 [0]. Company metrics include a ~$40.31M market cap and a 100% Buy rating from 7 analysts [0]. Clinical data from the brilaroxazine OLE study shows sustained efficacy (PANSS score reductions: 15.2-20.8 points across doses) and a well-tolerated safety profile (1.6% treatment-related discontinuation rate) [2]. However, Reviva’s planned Q1 2025 biomarker data release has not been found in public searches [2], and the pre-NDA meeting referenced in the Reddit post lacks public confirmation.

- Retail investor influence: The 6.49% stock gain on December 3 appears linked to the Reddit analysis, highlighting retail investor sentiment’s impact on small-cap biotech stocks [0][1].

- Discrepant signals: A 100% analyst Buy consensus [0] contrasts with critical data gaps (unconfirmed pre-NDA, missing biomarker data), suggesting potential discrepancies in available information.

- Regulatory uncertainty: The unconfirmed pre-NDA meeting raises questions about the FDA’s preliminary stance, despite the Reddit post’s positive framing [1].

- Regulatory risk: FDA approval is not guaranteed; unconfirmed pre-NDA details and missing data may delay or negatively impact the decision [0][1].

- Volatility risk: Historical short-term volatility (7-day range: -11.83% to +7.44%) could continue as regulatory developments unfold [0].

- Data completeness risk: Missing biomarker and primary phase 2/3 trial data may weaken the regulatory submission [1][2].

- Competitive risk: The schizophrenia treatment space has existing and pipeline competitors (e.g., BMS’ Cobenfy) [2].

- Clinical potential: Durable OLE efficacy and favorable safety profile support brilaroxazine’s therapeutic value [2].

- Analyst support: A 100% Buy consensus may attract investor attention if data gaps are resolved [0].

- Approval upside: FDA approval could lead to significant stock appreciation for the small-cap biotech [0].

On December 3, 2025, a Reddit discussion highlighted Reviva Pharmaceuticals (RVPH)’s prospects for FDA approval of brilaroxazine, a schizophrenia treatment. The OP cited trial data, OLE results, and biomarker evidence, with users supporting the analysis and linking it to a 6.49% stock gain that day. Critical considerations include a ~$40.31M market cap, 7 analysts rating 100% Buy, recent stock volatility, positive OLE data, unconfirmed pre-NDA meeting details, missing biomarker/phase 2/3 data, regulatory/volatility/competitive risks, and clinical/approval opportunities.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.