SEC Unveils Major Wall Street Reshaping Plan Focused on Tokenization and Digital Assets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

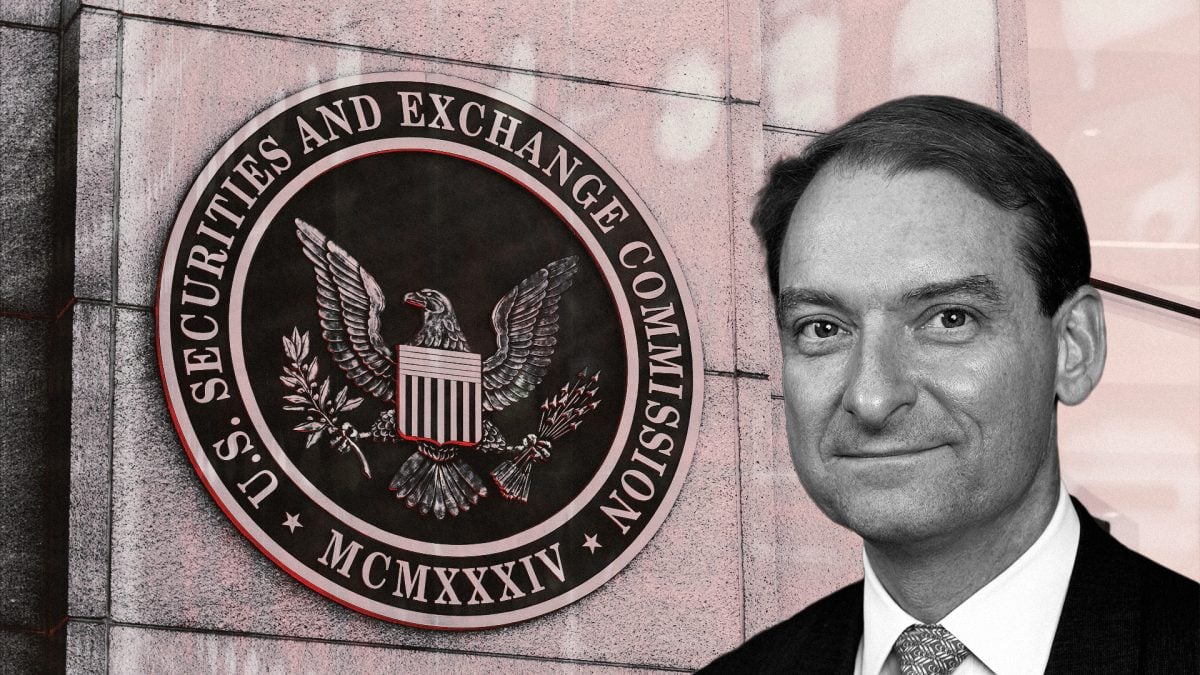

The event centers on SEC Chairman Paul Atkins’ December 3, 2025, CNBC interview [1], where he announced a major plan to reshape Wall Street with three core components: tokenization of assets, faster settlement processes, and an updated regulatory framework for digital assets. Notably, a separate report from Insurance Journal [2] reveals the SEC will introduce an innovation exemption for digital asset firms in January 2026, exempting qualifying crypto firms from certain securities requirements while maintaining investor protection measures.

Initial market reaction saw Coinbase (COIN) close at $263.26 on December 3, 2025, up 1.32% from the previous trading day [0], suggesting preliminary positive sentiment toward the regulatory clarity implied by the announcement. In contrast, Atkins’ earlier December 2 speech focused on IPO reform, disclosure rules, and shareholder meetings—without addressing digital asset-related measures [2].

Information gaps remain, including detailed specifics about which assets will be targeted for tokenization, the timeline for implementing faster settlement, and full broader market data (S&P 500, NASDAQ, Dow Jones) for December 3, 2025 [0].

- Regulatory Balancing Act: The SEC’s plan signals an attempt to foster innovation (via the upcoming exemption) while mitigating investor risks, marking a potential shift toward more accommodative digital asset regulation.

- Targeted Market Impact: Coinbase’s positive price movement reflects investor optimism that regulatory clarity could benefit established digital asset firms, though long-term effects depend on final rule details.

- Staged Announcements: The contrast between Atkins’ December 2 (traditional market focus) and December 3 (digital assets) statements suggests a phased rollout of the SEC’s comprehensive Wall Street reshaping strategy.

- Regulatory Clarity: A formal digital asset framework could reduce uncertainty for firms operating in the space, potentially attracting more institutional investment.

- Efficiency Gains: Faster settlement and tokenization may streamline financial transactions, reducing operational costs for Wall Street firms.

- Incomplete Details: Lack of specific plan timelines and asset scope could lead to market volatility as stakeholders await further clarifications.

- Regulatory Adaptation Costs: Firms may face significant costs to comply with new tokenization and settlement requirements once finalized.

- Crypto Market Uncertainty: While the innovation exemption offers relief, it may not address all regulatory concerns, leaving room for ongoing industry friction.

This analysis covers the SEC’s December 3, 2025, announcement to reshape Wall Street through tokenization, faster settlement, and digital asset regulation, including an upcoming January 2026 innovation exemption for crypto firms. Initial market reaction saw Coinbase (COIN) close 1.32% higher on the same day. Critical details remain unresolved, including tokenization specifics and full December 3 broader market data.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.