FEMY (Femasys Inc.) Stock Analysis: Retail Sentiment and Market Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis draws from a December 3, 2025 Reddit discussion, internal market data [0], and external financial reports [1][2]. FEMY (Femasys Inc.) operates in the healthcare sector (medical instruments & supplies) with a current price of $0.89 and market cap of $26.21M (as of 2025-12-03) [0].

FEMY is trending due to:

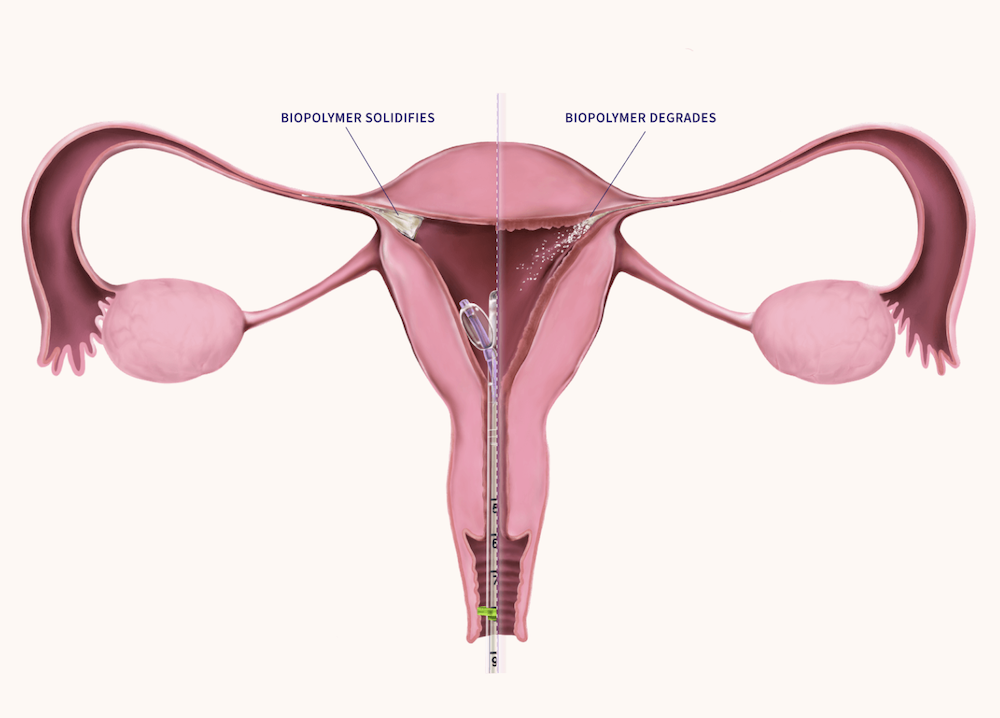

- Diversified Product Portfolio: FemBloc (non-surgical sterilization) and FemaSeed (fertility treatments) target both “child-free” and “baby-making” demographics, viewed as a unique growth driver [0].

- Regulatory Progress: Recent approvals for FemBloc in Europe, UK, and New Zealand, with ongoing U.S. FDA trials [1].

- Financing Update: A November 2025 $12M financing (potential $58M total) extended the cash runway to September 2026 [1].

- Retail Speculation: Reddit discussions highlight 2-5x return expectations in 18-24 months, Q1/Q2 2027 M&A potential, but concerns about a reverse stock split if the price stays below $1 for 10 days by mid-January.

Price metrics show 30-day gains of 48.33% (from $0.60 to $0.89), a 52-week range of $0.31-$1.80, and 2025-12-03 volume (847,791) below the 3-month average (8.49M) [0].

- Unique Market Position: The dual focus on sterilization and fertility treatments differentiates FEMY from competitors, addressing two large consumer segments [0].

- Sentiment Divergence: High institutional ownership (65.27%) [2] contrasts with retail concerns about near-term risks, indicating differing time horizons.

- Critical Price Threshold: The $1 level is crucial—failure to maintain this price by mid-January could trigger a reverse stock split, impacting investor perception.

- Financing Dependency: Consistent net losses (Q3 2025: $4.19M [1]) mean future funding is necessary despite the recent financing extending the runway.

- Opportunities:

- U.S. FDA approval of FemBloc could drive commercial growth [1].

- Biotech M&A activity may attract acquirers.

- Product diversification offers multiple revenue streams [0].

- Risks:

- Cash runway only until September 2026; need for additional funding [1].

- Potential reverse stock split if price stays below $1.

- Regulatory and commercial risks for new products [1].

- High volatility (beta -2.59) [0].

FEMY is a healthcare stock with a unique reproductive health product portfolio, recent regulatory wins, and bullish long-term return expectations from retail investors. The stock has gained 48.33% in 30 days but faces near-term risks including cash runway limitations and a potential reverse stock split. Analyst consensus is “Buy” with 65.27% institutional ownership. Investors should monitor regulatory milestones, financial updates, and the $1 price threshold.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.