October 2025 Job Cuts Surge to 22-Year High with Tech Sector Leading Layoffs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the CNBC discussion [3] featuring Andy Challenger (SVP at Challenger, Gray & Christmas) and Evan Sohn (Aura Intelligence CEO) on November 6, 2025, which highlighted alarming labor market deterioration. U.S. companies announced 153,074 job cuts in October 2025, representing a 175% increase from October 2024 and marking the highest October total since 2003 [1][2][3]. The technology sector led with 33,281 cuts, driven primarily by AI-driven restructuring, while year-to-date cuts reached 1,099,500, the highest level since 2020 [1].

The October 2025 job cut figures represent a significant shift from the post-pandemic “no hire, no fire” environment [4]. The surge is particularly notable given its timing in the fourth quarter, when companies traditionally avoid announcing layoffs due to holiday season considerations [3]. This suggests urgency in cost-cutting measures that overrides seasonal norms.

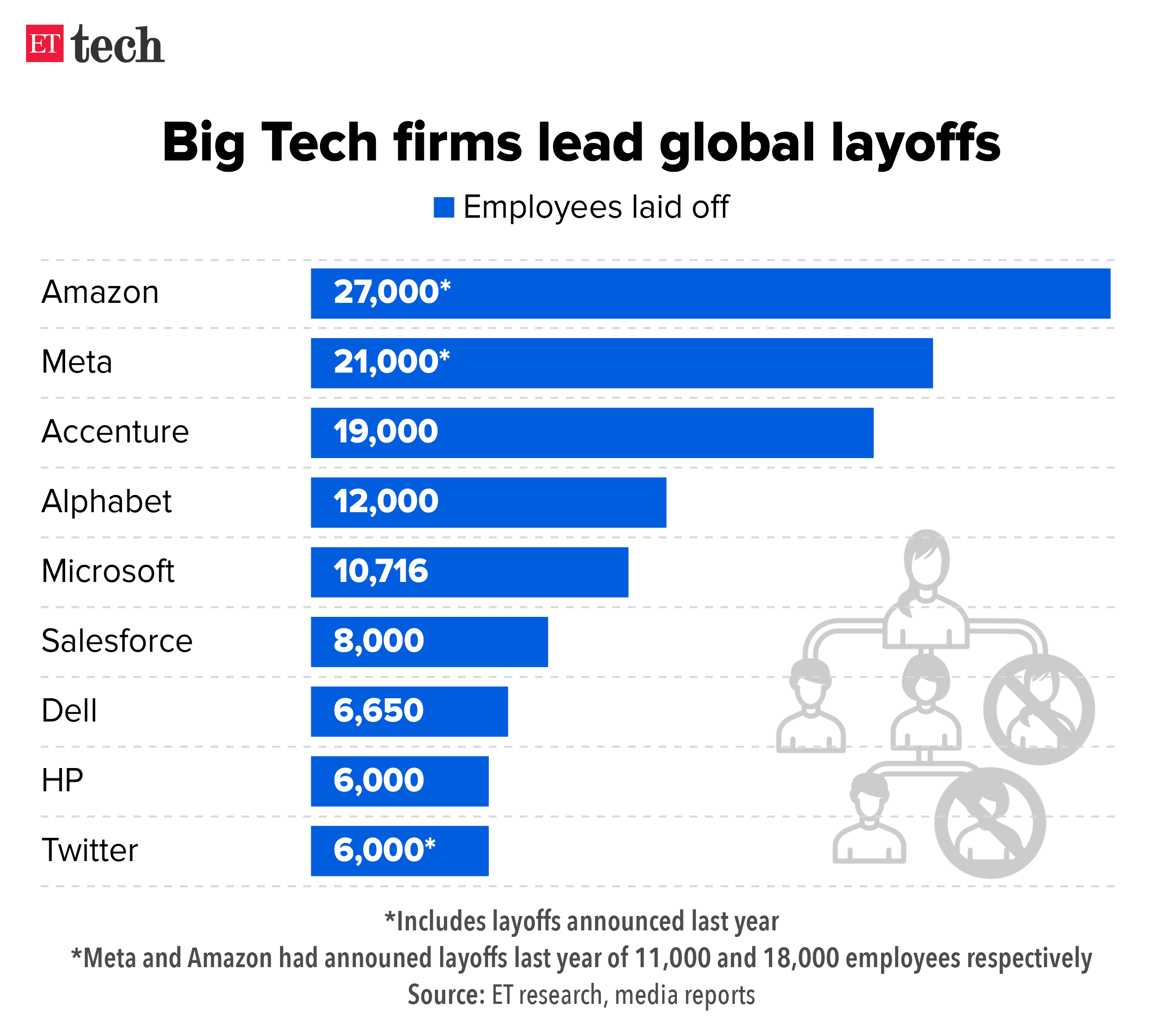

The technology sector’s dominance (33,281 cuts) reflects a fundamental restructuring driven by artificial intelligence adoption [1][3]. Andy Challenger drew a parallel to the 2003 cellphone revolution, indicating that AI represents a similarly disruptive technological shift [3]. The sixfold increase in tech cuts from September to October demonstrates accelerating rather than slowing disruption.

Multiple converging factors are driving this labor market deterioration:

- AI-driven automation replacing human workers

- Softening consumer and corporate spending

- Rising operational costs and inflationary pressures

- Post-pandemic hiring corrections [3]

The broader economic context shows consumers increasingly prioritizing essentials, with 70% of purchasing volume going to everyday essential purchases [5], creating pressure on companies to optimize costs.

The current layoffs differ from typical cyclical cuts. The AI-driven restructuring represents a permanent shift in the labor market that may not reverse with economic recovery, as companies are fundamentally reconfiguring operations around automation [3][4].

The fourth-quarter timing of these announcements is particularly telling. Companies typically delay layoffs until after the holiday season to avoid negative publicity and maintain employee morale during peak retail periods. The October surge suggests either severe financial distress or strategic urgency that overrides these considerations.

Technology’s disproportionate role in job cuts (21.7% of total October cuts despite representing a smaller share of overall employment) highlights how AI adoption is creating both displacement and opportunity simultaneously [1][3].

- Consumer Spending Pressure: With nearly 1.1 million job cuts announced year-to-date [1], cumulative income losses could significantly impact consumer spending, which already shows a shift toward essentials [5]

- Unemployment Rate Increase: Projections suggest the unemployment rate could rise from 4.3% (August) to 4.5% in 2026 [4]

- Reduced Job Security: Workers laid off now face greater difficulty securing new positions compared to previous cycles [2]

- AI-Related Job Creation: While AI is driving displacement, it’s also creating new roles in AI development, implementation, and oversight

- Productivity Gains: Companies successfully implementing AI automation may achieve significant efficiency improvements

- Sector Rotation: Resources displaced from overstaffed sectors may find opportunities in growing industries

The year-end timing creates additional urgency, as companies typically finalize annual budgets and headcount plans during this period. Decisions made now could have lasting impacts through 2026.

- October 2025 job cuts: 153,074 (175% increase YoY) [1][2][3]

- Technology sector cuts: 33,281 (6x September level) [1][3]

- Year-to-date cuts: 1,099,500 (highest since 2020) [1]

- Unemployment projection: 4.5% for 2026 [4]

While Chinese markets showed positive performance on November 6 (Shanghai Composite +1.2%, Shenzhen Component +2.1%) [0], the U.S. labor market deterioration signals potential broader economic challenges ahead. The technology sector’s significant cuts may reflect overcapacity following pandemic hiring and could lead to sector-specific volatility.

Andy Challenger’s comparison to the 2003 technological disruption [3] provides valuable historical context for understanding the current AI-driven changes. His anticipation of continued layoffs through year-end [2] suggests the current cycle has not reached its peak.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.