AI Stock Resilience Amid Bitcoin Volatility and Potential December Rally

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Barron’s article [1] published on December 3, 2025, which highlights AI stocks’ role in sustaining Wall Street amid Bitcoin’s volatility and a potential December rally driven by a Bitcoin rebound.

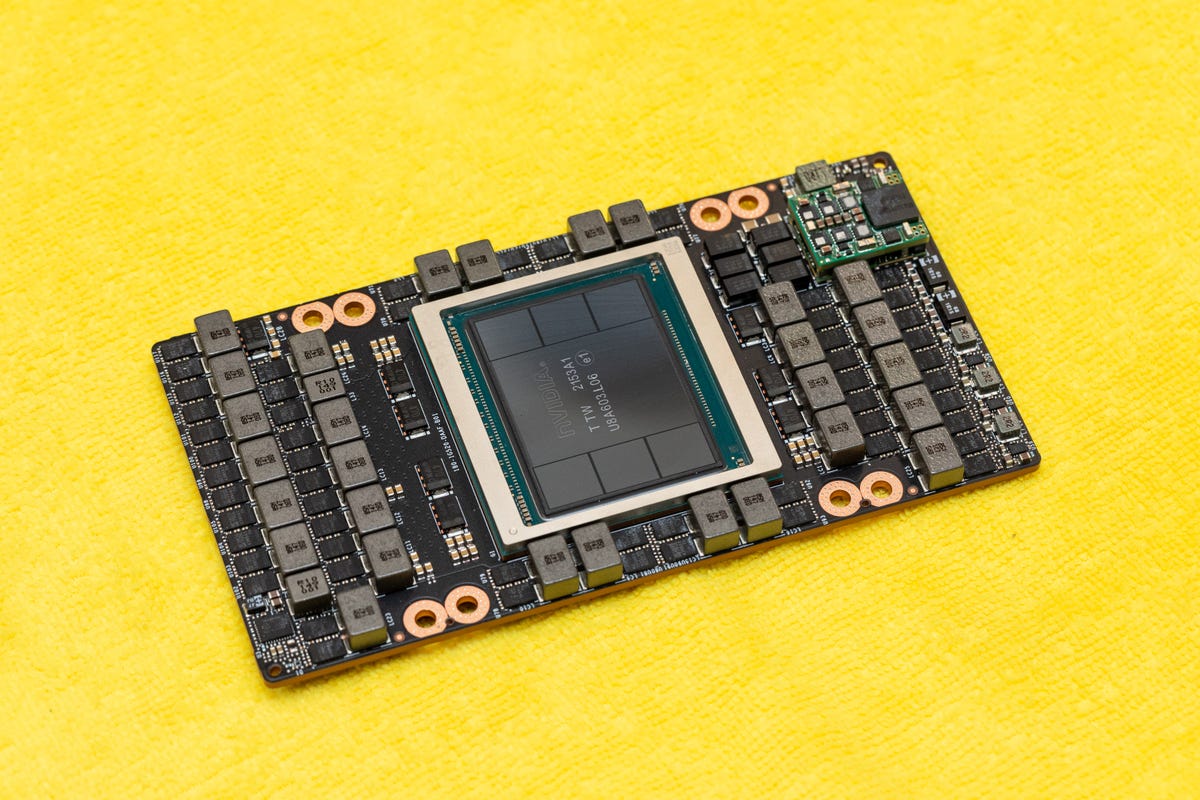

- AI Stocks Performance: NVIDIA (NVDA) closed at $181.46 on December 3 (+0.86%), displaying resilience despite competition from Amazon’s newly launched Trainium3 AI chip [2]. A $2 billion investment in Synopsys (SNPS) to expand AI chip design capabilities may support NVDA’s long-term growth [0][2]. Oracle (ORCL) closed at $201.10 (+0.08%) with mixed sentiment: HSBC reaffirmed a “Buy” rating ($382 target) citing strong backlogs, but its credit fear gauge hit a 2009 high amid AI bubble fears [0][3].

- Bitcoin Market Dynamics: Bitcoin (BTC) rebounded to $93,000 intraday on December 3, its highest in over two weeks [4]. However, the Crypto Fear & Greed Index remains in “Extreme Fear” territory (23/100), indicating persistent investor pessimism [5].

- Broad Market Trends: The S&P 500 (^GSPC) closed at 6,829.37 (-0.02%) on December 2, while the NASDAQ Composite (^IXIC) closed at 23,413.67 (+0.15%), reflecting modest tech strength amid partial recovery from the November 20 decline [0].

- AI-Crypto Market Interplay: The Barron’s thesis suggests a potential correlation between Bitcoin’s rebound and AI stock momentum, but empirical data on this relationship is lacking [1].

- NVIDIA’s Competitive Edge: NVDA’s Synopsys investment and existing partnerships may mitigate risks from Amazon’s Trainium3 and Google’s TPU expansion [0][2].

- Oracle’s Dual Sentiment: The company’s strong data center strategy and backlog contrast with elevated credit fears, highlighting market uncertainty about AI-related valuations [0][3].

- Bitcoin’s Technical vs. Sentimental Split: The recent rebound to $93,000 contrasts with the Extreme Fear index, indicating unresolved market anxiety [4][5].

- Bitcoin Volatility: A reversal of the recent rebound could undermine the predicted December rally [4][5].

- AI Bubble Concerns: Elevated credit fears for ORCL and broader market sentiment about AI overvaluation pose downside risks [3].

- NVIDIA Competition: Amazon and Google’s in-house AI chips may erode NVDA’s pricing power and market share [2].

- Macroeconomic Factors: Federal Reserve policy decisions in December will significantly impact both crypto and equity markets [6].

- December Rally Potential: Sustained AI risk appetite and a Bitcoin rebound could drive market momentum [1].

- NVIDIA’s Long-Term Growth: The Synopsys investment may enhance NVDA’s AI chip design capabilities [0][2].

- Oracle’s Backlog Strength: Strong visibility into future revenue may support ORCL’s performance [0].

Key metrics as of December 3, 2025:

- NVIDIA (NVDA): $181.46 (+0.86%), Market Cap $4.42T, P/E 44.80 [0]

- Oracle (ORCL): $201.10 (+0.08%), Market Cap $564.15B, P/E 46.55 [0]

- Bitcoin (BTC): Intraday High $93,000, Fear & Greed Index 23/100 [4][5]

- S&P 500 (^GSPC): December 2 Close 6,829.37 (-0.02%) [0]

- NASDAQ (^IXIC): December 2 Close 23,413.67 (+0.15%) [0]

This summary provides context for decision-making without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.