Analysis of Benzinga’s 4 Stocks Highlighted for the Next AI Rally Phase

Related Stocks

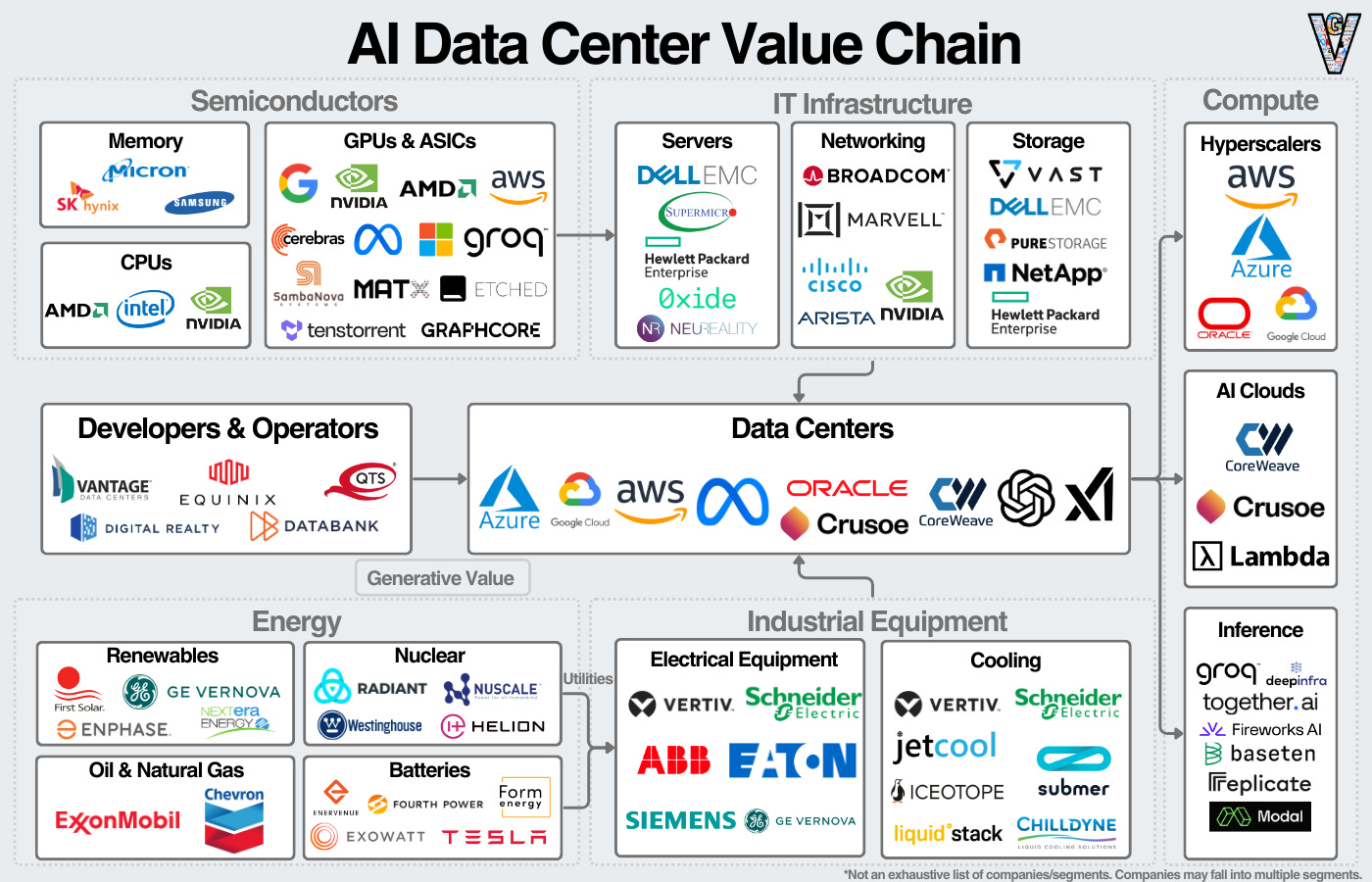

This analysis is based on the Benzinga report [1] published on 2025-12-03, which identifies Alphabet (GOOG), TTM Technologies (TTMI), Celestica (CLS), and Amphenol (APH) as potential candidates for the next leg of the AI rally. The report indicates a shift in AI market leadership from traditional players (NVIDIA, Microsoft, Tesla) to these four companies, driven by two key factors: AI technological advancements (Alphabet’s Gemini V3 and Waymo initiatives) and growing demand for AI-related hardware infrastructure (TTMI’s high-density PCBs, Celestica’s data center servers/switches, Amphenol’s connectors/cables) [1].

As of the event day’s regular trading hours, three stocks outperformed the broader tech sector (which gained 0.69% [0]): TTMI (+2.84%), CLS (+2.60%), and GOOG (+1.53%), while APH (-1.07%) underperformed but retains strong YTD growth of 104% [0]. Valuation analysis shows hardware stocks (TTMI, CLS, APH) have higher TTM P/E ratios (54.48, 50.85, 46.81 respectively) reflecting market optimism for AI-driven growth, while GOOG’s more moderate P/E (31.64) aligns with its diversified business model [0].

- AI Rally Expansion to Non-Traditional Players: The report signals a transition in AI market leadership from established AI/software leaders to hardware infrastructure providers and companies with emerging AI capabilities, indicating the rally’s growing breadth.

- Alphabet’s Competitive Positioning: Alphabet’s Gemini V3 and Waymo advancements position it to compete with leading AI platforms, potentially boosting its cloud and advertising revenue streams.

- Valuation-Driven Optimism and Risk: High P/E ratios for hardware stocks (TTMI, CLS, APH) reflect strong market expectations for AI-related growth, but also introduce valuation risk if growth fails to meet projections.

- Volatility in High-Growth Stocks: APH’s 1.07% decline on the event day, despite its 104% YTD gain, demonstrates potential short-term volatility in stocks with significant prior growth.

- Opportunities:

- Increased AI data center capex is expected to drive demand for hardware products (TTMI’s PCBs, CLS’s servers, APH’s connectors) [1].

- Alphabet’s Gemini V3 and Waymo initiatives present opportunities to capture market share in AI platforms and autonomous vehicles.

- Risks:

- Valuation Risk: High P/E ratios for TTMI, CLS, and APH may limit upside if AI growth underperforms expectations [0].

- Competition Risk: Alphabet faces intense competition from Microsoft’s Copilot and OpenAI’s ChatGPT [1].

- Volatility Risk: Short-term pullbacks are possible for stocks with strong uptrends, as seen in APH’s event-day decline [0].

- Supply Chain Risk: AI hardware providers (TTMI, CLS, APH) may face disruptions affecting production and delivery.

- Stocks Analyzed: GOOG, TTMI, CLS, APH

- Market Caps: GOOG ($3.87T), TTMI ($7.09B), CLS ($35.91B), APH ($171.34B)

- YTD Gains: TTMI (~170%), CLS (~438%), APH (~104%), GOOG (~125%)

- Event-Day Volume: 54% (GOOG), 23% (TTMI), 41% (CLS), 57% (APH) of 50-day averages [0]

- Technical Indicators: All stocks traded above their 50-day/200-day SMAs [1]

This summary provides factual market context and analytical insights without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.